Argentina Outlook 2025

What are the main things to watch in 2025

Welcome Avatar! According to different growth predictions, Argentina will top the list of GDP growth in 2025 after the structural — and still ongoing — reforms implemented by President Javier Milei. What will be the main things to watch this year? Let’s dig in.

Maturities, Maturities

The Treasury accelerated the purchase of foreign currency from the BCRA at the end of the year and has almost covered the principal payments in dollars for January and July, which are the months in which the two biggest payments are due.

Once the Government deposits the capital and interest for January to bond holders, there will be around USD 2.7 billion in the Treasury account at the BCRA, if it does not buy more foreign currency in the next few days - which would be enough to pay the July maturities.

The acceleration in dollar purchases by the Treasury occurred in a context of a new drop in the country risk index, which on Thursday was close to 600 percentage points.

A country risk of this level means that Argentina is now in a zone of refinancing rates considered acceptable in terms of financial cost (below double digits). Despite this, the economic team still maintains a firm option to postpone the market launch until 2026, since Milei’s team is considering waiting for a further drop in Argentine risk.

For the rest of Milei’s term the maturity landscape looks like this:

2025: $18 billion

2026: $18.7 billion

2027: $20.3 billion

Dollar rate, Inflation & CEPO

The stabilization of the dollar rate and the convergence of the parallel exchange rates towards the official rate raises the alarm regarding the exchange rate lag, especially in an election year, which tends to have greater volatility.

Some say the ideal moment to lift the cepo currency restrictions when the official and the black market rates converged back in December, but with inflation still at 2-3% monthly and close to zero net dollar reserves in the BCRA, the Milei admin prefers to wait a bit longer.

Minister Caputo is still negotiating another $10 billion IMF deal to strengthen the reserves, but so far the international money tree has been reluctant to drop any fruit.

As you might now from my posts on X this rodent is not a fan of the economic hitmen at the IMF, and in my opinion, the fact that there has been no new agreements is a good thing because it forces the government to keep accumulating USD in order to meet maturities.

So far, it has been doing a great job at this and there are no signs of default, despite the time over -$10 billion net reserves time bomb handed to Milei at the end of 2023.

Then again, without that additional $10 billion from the IMF, it seems unlikely that the currency restrictions will be lifted earlier than after the midterms in October. This is not due to the same set up as Caputo managed under Macri, who lifted the cepo on day one of his presidency, allowing one of the biggest outflows of USD in history and eventually being forced to take on the biggest IMF loan in history in 2018.

The current dynamics are completely different: there is a surplus (as we have seen recently, no matter how you slice the pie in terms of including certain line items or not), and inflation is trending downwards. This is a very different scenario than under Macri, who was maintaining the same Kirchnerist state without practically any structural reforms.

However, Milei’s need to accumulate reserves for lifting the restrictions could be pressured by an increasingly deficitary current account and by a possible increase in imports due to the recovery of economic activity and demand for tourism, in addition to the payment of bond coupons.

