Welcome Avatar! You might think that buying a car in Argentina entails less paperwork than buying property, but you would be wrong. The road to car ownership is paved with bureaucracy hell, and I’ve ran through both used and new car scenarios to guide you through it. Let’s dig in.

Buying a Used Car

Let’s start here since this will be the most common and easiest scenario. Buying a used car is definitely the easiest road to car ownership in the Republic of the United Provinces of Inflation.

My first car was a second hand car, as was the one after that. The process is smooth and takes little over a week or less.

Platforms / dealers

The best way to get a grasp of car prices is to visit the car section on mercadolibre.com.ar. You will quickly see that cars here are vastly more expensive than in “first world” countries, and even more so if they’re imported.

You can meet with the owner if it’s an individual, or check a car dealer with multiple second hand models (this is probably easier).

The plus of buying from a car dealer is that they will also take care of all the forms and the ownership card, so you only have to fill out a few forms there, show up a few days later and everything is taken care of.

If you deal just with a single seller, you will have to personally take care of all the registry steps below, which are quite bureaucratic.

Even the mileage can be insane and the car will still be expensive relatively compared to other countries.

The operation

In a used car purchase operation, one of the most important things to take care of is to carry out the transfer process quickly. By transferring the ownership title quickly, the buyer obtains the change of ownership that accredits him as the owner of the vehicle and the seller is released from all civil, criminal and tax liabilities after that.

At the end of the transfer procedures, the buyer will own the vehicle outright even if the seller later regrets the transaction.

Whoever buys the car will be responsible for fines and license fees (even existing ones, since these are tied to the vehicle, not the owner). Also, the deadline to make the transfer of a used car is 10 days maximum.

Sometimes fines take a while to register, and if the previous owner got fined in the last couple of weeks or days before the transfer, those fines could end up on your doorstep once the transfer is complete. Not much you can do about that, but looking at existing fines gives you an idea of driving behavior.

It is estimated that the change of ownership is around 6% of the value of the vehicle in taxes and transfer costs. This number includes the price of the vehicle, tariffs, forms and taxes that must be paid to the Registro Seccional.

One of the most common situations when buying and selling a vehicle is that the seller finds out about the existence of traffic fines. Existing fines at the moment of transfer HAVE to be settled first before vehicle ownership can be transferred.

How to check if a vehicle has outstanding fines

If you have the DNI number of the seller you can check for multas (fines) tied to his person here. If you have the license plate of the car you want to buy, you can check for the fines tied to the plate in the City of Buenos Aires here and in the Province of Buenos Aires here.

Each province has it’s own register of fines, this is unfortunately not a national database. So if your owner has a holiday home in Mendoza, it might be worth the effort to check that database as well.

In the event that the car has fines, you have the option of paying them at the registry so that the operation can be completed. Ideally you check before going to the registry and make sure that the current owner pays the fines. If he doesn’t have the money you can offer to pay them during the transfer and deduct it from the final vehicle price.

Without a debt free vehicle it is not possible to move forward with the transfer process.

Transfer process

One of the easiest ways to know the value of the transfer of a used car is to verify the value on the website of the National Directorate of Automotive Registration (DNRPA). You only have to indicate the make and model of the vehicle to know its market price.

This is also the price table the government uses when determining the taxes for the vehicle you own. Doesn’t matter if the car is completely rekt, they will use that table regardless.

The fee to carry out the transfer is 1.5% of the value of the vehicle in the case domestically produced vehicles, and 2% for imported ones.

According to the DNRPA, these are the essential requirements when buying and selling a used vehicle in Argentina:

Signature certification per person

Car Title

ID / Passport

Driver’s license*

Tax register (you need to “exist” in the AFIP database, either with a CUIT, CUIL or otherwise)

Debt / fine / traffic violation clearance

Form 13

Provincial stamps and taxes

*Autist note: You can do the transfer with a foreign license. It doesn’t have to be a local license, but take into account that you can only drive a car for 6 months max on a foreign license. If you get into an accident after that, you’re f’d. Very hard to get insurance (which is required) on a foreign license as well. Unfortunately unless you have a Spanish or an Italian drivers license, you will have to retake the theoretical exam AND the practical exam in Argentina in order to get a local license. It’s very easy though, but still a pain.

Estimating transfer costs

The DNRPA also allows you to make an estimate of the costs involved in the transfer process of the used car. To do this, you have to go to their website and in the "Estimador" choose the "Transferencia" option. Once there, you simply have to enter the license plate number, the declared value and the province of residence of the current owner.

Digital transfer: seller

The easiest way to start the process is by starting at the DNRPA website in the "Digital Transfer" section, where you have to complete Form 08. This can be done by both the buyer and the seller, since it will be necessary to enter the data of both, the domain number and the chassis number of the vehicle (this data is located on the cédula verde of the current owner, which I will call the car ownership card from here on out).

According to the DNRPA website, the necessary documentation to carry out the Digital Transfer is the following:

Original and photocopy of the DNI.

Automotive title (when the transfer is presented in the registration of filing) or CAT - Proof of Title Assignment - (when the transfer is presented in the registration of future filing) and all issued IDs, including IDs for authorized drivers .

