Mercado Libre: Latam's Amazon

An overview of one of the most important Argentine companies this century

Welcome Avatar! Today we’ll go over the history and rise of Mercado Libre (MELI) in Latin America, one of the most important Argentine companies this century and often referred to as the “Latam Amazon”, and why it is not necessarily a good 1:1 proxy for Argentina growth exposure. Let’s dig in.

Today, with a net worth of US$7.3 billion, Mercado Libre founder Marcos Galperín is ranked 453th among the richest businessmen in the world according to Forbes.

But just like most tech growth stories, the Mercado Libre story also started in a garage, except this one was not located in Silicon Valley but in the Saavedra neighborhood of Buenos Aires.

Prior to founding Mercado Libre, founder Marcos Galperín interned at J.P. Morgan and worked for local oil company YPF, from 1994 to 1997. He went to college in the US at the Wharton School of Business at the University of Pennsylvania and earned an MBA from Stanford University.

His time amongst the US Ivy League circles was not spent in vain, and he was able to spin up a business plan for Mercado Libre and secure millions in startup funding to get a platform off the ground that would be initially a close copy of Ebay in the US.

Before launching his project, Galperín had discussed his idea with a few people, but almost no one had faith that it would be successful, given that internet penetration in Latin America was only 3% in the overall region at the time and many people feared being victims of scams when making online purchases.

However, one of his professors at Stanford, Jack McDonald, helped him get in touch with John Muse, co-founder of HM Capital Partners. Muse was captivated by the idea of Mercado Libre and decided to invest $7.5 million in the project.

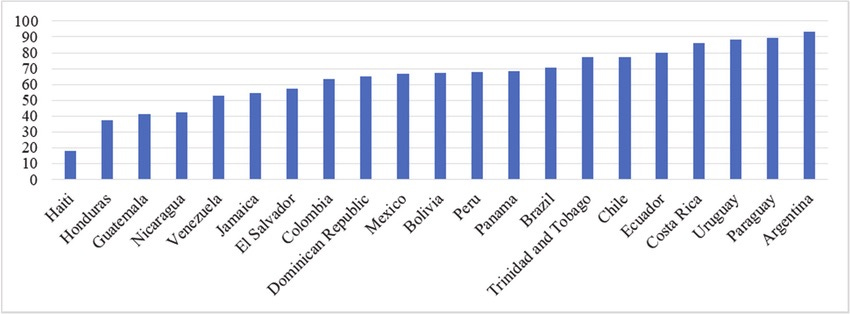

Besides the fact that Argentina is the home country of founder Marcos Galperín, historically, the country’s higher internet penetration rate compared to other Latin American countries — Argentina got to 90%+ of the population with access to internet relatively quickly, whereas countries with bigger populations like Mexico and Brazil lagged behind — has made it a key country for launching pilot apps, websites and platforms.

The Launch

At the start of Mercado Libre, there were no online payments and everything worked on internal messages between users and auctions. It adapted perfectly to the cash-based nature of the Argentine economy.

When the Mercado Libre platform launched in 1999, it had a tough local competitor: DeRemate, the company founded by Alec Oxenford. But Galperin, more austere and focused on the product, won the battle: several years later he ended up buying what was left of his competitor and incorporating it into Mercado Libre.

Legend has it that both companies held their launch event one day apart, in the same place: El Divino, a trendy nightclub in Puerto Madero.

Galperin and his team chose the place and the date: August 21, 1999. When they went to pay the deposit, they were told that it had already been paid and they were shown a check from DeRemate for its own launch party. Oxenford and Galperín met.

They had already done so before to see if they could join their businesses, but neither was willing to take orders from the other. Eventually Galperín and his team decided to hold their Mercado Libre launch party one day earlier, on August 20.

In 1999, Mercado Libre was still very much an online auction site. Additional product lines like Mercado Pago (for online payments), Mercado Envíos (shipping), or other solutions and tools that form the ecosystem today, did not exist yet, and buying and selling it was exclusively conducted through p2p agreement (similar to Facebook marketplace today).

Bigger Investors & IPO

By 2001, two years after starting operations and after receiving a second round of financing of 46.5 million dollars from different shareholders, Mercado Libre closed an agreement with eBay which made the latter the main shareholder of the Argentine company.

In 2005, Mercado Libre acquires the operations of DeRemate.com, belonging to the newspaper La Nación, in Argentina, Chile, Colombia and Mexico for US$40 million. Shortly after, the operations in Argentina and Chile generate about US$95 million.

By August 2007, after having expanded to several Latin American additional countries, Mercado Libre began trading under the initials MELI 0.00%↑ on the NASDAQ, being the first Latin American eCommerce stock to get listed on the tech stock market index.

Today Mercado Libre has a presence in 18 countries: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Dominican Republic, Uruguay and Venezuela.

Mercado Pago

One of the greatest fears of most internet users in Latin America has always been to fall victim to scams when making a purchase online.

In response to this, Mercado Libre sought to provide a solution in 2003 by implementing a payment processor, while also verifying that the product or service was received before the seller receives the money from the customer. That was the seed for the birth of Mercado Pago, Mercado Libre's own payment management system.

The main downside of all these additional security measures and payment systems is that Mercado Libre (at least in Argentina) does not allow anyone to buy on its platform. So if you do not have a local ID (DNI), it is virtually impossible to use the platform as a non-resident.

Amazon, for example, couldn’t care less about your ID or your residence, as long as you enter a shipping address that is supported. Another thing that is more complicated on Mercado Libre, at least the last time I tried, is to pay with foreign cards — everything has to go on Argentine payment systems, which is also mainly due to currency restrictions still in place. So even if you would have a DNI after obtaining residency as a foreigner, you would still need a local $ARS credit card to make purchases on Mercado Libre.

Besides owning the logistics side in Amazon-style through Mercado Envíos — which really improved delivery —, Mercado Libre has now also filed to become a bank as an extension of Mercado Pago.

There is no mention of start dates to launch the bank, and for the moment the option would be to create an entity from scratch instead of buying an existing bank. Mercado Libre is already a major player at the financial level thanks to the expansion of its digital wallet Mercado Pago, but this would mean going one step further and putting a giant to compete with regulated financial entities.

It would be a major competitor for existing banks, since it’s the largest Argentine company by market capitalization, with a market cap of USD 93 billion.

Galperín & Milei

Marcos Galperín has lived in Uruguay since 2019 for obvious tax reasons — in 2019 the Alberto Fernández administration implemented a “wealth tax” which has been contested in court by many wealthy Argentines.

If you follow his X account however, it becomes clear that mentally Galperin has never left Argentina and he is actively envolved in the political and economic changes the Milei administration is implementing.

Since Milei took office as president Galperín has multiplied his retweets and likes of posts praising the management of the president and his team, while harshly criticizing and ratio’ing Kirchnerist leaders.

MELI is not an Argentina Proxy

Many followers on X ask why the Mercado Libre stock does not move in tandem with other Argentine ADRs like YPF, Pampa etc. This is mainly because MELI has lost the correlation to Argentina and is not a 1:1 proxy for Argentina’s growth story like most of the other local stocks in the country and ADRs listed in the US.

The bulk of net income for Mercado Libre comes from Brazil, which generates more than double of Argentina’s revenue, and Mexico is on trend to surpass Argentina simply due to the amount of users and expansion of Mercado Envíos in that market.

For Mercado Libre, growth is expected to keep increasing with high double digits especially in growth markets like Peru and Colombia:

So the Mercado Libre stock is much more an overall Latam exposure versus being a pure Argentina play.

When looking for Argentina exposure, the ETF or one of the main stocks like YPF etc would make more sense.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.