Individual Sovereignty in the Age of Cashless Societies

Will the Southern Cone be able to resist the upcoming CBDC storm?

Welcome Avatar! Do you want to live in a place where you need to request permission to build a shed in your own backyard, or do you prefer a country like Paraguay where you can still drive around without license plates or car insurance? The choice is yours, anon, but for how long? Let’s dive in.

Cashless?

In the Digital Age we’re racing towards, one of the downsides is the war on privacy.

In the last couple of months, it seems that the CBDC narrative is getting an extra push and in this mara’s opinion the first Central Bank Digital Currencies will launch in most developed economies. They will not replace cash just yet, but it is the last step towards fully cashless societies.

Covid was a giant push towards a CBDC-world and cashless societies. Remember how media outlets started shaming physical bills for being germ carriers etc? This narrative will increasingly be pushed upon the public. Cash is “inconvenient”, “unsafe”, “unhygienic”.

Plus, we want “financial inclusion”, which is another great USP for the mirage of CBDC benefits according to our central bankers.

As if cash excludes certain parts of society (it’s actually the opposite if you think about it, for anything digital, you first need a screen).

This week, news came out that the IMF is working on launching an international CBDC platform (emphasis added):

As representatives see it, CBDCs should not be fragmented national propositions. To have more efficient and fairer transactions there must be systems that connect countries, to provide interoperability. For this reason, the IMF is working on the concept of a global CBDC platform.

The IMF wants central banks to agree on a common regulatory framework for digital currencies that will allow global interoperability. Failure to agree on a common platform would create a vacuum that would likely be filled by cryptocurrencies. A CBDC is a digital currency controlled by the central bank, while cryptocurrencies are nearly always decentralised.

If it wasn’t clear yet who the bad guy is for the central planners, then that quote should make it obvious. Cryptocurrencies (some, not all) provide private transactions, are decentralized, and can be used without a centralized entity blocking the transaction.

Basically those are all things that our unelected monetary overlords at Central Banks and planning agencies do not like and want to avoid. It takes control away from their buttons and puts it into the hands of individuals.

Autist note: I’ve written extensively on CBDCs and the impact on future black markets before, including an article about Silvio Gesell, the Argentine inventor of money with an expiration date. That article goes into more depth about the implications of a cashless society, and Gesell’s theory in general of how to get rid of the rentiers in society (something that seems to appeals to our current political leaders very much):

Case of Argentina: why did the zeros stop?

Pulling the current IMF charge into the Southern Cone, there is one interesting detail that shouldn’t be overlooked: Argentina is not printing higher denomination bills.

To keep up with current inflation (in reality close to 150%, officially 104%), technically the Central Bank should’ve started printing $10,000 peso notes already (that would translate into roughly $20 US token at the current blue rate). Instead, the only new bill is $2,000 ($4 USD), which between design and rollout already lost 20% of its value.

Banks are struggling to store all the physical bills, but instead of printing $10k, $20k bills, the max is still $1,000 and $2,000 pesos.

The Argentine Central Bank (BCRA) closed contracts to print banknotes printed in Argentina, and some will also be printed from the Casa da Moneda do Brasil (CMB).

In addition, to import the $2k peso banknotes, a contract was approved with the Brazilian Mint, the National Currency and Stamp Factory of Spain and France, and the China Banknote Printing And Minting Corporation.

So the Central Bank USD reserves, which are already -$7.9 billion US, are being burned to import inflationary peso notes that evaporate faster than a fart in the wind? Yes. One could argue that this just doesn’t make any sense, as so many of the economic policies applied in the country that is never boring.

But in this particular case, there is more than meets the eye in my opinion. For one, politicians would like to pretend the peso is worth more than it actually is and are therefore reluctant to print higher denomination bills. That has been the case for a while now.

Politicians would be thrilled if their reluctancy to print higher bills would be perceived as a limitless patriotic love for the peso. However, the more likely explanation is this: make it less and less convenient to use cash and force people to pay digitally, slowly but surely.

It is already happening at a breakneck pace. Most will find it highly inconvenient to walk around with a brick of pesos under their arm just to go out on a family dinner. The increased adoption of digital payments is faster than ever, with new options popping up every other month.

What better scenario for a CBDC than to keep devaluating, not printing higher denomination bills, and forcing more and more people onto digital payment rails? And that, my friends, is where we are headed in my opinion.

Current state of cash in the Southern Cone

“But, Mara, cash is king in the south”, I hear you say. Yes, this is true, for now. And luckily about 40-50% of the economy completely moves in the shadows and is fully cash based.

This is one of the IMF’s main pain points regarding this region and Argentina in particular: the shadow economy that cannot be controlled that easily.

We know that Argentina in 2018 received one of the highest IMF loans ever, about 60% of all outstanding loans at the time. Argentina is not getting off the hook any time soon and could be an interesting candidate to be forced onto that CBDC project initiated by the IMF.

In 2020, a survey in Argentina, Uruguay, Chile and Paraguay, revealed that the majority (60%+) of merchants still prefer cash as a payment method:

Small businesses require cash payments for their normal operation. In Argentina, a large percentage of daily transactions are made in cash, such as purchases in local businesses (81%), payment for services (25%), purchases of clothing (27% ) or fuel (36%).