Form 12 with the verification carried out

Proof of CUIT, CUIL or CDI of the purchasing party (only for cases in which this information does not appear on the back of the DNI)

Once Form 08 is approved, whoever has carried out the procedure can go to Registry to physically sign everything previously established in the digital form.

Documents needed by the buyer

The buyer must attend the Registry with his ID, CUIL or CUIT certificate and proof of funds. The amount for which the source of funds must be certified, when buying a car, is equal to or greater than $12,031,145 (about $16k USD at the time of writing).

The source of funds has to be done by a certified accountant and he files it with the Colegio de Contadores. The Colegio certifies this document with a PDF certification and that can be emailed to the registry.

Now, as you can imagine, there is a lot more wiggle room here for used cars to avoid having to do that proof of funds versus when you buy a new car. The declared costs can be lower than the required amount, and you pay the rest under the table to the seller. This cannot be done for new cars, and you are 100% for basically any car going to have to get this certification of source of funds.

Although these documents are not required, it is recommended that the buyer request three reports on the car:

The informe del dominio report, which confirms the data of the car seller and that there are no judicial inhibitions, embargoes, reports of theft or other legal impediments (Gvmt website)

The libre deuda de infracciones (vehicle free of debt or fines) is also required. This records that the vehicle does not contain any unpaid fine at the time of making the transfer (DNRPA website).

Finally, you have to get the libre deuda de patentes (license plate tax, which is the tax just for the vehicle ownership, paid monthly or yearly, based the previous rate table). The latter is obtained from AGIP if the car is registered in CABA (Buenos Aires City), and from ARBA if it is registered the province of Buenos Aires.

Other costs related to the purchase

The seller and the buyer must agree who is responsible for the Stamp Tax (3% of the value of the car), the transfer fee (1.5% of the value of the vehicle if it is national and 2% if imported) and other documents, which usually cost between 0.5% and 1% of the vehicle value.

Buying a 0km / New Car

Earlier this month I bought a new 0km car, and in the end the process is similar compared to the used car. The main differences are:

You can only buy a new car at a dealership;

The price bracket will unlock the awesome experience of having to file a “source of funds” at the Colegio de Contadores sí o sí, there’s no way around it since no new car will be below $12M pesos;

The license plate has to be created, this is a step that takes a few business days (and can only be completed after handing in the source of funds certification)

Depending on the sourcing of the car (most dealerships sell new cars that are actually located at a different dealer, which then needs to combine to ship the car), it can take 5-7 days for the car to show up;

Once you have the car on your name, in your possession and you also have the car ownership card (cédula verde), you will have to take the car to an engraving shop where they engrave the license plate number on the windows and other parts. This is mandatory, driving around without that step is illegal.

All in all, the process took about 3 weeks for me, but this included a delay because my first request for source of funds certification got bounced. With the second request there was no issue.

Timing the buy

Another important thing to keep in mind is timing your buy: many car brand HAVE to conclude the sale of the car within the same calendar month, or they will issue a fine to the dealer (who will then try to tack that fine to you).

This is also why many dealers will not start a sale after only 5 business days are left before the end of the month.

Of course this Mara did not know this, and I bought it a week before the end of the month. Because my SOF certification was delayed, the sale did not conclude in that calendar month, and Volkswagen fined the dealer with a 6% right then and there.

I ended up paying 1.5% additionally because of that, after refusing to pay more because they didn’t tell me about this (it was a real thing because they showed me the VW invoice that cannot be faked, so it’s not that they were just coming up with this 6% because they felt like it).

So time the buy at the start of the month. It also depends on the brand, but VW does the 6% fines, other brands might not do this or handle it differently. It is a sales incentive to conclude sales as fast as possible.

The actual buy in cash USD

In my case I handed in my 2017 Renault once the sale was completed, and they deducted that from the price of the VW. They came up with the final price and paid that in cash Benjamins.

No need for Source of funds here, that is only once you get to the Registry and you have to “create” the license plate (since it is new, they need to create it, and in that process you will need to email the Source of Funds certification to the Registry).

Interestingly, the dealer never even inspected my used car and paid just little under the market price for it.

Could’ve been totally rekt, they wouldn’t have known up until the last minute, after the sale was already completed.

Autist note: the Source of Funds certification at the Colegio sounds like a big deal, but if you have a good accountant it is no big deal. There are no checks for actual transfers, everything is written up in a statement. No ledger checks whatsoever, because otherwise they wouldn’t sell a thing in a cash-based country like Argentina. In my case, it was money from a family “donation”. That tells you all you need to know. Just get yourself a good creative accountant, this is one of the best investments you can make in Argentina. I’ve had a few, and 2/3 is not creative enough. You can read this tweet thread if you want to understand what I mean by creative. Bookmark it if you are thinking about permanent residency in Argentina, for real.

