Cepo & Currency Competition

When will the Milei government lift the dreaded "Cepo" (fx restrictions)?

Welcome Avatar! Close to six months into the Milei presidency, the cries for lifting currency restrictions and launching his currency competition are getting stronger. Will Milei simply turn the peso in to one of the strongest currencies or will he let Argies convert all of their pesos to dollars on their home banking versus being forced to go to a cueva? Let’s dig in.

What is the “Cepo”?

Most people outside of Argentina reading about a cepo cambiario will probably not be familiar with the term what it means:

The set of restrictions on the purchase of foreign currency from people and companies in the Single and Free Exchange Market (MULC) is called "cepo" in Argentina. These are quantity controls and even limits on transfers abroad and restrictions on access to currency exchange operations.

If you live in any reasonably “free” economy, this is hard to grasp what this concept means in practice since you can always buy whatever you want to buy with your hard earned euros or dollars. Not so much for Argentines.

The exchange rate cepo was originally established by Cristina Fernández de Kirchner as soon as she won the 2011 elections, and was maintained throughout her second term.

The idea behind it was to avoid a flight to the dollar, which happened anyways through the black market exchange rate (dollar blue). This parallel currency market spun up almost immediately after Cristina first announced the cepo.

In 2015, when Mauricio Macri won the elections, he lifted these restrictions as soon as he took office, only to put them back in place in September 2019, right before Albert Fernández’s term.

This cepo was even stricter, with only $200/month/person allowed to go to the dollar. Buying more is possible, but with all the additional taxes on top, this rate became pretty much the same or higher compared to the parallel market rate.

Tearing down the cepo walls

Milei’s plan for free currency competition and a free-floating peso/dollar rate is the first step towards “dollarizing” the economy, but it is increasingly uncertain if that is still on the table if the peso keeps performing the way it has.

As we have seen in the past few months, a strong peso feels very similar to a de facto dollarization. Even the blue rate didn’t budge, and is only now starting to creep up again.

But the cepo restrictions are still in place.

The government's argument is that to get out of the currency restrictions, two things are needed: 1) accumulate more reserves and 2) clean up the BCRA's balance sheet.

In order to accumulate reserves before lifting the restrictions, the BCRA has to force exporters to liquidate their currencies at the official exchange rate.

To buy dollars from exporters, the BCRA has to issue pesos. This is what the BCRA has also been doing to prop up the reserves, as discussed in The Printer in Disguise.

Issuing more pesos generates inflationary pressure because there is no demand for pesos, and to solve this the BCRA issue 1-day REPOs (Pases) to absorb these pesos (paying interest).