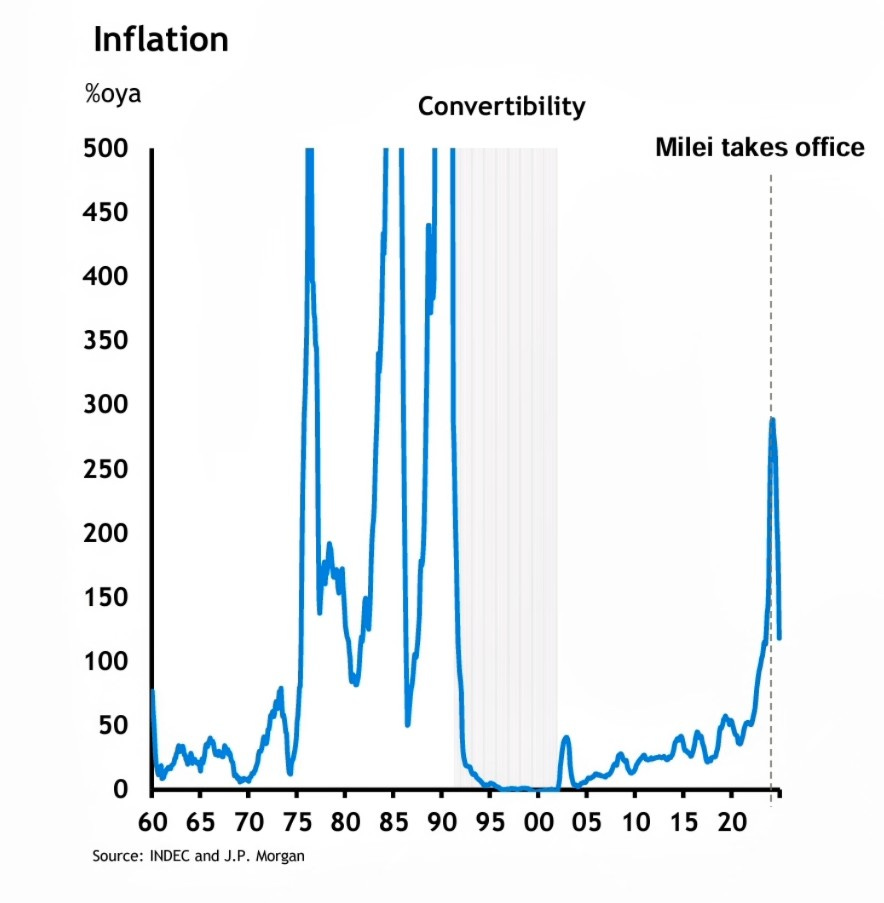

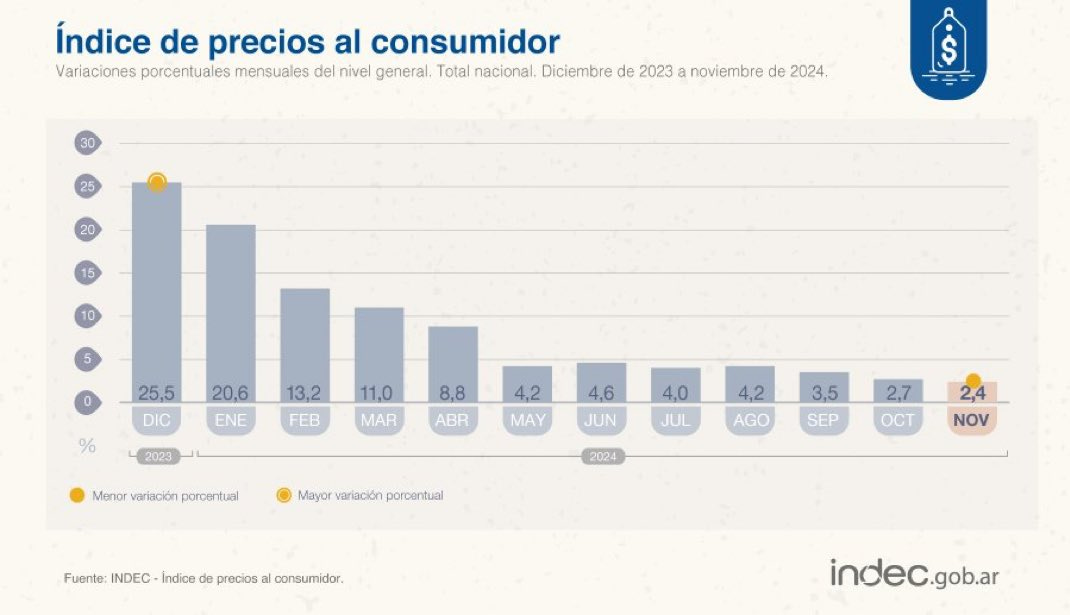

Inflation is trending down, and will keep on trending down within the current dynamics. As the economy improves, that decline will cement itself and eventually might even turn into deflation since many items are currently miss-priced and have to find an equilibrium after less regulation, less tariffs and no more inflation.

As this was one of the main campaign promises and Milei’s legacy is tied to the fact that he was able to bring inflation down so quickly — from 25.5% a month to the current 2.5% monthly —, the one thing that can destroy the narrative of his government would be if inflation picks back up again.

One way that could happen is with a consistent increase in the blue dollar rate, which is another reason why Milei is so hesitant to pull off the cepo too soon: the blue dollar rate is indicative of what a floating peso rate would do. If that increases significantly, it would mean more future inflation.

