A Tale of Two Currencies

Argentina's bipolar economy and what's in store for the upcoming months

Welcome Avatar! If you’ve ever seen Groundhog Day, you can imagine what most Argentines are going through right now with yet another currency meltdown like the one we are witnessing at the moment. In this article I will try to provide a general update on the economic situation, and more specifically on the monetary situation and potential outcomes, since many seem to have a strong opinion on what should be done to fix this.

Bimonetary Bipolarity

The tale of two currencies for Argentina is the one between the dead presidents on the almighty dollar bills on the one hand, and the fauna and occasional dead president of the current peso notes on the other.

Argentina has lived through as many as 2 real hyperinflations in the 20th century (1978 and 1989), both ending either in slashing zeros or a completely new currency.

Zero slashing has happened about 4 times in little over 50 years: 2 zeros in 1970, 4 in 1983, 3 in 1985, and 4 zeros in 1992. You get the point by now: Central Banks are zeros, but the BCRA (Central Bank of Argentina), leads the pack.

Interestingly, Argentina changed its national currency only 5 times, if we take the National Peso created by Julio Argentino Roca during his first presidency in 1881 as a starting point.

If you want to count the provincial coins I discussed in Coinmarketcap in Real Life, Argentina basically invented the analogue version of a myriad of shitcoins during the 2001 crisis.

In combination with currency repackaging of the same explosive material in a new wrapper, Argentina has seen nine episodes of sovereign default since its independence from Spain (with 1 additional soft default).

Most of these defaults were accompanied with international conflicts, and ended in a major crisis.

All these episodes lead to an increasingly bigger dependence on US tokens, and Argentina went as far as pegging the peso 1:1 with the US dollar after the last hyperinflation.

In Argentina, all items that can be used as a store of value, are priced in dollars. This goes for real estate, cars, and even their own currency, the poor old peso. The street rate of the peso against the dollar (dólar blue) is front page news every single day.

What pulled the crisis Groundhog out of the ground this year?

Safe to say, this is not the first rodeo for most Argentines, especially not if they are old enough to remember the 2001 and 1989 crises.