Many merchants still agreed that a cashless society would exclude an important section of society, without access to digital payment systems:

During the pandemic, the use of digital payments skyrocketed, and many new providers started offering easy linkage with existing banks so people could start using their phones instead of their debit card, by scanning a QR code.

Now what happened from 2020 to today? See for yourself:

Granted this graph shows the amounts of pesos which will increase anyways due to inflation (a count of transactions would have been better), but you can clearly see that Digital payments (QR, payment buttons or POS payment terminals) already surpassed payments with debit cards for the first time in April of this year.

Roughly 40% of the population already uses these digital payments and in only 4 years, the number of users doubled.

Nubanks in the Southern Cone

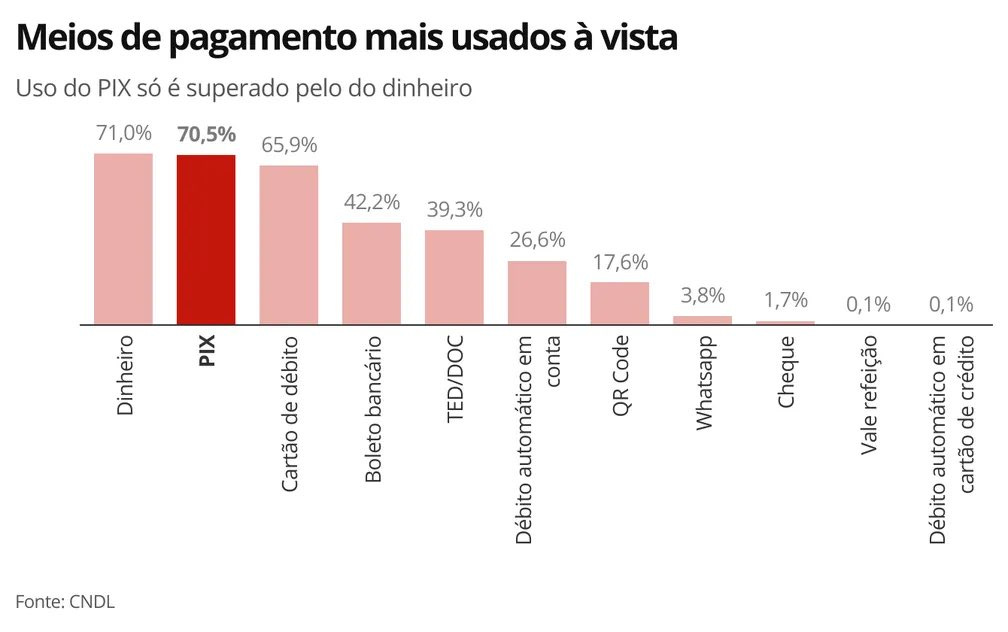

Increased Nubanks and Payment processors like Mercadopago and Pix are the main drivers for this development.

These apps linked to the traditional banking system are essentially stepping in to do what crypto has failed to do for now: enable easy digital transactions without much hassle for users and with a crisp UI/UX.

Users will always forego privacy whenever usability is better, and since everything is KYC and tied to your identity, these payments have no privacy vs using cash.

Starting June 2023, Brazilian tourists will be able to pay with a QR code in Argentina using Pix, and they will not need to exchange dollars. The operation will take as reference the value of the financial dollar (MEP), which is also used for international creditcards, and tends to be only -10% or so versus the black market rate or blue rate.

What’s next?

We are seeing the initial stages for the groundwork of a cross-border CBDC rails, the one that the IMF is so eagerly working on.

With the increased adoption of digital payment systems, and the reluctancy to print higher denomination bills, it will be easier to force Argentines on a CBDC once Argentina defaults. And believe me, that will be sooner than later. The leverage there is completely on the side of the IMF, no matter how many currency swaps Argentina decides to accept from China.

So unless Argentina decides to default on the IMF loan completely and exit capital markets (like the country has done in the past), this is the more likely scenario from this Mara’s point of view:

Default (technically Argentina is already defaulting on IMF interest payments this month);

Debt restructuring at 50 cents on the dollar (this is the bond play covered in my previous article) - this will likely happen under the new government;

Austerity measures + increased fiscal control over the economy - CBDC introduction and plan to eliminate cash in x years.

Now even if this is forced upon the population, I have no doubt about the ingenuity of the people to come up with circular economies.

Some absolute currency mayhem that ensued during the 2001 crisis is a good example of that, together with the omnipresent black market for US token swapping that is currently active in the country.

From that perspective you can rest assured that Argentines will not go down quietly into that digital dystopian night, like most of the sheeple in “developed” countries probably will, since “they have nothing to hide”.

Final thoughts

Argentina is so dependent on its shadow economy that it is unlikely that cash will be banned completely any time soon. But the gears have been set in motion to make sure this transition happens sooner than later.

Where can you still buy hectares of land in cash? Where can you still take a cab with a backpack full of USD cash to buy a nice $250k house in the best neighborhood in a big city?

Still here in the Southern Cone, but the window of opportunity is closing.

At least that’s what it feels like.

See you in the Jungle, anon!

IMF is a cancer.