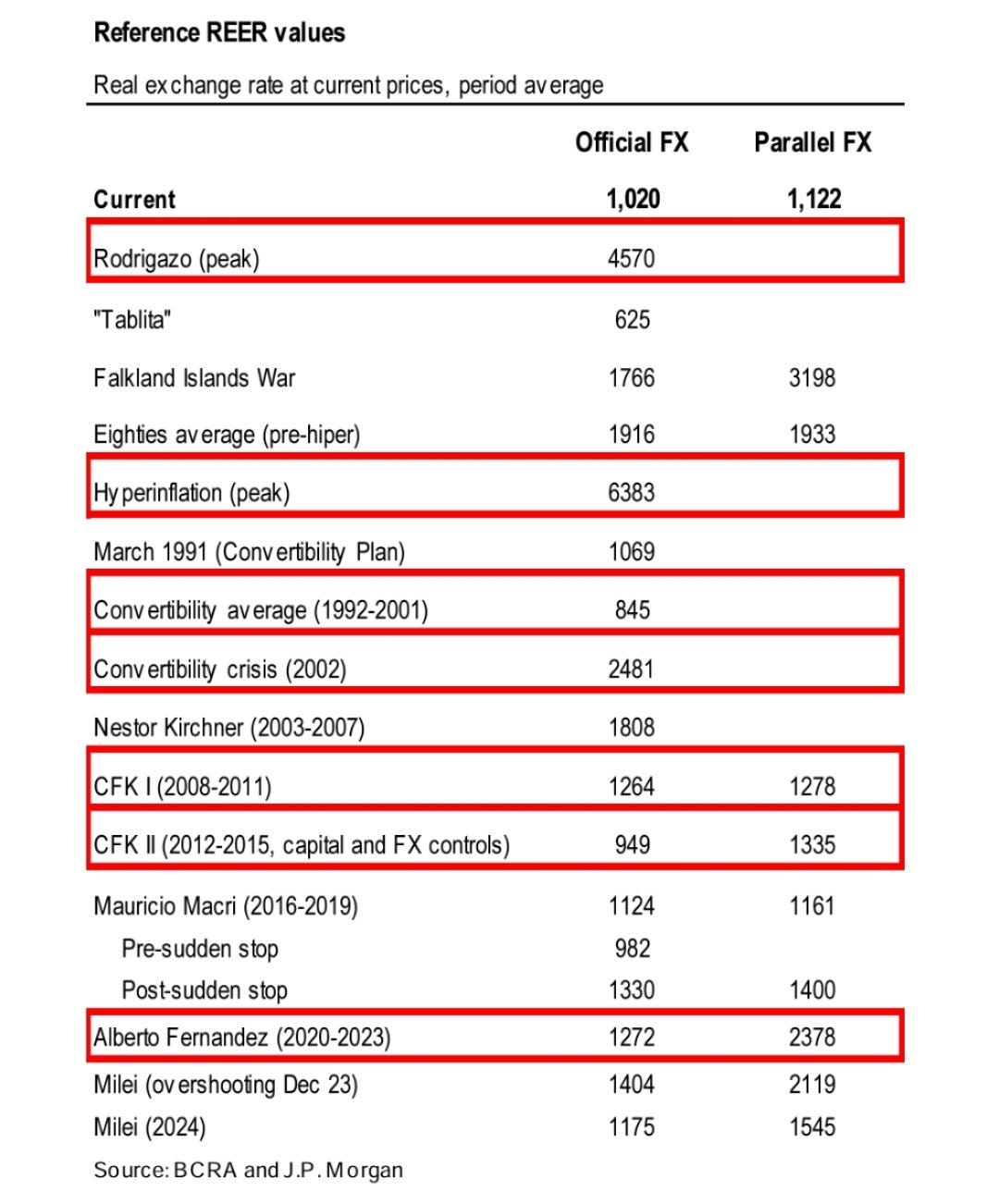

When looking at real exchange rates at current prices in each period in Argentina, it’s clear that the Milei government doesn’t need to devalue. It should work on lowering costs of doing business through more deregulation and deepen a major tax reform.

Out of all 2025 variants, the timeline lifting the cepo is one of the least certain. It’s a combination of cagazo due to previous runs on the dollar, and the fact that whenever there’s a clear timeline for financial decisions in Argentina, literally the full adult population will try to front run it.

Legislative Elections

The 2025 Argentine legislative elections will be held on Sunday, October 26, 2025, with the aim of renewing 127 of the 257 seats in the Chamber of Deputies for the 2025-2029 legislative period, along with 24 of the 72 seats in the Senate of the Nation for the 2025-2031 period.

The 2025 midterms in October will be a pivoting moment for the Milei admin: if La Libertad Avanza is able to secure a majority together with Macri’s PRO party in both the Senate and Congress, Argentina will be in for a world of additional chainsaw mowing. It would make it much easier for Milei to push reforms through after his executive order superpowers end around Q3 of this year.