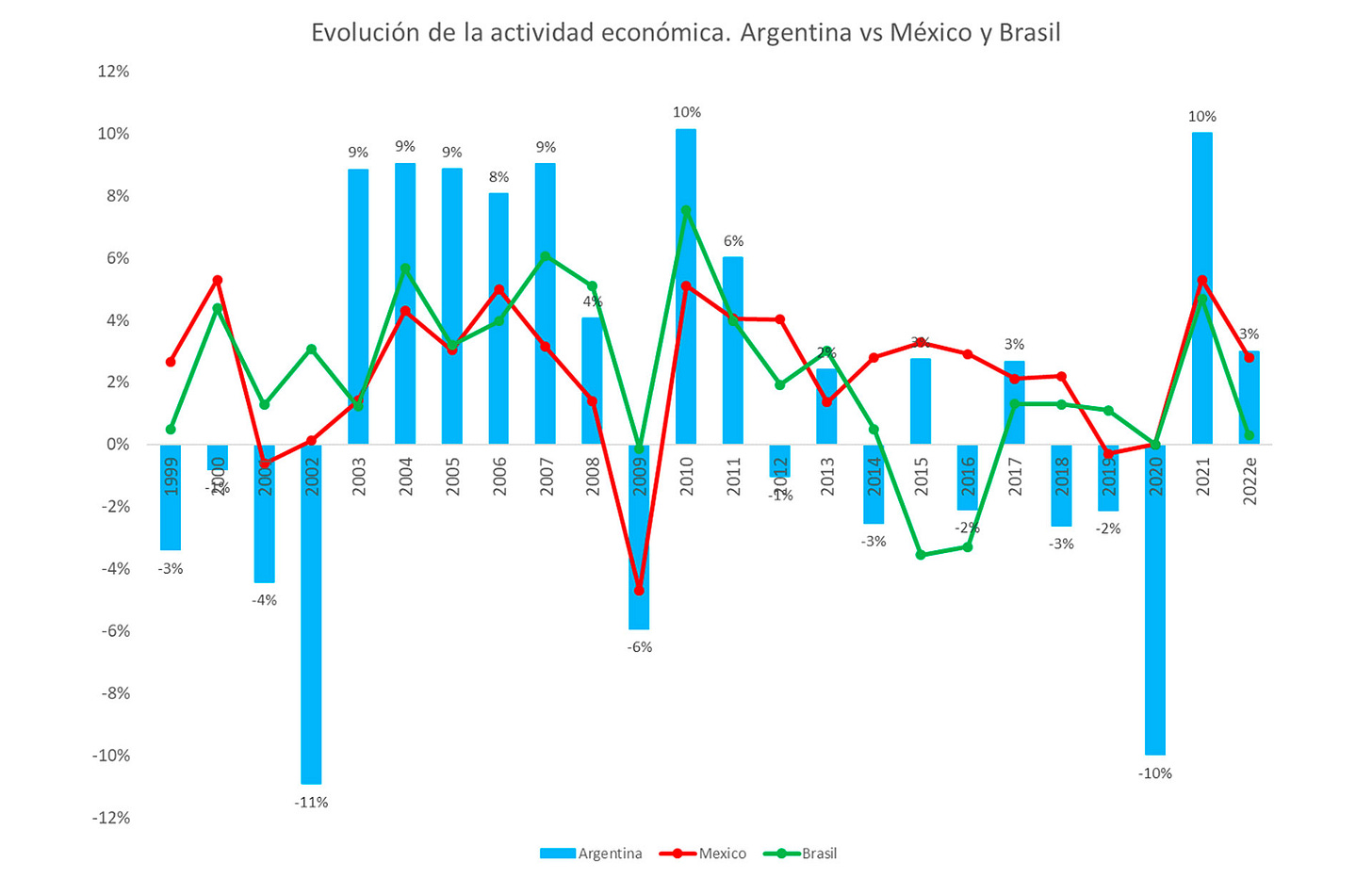

Argentina has basically not been growing since 2011, and this is reflected in lack of GDP growth, lack of foreign investments, and lack of economic activity (see chart below).

The Patagonian rabbit writing this up for you will not start pointing fingers of who did a worse job in terms of administrations, safe to say that each administration after 2011 has done a terrible job in shielding its voters from inflation and preserving purchasing power.

The gravitational pull of Argentina’s black hole deficit

One things that has grown substantially since 2011, is the government deficit.

In Argentina 52% of the population receives some kind of social plan, and almost 2 million “work” in the public sector.

No society in history has ever grown with this level of public spending.

How does Argentina fund all this?

In “Alice in Weimarland” I wrote about the preamble of the current setup of unsustainable peso debt, which is spiralling out of control at an ever faster pace, since the Central Bank keeps increasing the yield on the peso ponzi yield farms (currently at 81% YoY if you lock pesos up in a plazo fijo for at least 30 days). In that piece, I wrote:

With this dynamic, the remunerated liabilities of the Argentina Central Bank will double after a year. Due to the interest payments from Leliq, Passes and Nobac instruments, it will climb to the astronomical figure of 17 billion pesos.

For context, this represents close to 10% of GDP, and will be five times more than the fiscal deficit proposed in the Budget 2023 bill, of 1.9% of GDP lmao.

This will put more fuel on the hyperinflationary fire, and perhaps that will give Argentina the chance to dethrone Turkey in the race for the highest inflation levels in 2023.

This has played out exactly as predicted in that article. Argentina is firm in the second spot again, right after Venezuela, with the highest inflation rate worldwide.

The amount of peso debt due this year, is a staggering 3 monetary bases.

Pull out your calculator and see what peso/dollar rate you get (somewhere around 1200-1500 pesos per US token). Of course, this is only if no one renews and decides to harvest all of their pesos in the peso ponzi game.