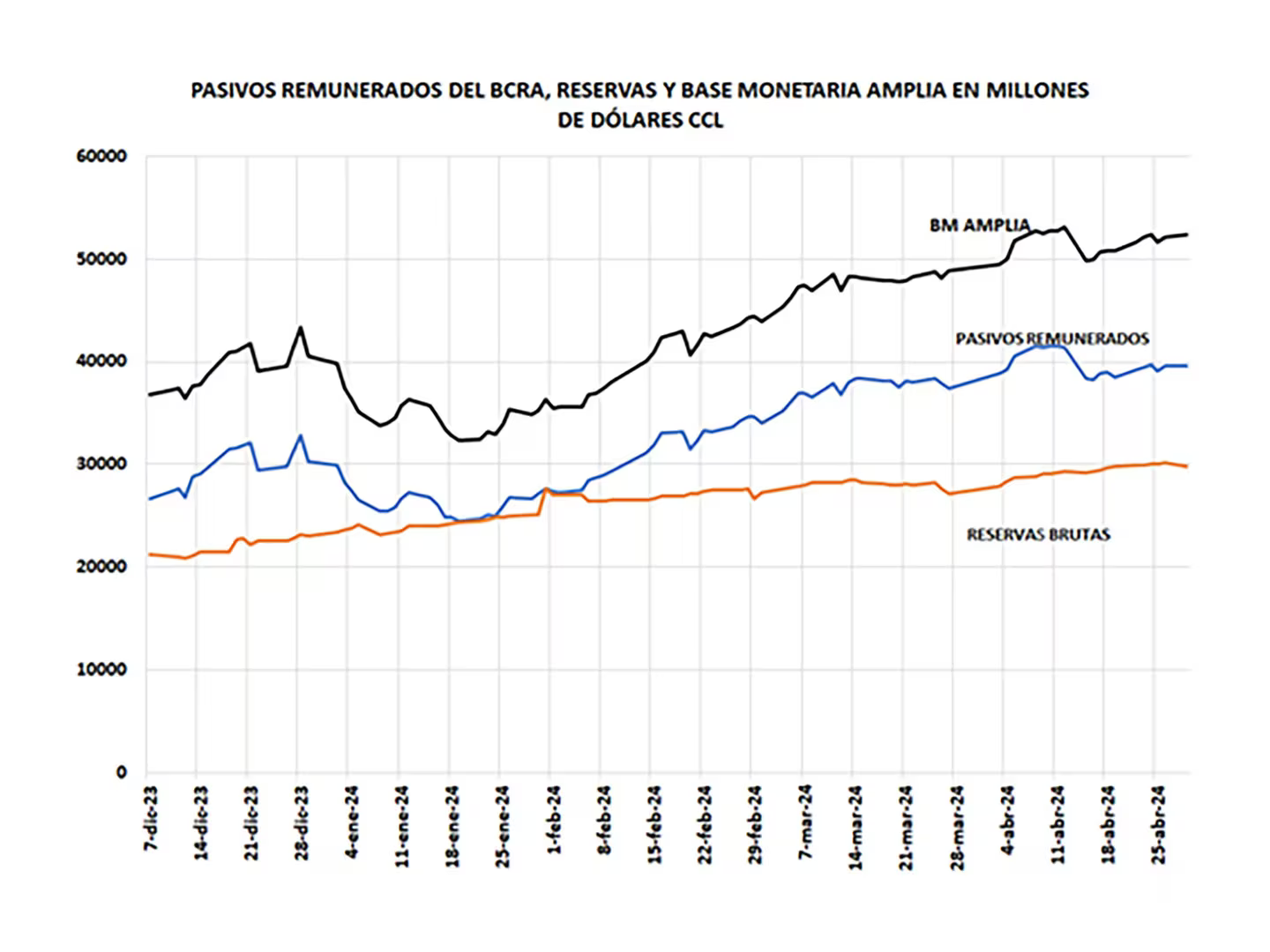

These remunerated liabilities together with the monetary base are currently still growing faster than gross reserves:

Now this is a kind of chicken and the egg situation, because at the same time, interest rates are dropping at lightning speed — from 150%+ in December to 40% today.

It is really the best possible strategy to bolster reserves given the situation Argentina was in, without taking on more foreign debt. But that does not mean that this won’t become a potential issue going forward.

Hyperinflation No More

The most important thing is that hyperinflation was avoided thanks to these policies, and due to the reduction in interest rates, Argentina will save the equivalent of 3 monetary bases in interest it will not have to print, just in 2024 alone.

These would have otherwise been paid to the banks.

Maintaining the restrictions with the current set up seems to be more expensive than eliminating them, because the liabilities and the monetary base are growing faster than the BCRA's gross reserves. But at the same time the Caputo-Bausili team is lowering interest rates at record pace, and will keep doing that.

Peso and USD Debt

And when we take a peek at the debt maturities… these can only be met if Argentina keeps this year’s record high crop yields for the foreseeable future (not likely because rain and sunshine are inherently unstable factors YoY), and that the Milei admin keeps the absurdly high Kirchnerist export tariffs in place.

If the government plans on keeping the support of the agro sector, it will need to at least lower these export tariffs considerably starting 2025.

If the cepo is lifted and despite an economic plan that changes expectations, there is a withdrawal of deposits, the BCRA has a number of bonds and Non-Transferable Bills that should be exchanged for negotiable Treasury bonds to absorb the issuance to cancel remunerated liabilities by selling those bonds.

The sooner the cepo restrictions can be lifted, the better, you would think. Not so fast.

From a theoretical perspective if the government keeps the restrictions in place for longer, there is a real danger of widening the gap between the remunerated liabilities and gross reserves even further, increasing the need for more peso devaluations in the future.

That is only true if rates remain where they are. As we have seen above, rates are rapidly dropping. This means the cepo could be in place a while longer without overcomplicating the imbalance highlighted above.

But why would you want to keep the cepo longer and why is there no clear date for when the Milei administration pretends to lift restrictions?

Enter the IMF and recent history.

IMF

As discussed before, Argentina has a long standing relationship with the IMF, and it it is definitely a thorn in the country’s side.

Argentina is one of the biggest borrowers (44 billion) at the institution:

When the Macri government started in 2015 and started applying gradualismo, there weren’t any big reforms with regards to the State budget and size as we are seeing now with Milei’s chainsaw.

One of the first thing Macri did was take it off. So Macri kept the Kirchnerist machine running without the cepo restrictions.

You can quickly imagine what happened: massive capital flight to the dollar, combined with a growing deficit funded by the peso printer.