“Luxury tax”

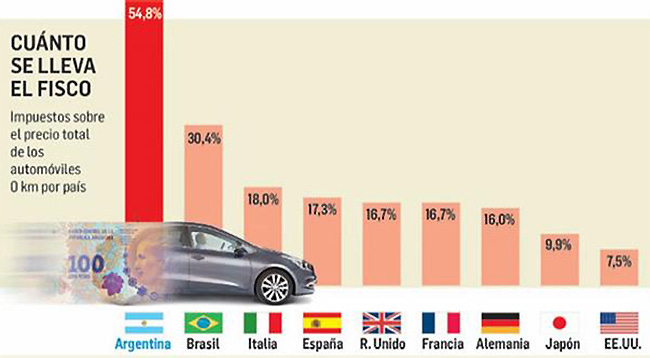

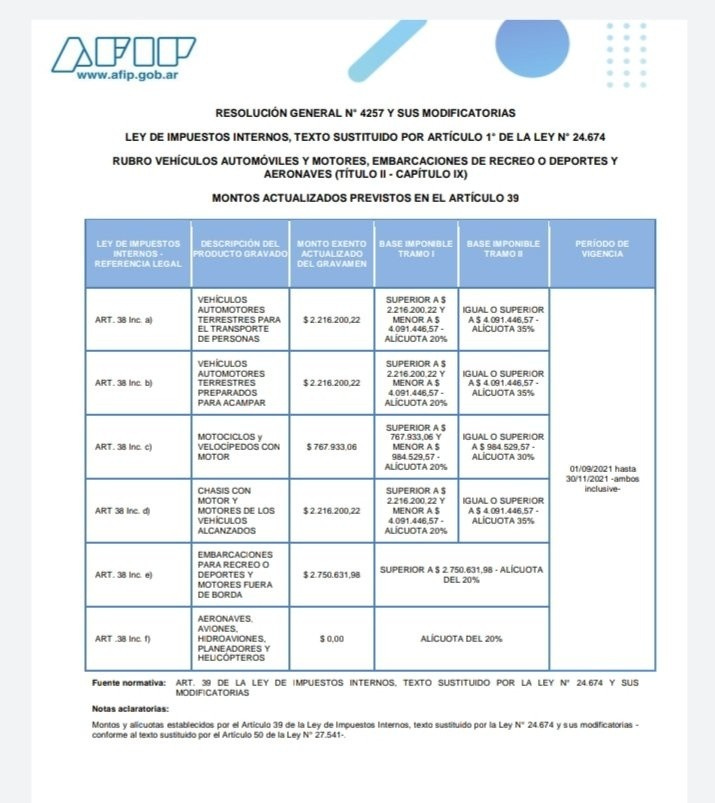

Because there can never be enough tax on anything, in 2023 Argentina started levying a “luxury tax” on new 0km cars. This additional tax is only paid for new cars that exceed a certain threshold in terms of price tag.

You guessed it: literally ALL cars exceed this threshold, except for 2 or 3 models. So basically Argentina is saying that the mere fact of buying a new car deserves the punishment of slapping on an additional luxury tax.

This means that new cars became 35%+ more expensive this year, just because of that single line item. This tax is already included in the prices you see, so it’s not the case that this will come up as an additional surprise once you start the buying process.

Once you get your car and you can proudly call yourself a dueño, check out this post for recommended road trips in the Southern Cone:

Road trips in the Southern Cone of South America

Welcome avatar! Road trips in Latam are the absolute bomb. It is the best way to discover more about a country and also visit the smaller towns that usually aren’t included on the general tourist agenda. Over the years I’ve done quite a few road trips, mainly in Argentina, Brazil, Chile and Paraguay. Some countries that are still high on my list are Col…

Owning the car

Once you own the car you will have to pay monthly tax (patente) just for owning the vehicle. What you pay depends on the year and the model, starting from the purchase price of the vehicle and the model and year in which it was manufactured.

Although the amounts vary from province to province, the average payment (so you have an idea), is 3.5% of the value of the vehicle on a yearly basis.

On this website you can check for cars registered in the city of Buenos Aires if there are still patente taxes due, and you can pay them directly online. This is what it looks like for my new 0km car (considerably higher amounts because it is new):

Final thoughts

Overall what I would recommend is buying a practically new but used car at a car dealership. The transfer process is faster, and you will have the keys in your hand about 2 weeks sooner versus buying a completely new car.

It also saves you the step of the license plate creation and engravings, but for the ownership transfer you will have to do the source of funds certification with an accountant (just because virtually all newer cars are 12M+ pesos nowadays).

It is surprising that the car sales process is so much more cumbersome compared to buying property. Property values are way higher, yet nobody ever asks you for even a whiff of source of funds, and it is all payable in cash.

Apparently in the 1980s there was a huge problem with car parts contraband, theft of parts and other illegal activities, which forced authorities to start with engravings, source of funds etc.

Still amazing to see that for something way more trivial compared to buying a house, the process actually works the way it is supposed to and there is virtually no way around official numbers and prices (maybe a little bit more wiggle room for used car prices).

See you in the Jungle, anon!

This is spot on target. Many years ago I bought a brand new convertible Peugeot. I don't remember it being so difficult. I just bought it at the dealership and they did all the paperwork.

The coolest thing was selling it 5 years later for MORE than I paid for it. Ha, ha. Only in Argentina!