Every time the blue rate starts climbing, is basically when depositors decide to harvest their pesos and swap them for dollars.

This is what has been happening in the past week, combined with negative BCRA reserves and an overall dollar shortage due to the extremely bad crop yields after the 2022-23 summer drought.

Looks like the Argentina Central Bank has been dipping into customer USD deposits at local banks. This was last month:

It has gotten worse since then, with the BCRA calling for bank holiday for foreign currency swaps last Friday and coming Monday. This means imports and exports can’t be settled in US token on those days… insert “this is fine” meme.

On top of all this, the current inflation rate is accelerating at a faster pace, and most segments of the economy are now at 130-150% YoY inflation rates, and it could get a whole lot worse before it gets better.

Autist note: Technically Argentina is not yet in hyperinflation mode, but it is a much higher inflation than most people will experience in their lifetimes. If you want to read more on how people deal with a semi-hyperinflation environment here and how to arm yourself for it, I recommend reading my guest posts for the BowTiedBull substack How to Survive in a World of Hyperinflation and The Weimargentina rollercoaster: At least it’s not boring. In that last piece I explain more about the IMF debt burden, and what an insanely bad decision it was to give that last loan to Argentina.

So, is there a way out for Argentina?

To dollarize or not to dollarize, that’s the question

Argentina is effectively already dollarized for most of the important parts of the economy, but dollarizing completely would still a big deal. It would mean doing away with their Central Bank completely, since they would not issue any currency like they did do during the peso/dollar peg in the 90s.

That peg eventually broke, because, yes: the government started printing more pesos than those backed by dollars. In 2001 the peg devalued to 1:3, and the last big crisis unfolded directly after.

Safe to say that the residents of Argentina would be better off without a Central Bank. Any country would for that matter, since Central Banks are inherently communist institutions, but Argentina’s case is a bit more pressing.

For this year’s presidential elections, the libertarian candidate Javier Milei is the only one talking about shutting down the Central Bank and dollarizing the economy.

Will this plan work? From what we’ve seen in other countries such as Ecuador and Panama, dollarizing has definitely had a positive effect on inflation and purchasing power.

