Welcome Avatar! After the 2020-22 pandemic rekt most of the financial city center (Microcentro) in Buenos Aires, many offices were put up for sale or abandoned. Are we near to a bottom in commercial real estate, or no? Let’s dig in.

Autist note: I have to thank Santiago Magnin for his excellent video on this topic, which made me look into this particular segment of the market. I’ve included some of his recommendations from that video in this article, and can recommend giving him a follow on X (@santivende)

Neighborhoods

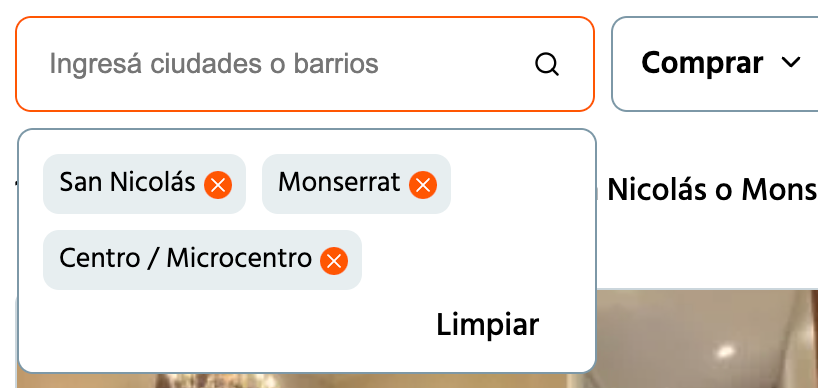

The most affected neighborhoods for this type of property were in and around Microcentro, which is sometimes classified as a neighborhood but is more of a zone consisting of San Nicolás and Monserrat (which are official barrios). Also around Tribunales (Uruguay / Corrientes / Córdoba), there is a lot available at crazy prices.

When selecting those 2 neighborhoods, at the moment there is a total of 787 offices for sale:

Even though the average listing prices (residential and commercial) in San Nicolás hovers around $1,818/m2, the average published value of the offices sold is $800/m2 and the final closings are closer to $750/m2.

Meanwhile, residential real estate in that same area is closer to $1,500/m2, with an average closing price of $1,370/m2.

(1370/750-1)*100

= 80% spread between residential and office m2 sold in the same area in similar buildings.

This is a spread that almost never happens in the Buenos Aires RE market and historically these final sales prices should be a lot closer to one another.

What to look for - Some Examples

These are the 3 neighborhoods to look at when evaluating the most interesting options for offices:

This will spin up around 1600-ish office listings for sale at the moment. Just walk through the steps outlined above and you should be able to shortlist some good options.