At the moment, many reforms can be pushed through by Milei thanks to these additional powers granted at the start of his mandate, but those were only granted for one year versus the regular two years for previous presidents. After that ends, Milei will only be able to push essential and structural reforms involving taxes etc through Congress first.

This is why Minister Sturzenegger of the Ministry of Deregulation has a countdown timer, making sure to nuke as many unnecessary regulations before Milei’s powers to bypass Congress will end.

Currently, the Senate and the Congress seats are distributed as follows:

As you can see, that’s a lot of blue Peronism that is waiting to be replaced. If the polls are close to accurate, Milei’s La Libertad Avanza could be in for a historic landslide if these levels of positive image keep up until October. Either way, the expectation is that LLA and Macri’s PRO will win with a slight majority, which would be very positive for quicker legislative changes.

Economic Activity

2024 was marked by a sharp drop in economic activity across the board. The chainsaw initially caused a recession, only to improve towards the end of the year. Some sectors are not yet back at their 2023 levels (construction).

In the first 11 months of 2024 economic activity accumulated a drop of -4.4%. The IMF estimated a -3.5% drop in GDP for 2024, which will turn out to be closer to -3%.

The sectors with the most economic growth in 2024 were agriculture, mining and energy, which are all more primary and export-oriented, versus other branches of industry, commerce and construction, which generate more jobs.

The challenge for this year will be to rebuild those most affected sectors, and besides just economic stability — which is a huge accomplishment in Argentina —, Milei’s program of economic growth will also need to start showing results.

Income and Poverty rates

The Government expects inflation of 18% for 2025 and the continued slowdown of inflation will continue the recovery in income in real terms — in the last two quarters of 2024 salaries in dollar terms have increased significantly:

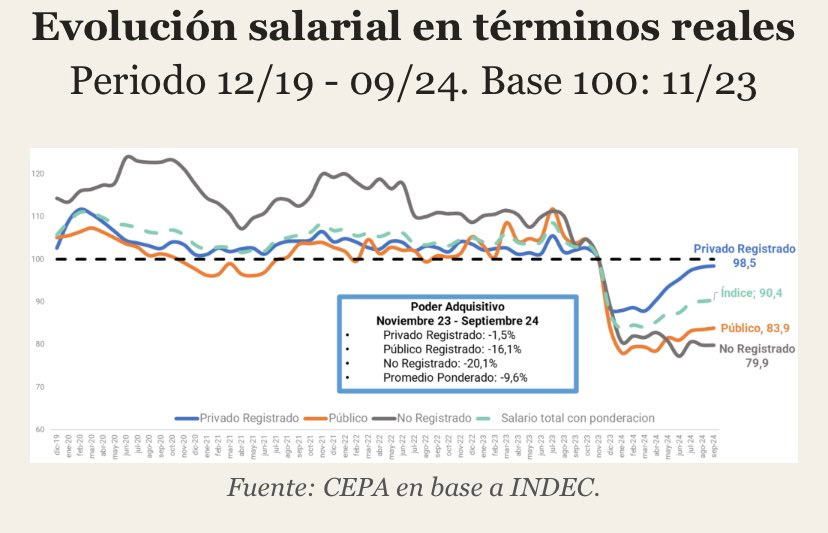

However, these increases do come with a grain of salt in terms of purchasing power, since Argentina still had over 100% inflation in 2024 and the peso has remained stable against the dollar. When looking at the most conservative salary evolution across the board, including non-registered salaries, purchasing power is still below previous levels:

Despite this loss in purchasing power during most of 2024, poverty rates have declined sharply after the 52.9% peak in Q2 2024, and are estimated to be around 37% now:

Low inflation is a necessary condition for the improvement of income and for poverty rates to drop further, ideally moving towards historic lows of 25%. If the price increases and income occur at the same pace in 2025, purchasing power can remain stagnant or grow very gradually.

The concern about purchasing power and the internal market is linked to the fact that consumption represents more than 80% of GDP.

However, expectations are that salaries will far outpace inflation and that these will be closer to the historic average of 1,000-1,200 USD/month.