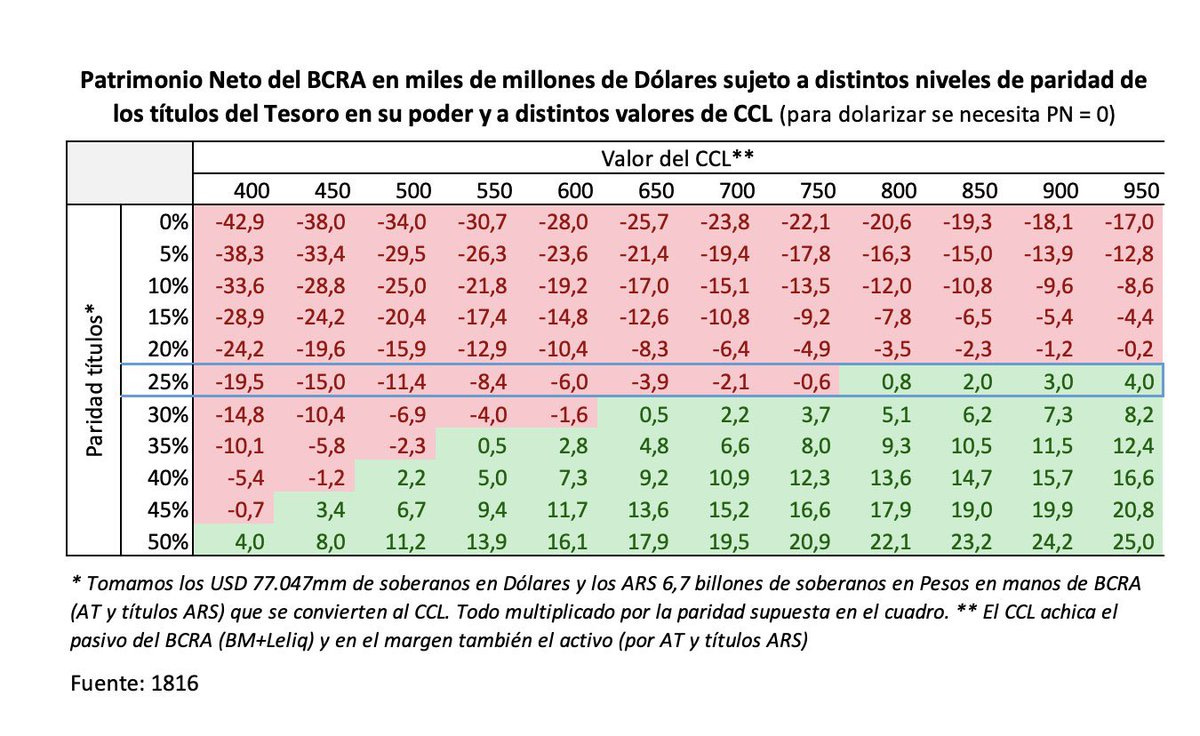

According to an analysis by consultants 1816, in order for Argentina to dollarize, with the current bond prices, the USD exchange rate should go to 800 to be able to dollarize without obtaining financing in USD.

Of course it has to be seen what will happen in the elections first to see if this hypothetical scenario could play out.

Even if Milei would win the election, it will be very hard to push this through in practice, given current legislation and opposition against the whole idea of dollarizing in the first place. Politicians really do hate giving up their money printer, who would’ve thought that?

Plan B?

And what about Plan B? So many people responded to this viral post about the BCRA scrambling for dollars that it’s time for Argentina to adopt a Bitcoin standard. Since I save in BTC myself, this is of course a compelling argument.

However, knowing the local economy very well, this is not something that would be adopted or could be implemented at this time. The infrastructure is not there yet, since Argentina is 50%+ cash payments, and many businesses only accept cash.

With the current poverty levels, in many poorer areas of the country people are more worried about getting food on the table first versus getting a phone that they can use for Bitcoin payments.

Besides, not even Milei is talking about anything Bitcoin related, so there is no political platform for this in Argentina, like there is in El Salvador for example.

The partially nationalized oil company YPF has been mining bitcoin in Vaca Muerta, but that is more of a small pilot.

Plan CCP?

One currency that is talked about more and more, is the capital controlled CCP coin: the Yuan.

In 2022, one story that caused a lot of laughter on Fintwit was the idea of Brazil and Argentina starting a joint currency.

What most mainstream media outlets including the Financial Times missed about the joint currency idea, was that it was never meant to replace the existing Argentine Peso or Brazilian Real, but that this would be an additional currency, used for trade settlements between countries in the Mercosur, to avoid using the dollar.

That was the big story that most people missed while they were laughing about the epic past currency failures of both countries.

Will China help out with setting that up? Only time will tell.

China is getting closer and closer to Latin America, and it is very possible that a next currency crisis could be a perfect entry point for China to gain even more ground in Argentina, by offering more help in the form of currency swaps, or even helping with a new currency.

As we’ve seen in “Vaca Muerta: Argentina's ticket to energy independence?”, China has already got a 20-year lease on a military base next to the second biggest oil field in South America after Venezuela. Additionally, China also started talks to build a port in Ushuaia, with access to both Antarctica and both the Pacific and the Atlantic.

The scramble for resources will only intensify this decade, and from that perspective Latin America will be a key focus for big geo board players like China.

WiFi Money Bliss vs Pure Peso Pain

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way – in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

— Charles Dickens in his famous opening lines of A Tale of Two Cities

Living on a US Token or Bitcoin standard in Argentina you can have a quality of life that is hard to beat anywhere else.

When you’re on the other end of the spectrum and earn your money in quickly devaluating pesos, all you can think about is emigrating as quickly as possible.

Whatever will end up happening in Argentina in terms of monetary policy, two things remain true for now:

It was the best of times, it was the worst of times.

See you in the Jungle, anon!