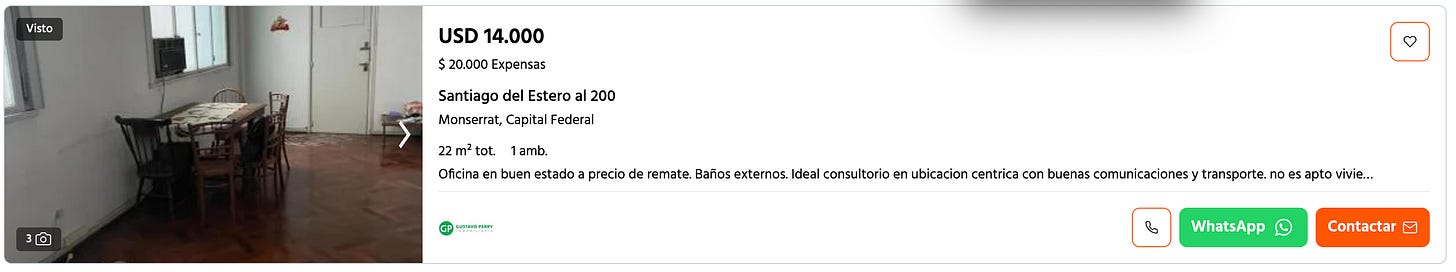

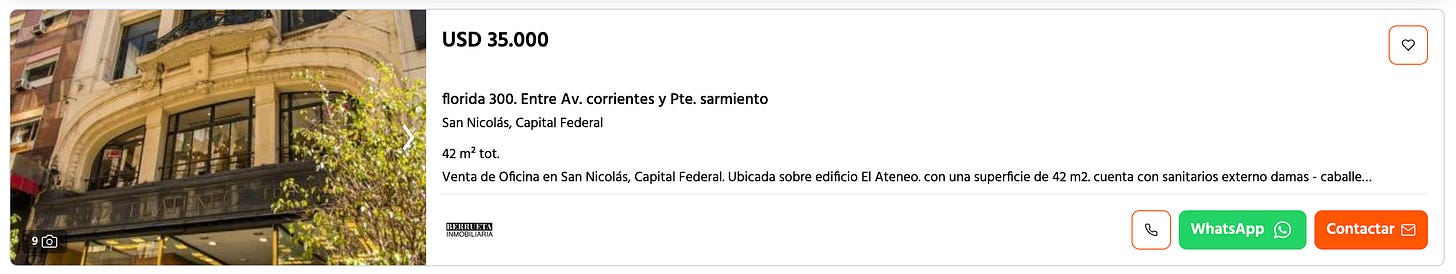

Just some quick examples that show how insane the prices in this market segment are at the moment (not in any particular order but so you get the idea of some of the insane m2 prices):

$636-700/m2:

$700-900/m2

You get the idea. Take into account that you can negotiate a 10% off these listing prices more or less.

A good rule of thumb for how quickly a listing will sell (this goes for both residential and office space) is to look at the visualizations of said listing. You can find this by scrolling down on the respective listing:

That number visualizaciones is the amount of monthly impressions. As a general rule, when the daily visualizations for the property are:

60+: sells within a week

=30: sells within 1-4 weeks

=20: sells within 1-2 months

=10 or less: sells after more than 2 months

These are industry averages from the local RE market which are pretty accurate. So for the listing example above, it got (48/30) = 1.6 visualizations per day, so this property will likely take a long time to sell.

Residential & Commercial: final sales prices

One of the annoying things about the Argentine real estate market — which also gives provides more opportunity —, is the fact that pricing is far from transparent. There is no tool like MLS or similar that you would have in more mature markets to see a track record of transactions for a single property.

There is simply no way to know how many times a property switched hands and at what price.

You can however, get to pretty close estimates of the currently sold properties (to find out the discounted real price). How? By going to actual realtor websites that list their reserved/sold properties on their site.

For this exercise we will run through some of the listings on Remax, but many brokers show when a property is taken off the market:

By filtering on office space for sale in San Nicolás, these two examples show up. One is $705/m2 and the other $786/m2.

There are many more examples like this, like this one for example ($714/m2):

For these internal listing price numbers you have to still deduct the 10% negotiation, which is standard. When you do that, the numbers really get insane:

$634/m2 and $707/m2 for the first two, and $642/m2 for the smaller unit.

Repeat this process for residential units and you have a pretty good idea of the prices properties are actually selling for.

When looking at the residential sales prices of $1,370 in the exact same neighborhood and type of building, the disparity between residential and office space is a 90-100%+ spread.

Of course office space is less desirable and will always be priced lower than residential m2, but historically this spread has never been this high.

Final Thoughts

Personally, I am very tempted to dive in and buy a small office in a historic building for less than $1,000/m2.

There are some real gems out there on super iconic streets, in beautiful buildings.

The flip potential once the economy picks up is one of the main narratives for investing in these types of properties, because the rental yield is negligible — you can only rent these out long term in pesos to local professionals, which would cover the building admin costs and maybe a little more.

However, I am already too deeply invested in the local RE market in Argentina and would prefer to keep that capital in more liquid assets at the moment.

That said, given the current credit boom that is slowly starting up, this opportunity will probably be gone quickly once the economy picks up again. It’s insane to think you can buy an office on what would be the equivalent of 5th Avenue or Broadway in New York (calle Florida, Reconquista, Avenida Corrientes, Alem) for scraps.

Even though the complete workforce might never 100% return to the city center after the pandemic and WFH, many professionals like lawyers, notaries etc, will always need office space there.

See you in the Jungle, anon!

Other ways to get in touch:

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

Is it allowed to equip an office space as a studio apartment by installing a kitchen and bathroom? If so, what do you expect such a renovation would cost, all-in, to make it a livable place rather than just an office?

I would guess that if you did this, it would make the place hard to resell later, as its in a location that people don't normally live in (only go for work), is that right?

I didn't quite understand how does looking at sold properties at ReMax helps. You have the price on zonaprop and you said that typically you can negotiate a ~10% discount. So The price is already there and known. Plus you can compare it to other similar listing on zonaprop itself. What did I miss?