Macri started with an exchange rate of $16 pesos per dollar in 2015 and in 2018 it was spiralling out of control through peso debt issuance and dollar demand: in December of that year the dollar rate was at $40+ pesos already.

In mid-2018 his administration ran to the IMF to take out one of the biggest loans in the institution’s history: $44 billion in total.

This prequel is important to keep in mind when talking about taking off currency restrictions, and this is a possibility the Milei administration has definitely taken into account — which is why the cepo restrictions are still active instead of taking them off right at the start of his term.

Historically, whenever Argentina has had more open economy policies, the IMF tended to hold back on any new loans, the last loan during Macri being an outlier. However, it was pretty clear what was going to happen since Macri didn’t implement any deep reforms: that money would go poof either with him, or with the Kirchnerists, and that is exactly what happened.

Autist note: This kind of “debt trap” was discussed in great detail in this episode of the Bitcoin Fundamentals podcast in an interview with John Perkins, the author of Confessions of an Economic Hitman. I highly recommend listening to that episode since it gives a unique view of how organizations like the IMF keep countries like Argentina in a choke hold through debt, despite the fact that many people in these organizations may have the best intentions.

If we go back to 2001 during one of the biggest crises in the country’s history, the IMF said no despite heavy reforms and an open economy. It looks like some more socialism was needed first.

The same is currently happening with Milei: the guidelines are almost impossible to meet, and even despite more than complying with those, it looks like the IMF is not very willing to lend Argentina more money.

Minister Luis Caputo has met with IMF officials multiple times to see if they could get access to another $15 billion dollar loan to be able to take off the currency restrictions with more reserves.

This week, spokesperson for the International Monetary Fund (IMF), Julie Kozack, praised the progress made with the austerity measures implemented by the Milei administration. She did insist on the need to deploy active measures to prevent the levels of poverty and unemployment suffered by the population from increasing in Argentina.

In this Mara’s opinion, it would be better but harder not to take on ANY additional loans, and try to get to the finish line with the current trajectory.

Taking out an additional loan will bolster reserves, yes, but why would the BCRA need more reserves to begin with? Does this administration plan to manipulate the currency market again by using reserves and burning those on manipulating the fx rates?

At the end of the day it doesn’t look like this government will steer in that direction.

Cleaning up the BCRA balance sheet should be the number one priority, together with making sure that the imbalance between remunerated liabilities, gross reserves and the monetary base doesn’t get bigger.

If Argentina can get this done without additional loans, it would be one of the biggest W’s in recent economic history.

Predictions / Final Thoughts

Unfortunately, short-term predictions for Argentina often miss, since changes tend to be very rapid and unexpected.

A good example of this is the peso strength in these last 6 months versus the dollar: if anyone would’ve known or expected this, locking up your pesos in the last months of the peso Ponzi and basically juicing them for 70% YoY interest rates on dollars wasn’t such a bad idea.

Currently interest rates are down to 40% and declining further, so that play is gone.

Purchasing power in USD terms got cut in half in most of Argentina on almost everything, and brokemads complained (for the majority of Argies on peso salaries, this has been even more brutal).

Luckily there are bigger trends that will continue, and that are easier to anticipate. A few include:

Real estate prices will start to rise (this trend continues, especially since construction costs are close to ATHs, and mortgages are coming back).

Local stocks and bonds will keep climbing upwards unless there is a catastrophic drop in confidence in the current government - some companies are still relatively cheap and have a lot of great assets on their balance sheets (might touch on some particular stocks I am watching closely in next updates)

The dollar is not going anywhere in Argentina. No matter how strong the peso is now, the tendency is to save in the preferred currency and that is the USD. This will not change, so my assumption is once exchange rates can float freely and Argies can buy as much as they want without the ridiculous limits and taxes on top, that the peso will devalue again vs the dollar.

Argentina’s economy will still be choppy, with more layoffs, less activity and higher unemployment (which increases social tensions). A rebound is more likely in 2025 vs Q3 2024 in my opinion.

With regards to lifting FX restrictions, the timing of that is a lot harder to predict, but I expect that to happen towards the end of the year.

The longer the Milei government can get away with leaving it the way it is, the better for bolstering reserves and dealing with a more predictable exchange rate scenario.

See you in the Jungle, anon!

Other ways to get in touch:

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

"In this Mara’s opinion, it would be better but harder not to take on ANY additional loans, and try to get to the finish line with the current trajectory." Agree

Agree. I wonder if you follow my friend Iris Speroni on X. She talks a lot about not incurring in extra debt.