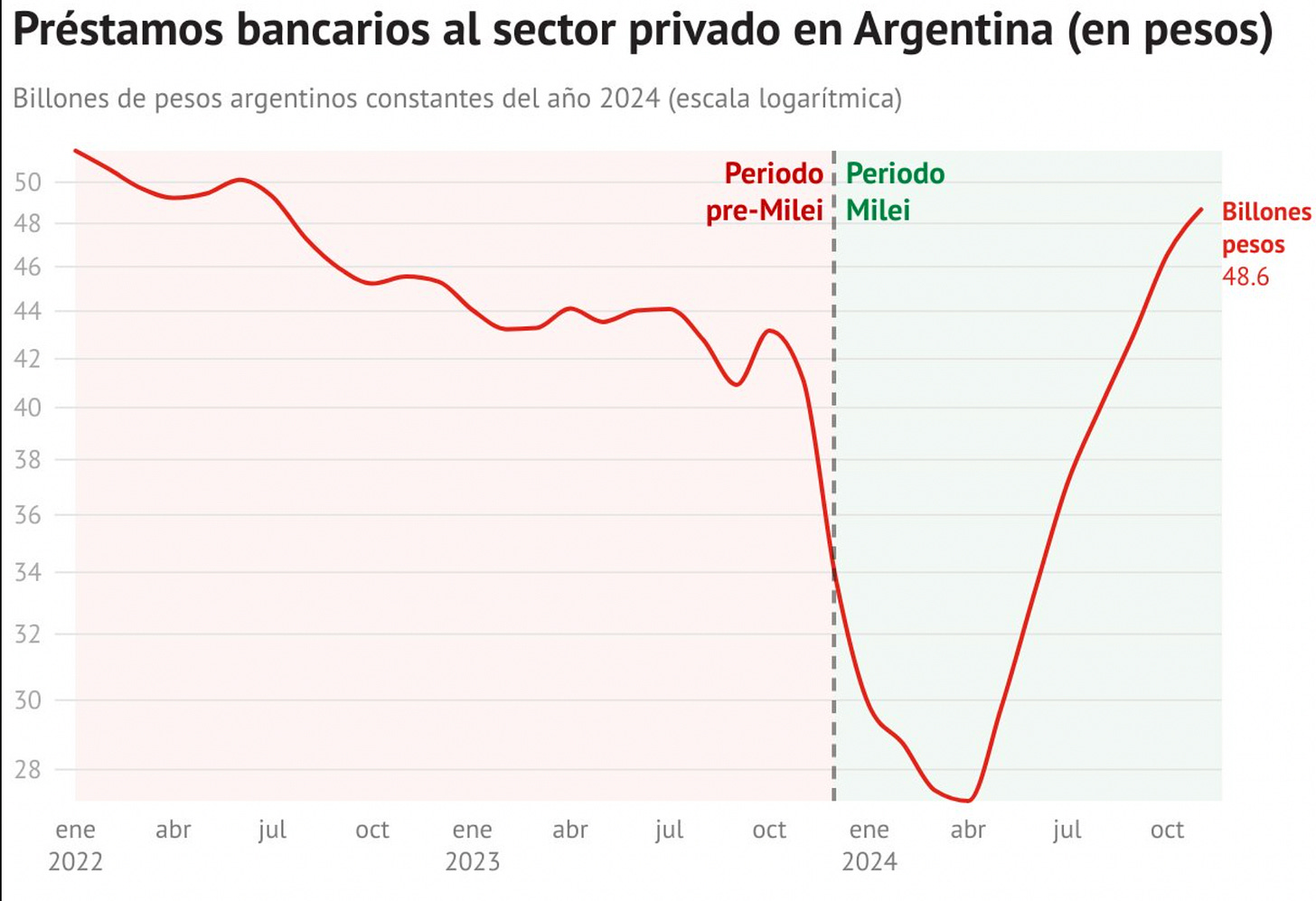

Besides better salaries in real dollar terms, banks are increasingly lending to the private sector again, which will also boost the recovery of domestic consumption.

Final Thoughts

Overall, the 2025 outlook for Argentina is very positive compared to little over a year ago. The groundwork has been done to ensure more economic growth, lower poverty rates and more stable prices across the board.

There are still many roadblocks, but they are closer to speed bumps compared to the killdozers blocking progress at the start of Milei’s term. The one mayor item, which is tied to increased foreign investment, is lifting the currency restrictions and capital controls. One by one the BCRA is loosening its policies for foreign exchange requirements, but Argentina is still a long way from having a floating exchange rate.

No matter how it plays out, this year will be nothing short of epic.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

So with the poverty rate being pretty high, how do people get by?

And how many government jobs have actually been eliminated since Milei's start?

Do you think Milei will remove import taxes and tariffs on consumer goods? That would allow for prices to drop quite a bit, thus increasing real consumer purchasing power.