Plan Bonex II: another default on the horizon?

Possible debt restructuring & 2023 election outcomes in Argentina and investment plays

Welcome Avatar! As we surf the tail end of a crisis to another possible default, with a slightly desperate economy Minister Massa doing the rounds to secure more funding before the debt Ponzi comes crashing down, it is time to look at potential plays in terms of trades around Argentina sovereign debt, real estate and more.

What was Plan Bonex?

The Bonex Plan was an economic plan promoted in Argentina in December 1989, during the presidency of Carlos Saúl Menem.

The currency at this point in time was called the “Austral”, which was just as quickly evaporating as the current Pesos we still use today.

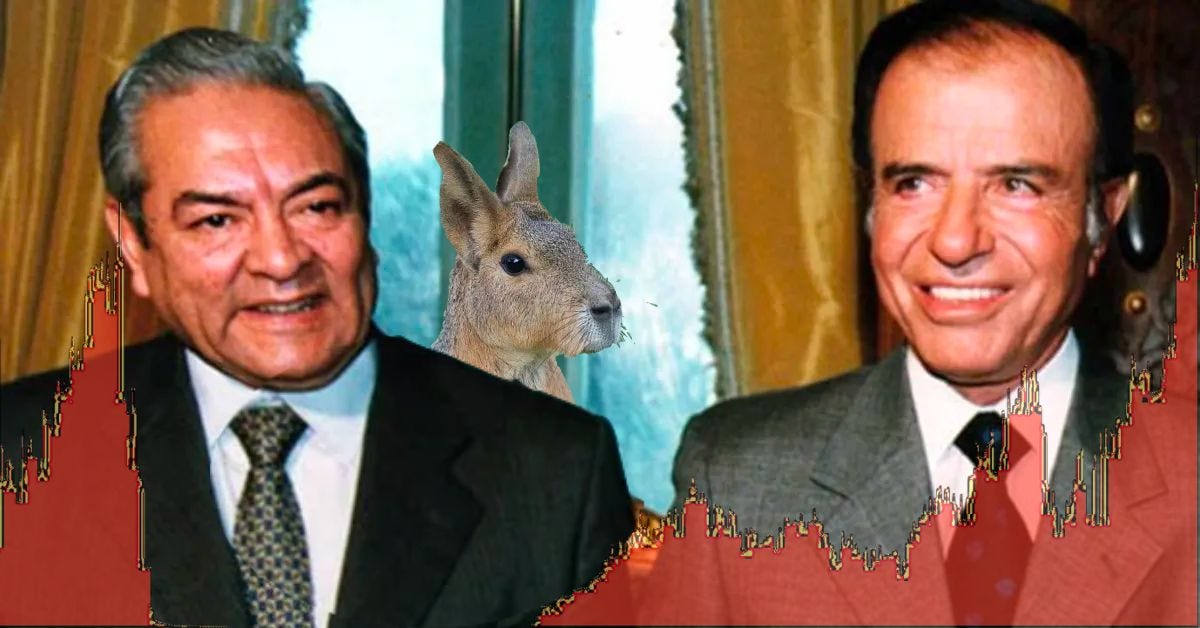

In a hyperinflationary setting of 5,000%+ in a 1988-1990 time period, the Bonex Plan consisted of a compulsory exchange of fixed-term Austral deposits for government bonds called Bonex 89.

You thought the current 97% YoY rates in Argentina were high? Those are child’s play compared to the 30-day fixed-term Austral deposits with rates of 400% in 1989.

These fixed term rates were spiralling out of control, causing more printing to be able to pay the interest, debasing the currency further, and fueling inflation. Basically the exact same recipe we are seeing today.

Faced with this reality, the government carried out a compulsory exchange of all fixed terms that exceeded one million australes in exchange for Bonex 89 bonds under foreign legislation, with a maturity date in 1999.

As part of the debt restructuring, financial institutions were prohibited from receiving fixed-term deposits until further notice.

The Bonex Plan generated benefits and negative consequences: the confiscation of Australes locked up in fixed-term rates reached 60% of the monetary base, which caused a strong recession due to the drop in overall liquidity. On the plus side, the plan did manage to stop the hyperinflation due to lower demand for goods and services, in addition to the purchase of dollars vs locking up Australes.

The big losers in this forced conversion from savings to bonds were the hodlers of fixed terms Australes contracts, and it was a hard lesson for many Argentines who had tried to protect their savings in their own currency in vain.

The Bonex bonds traded at 30%, so Argentine savers lost about 70% of their savings and liquidity.

The Bonex Plan was a solution to solve the quasi-fiscal deficit, but prior to that, the Menem government had already begun to implement a privatization process of state companies, with the sale of some 50 public companies — among the most important were YPF, Entel, TV channels such as 13, 11 and 9, and many more.

All these public companies were generating huge fiscal deficits, a situation that is very similar to the fiscal deficit generated by public companies in Argentina today.

Shortly after in 1991 Domingo Cavallo took office as Minister of Economy, launching the Convertibility Plan, thereby creating the Argentine Peso with a dollar peg of 1:1.

This is the same peso in use today, except that the exchange rate is now closer to 500:1.

New currency, same Ponzi

With current inflation well above 125% YoY, fixed-term peso interest rates of 97%+ and exchange rate pressure that continues to put pressure on wages, several economists are talking about the possibility of a Plan Bonex II.

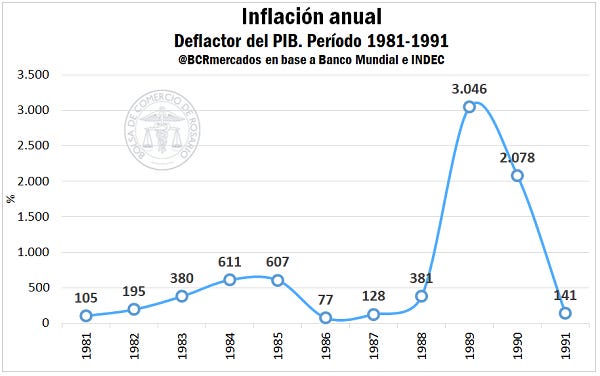

As of early June 2023, the ratio between the Argentina Central Bank liabilities with a rate above 134% and the monetary base, hovered around 278%.

This far exceeds the all-time high of March 1989 right before Plan Bonex, when this ratio was more in the realm of 236%.

In the case the Central Bank decides to increase fixed term peso rates even further — and keep in mind that these are nowhere close to the 400% rates in 1989 — this ratio will deteriorate even further.

This is why playing the peso yield farm game is similar to Russian roulette: you never know when you’re initial capital will get smoked, and by the looks of it that moment is getting closer and closer by the day.

If we follow the same recipe as in 1989 this would quickly turn into a hyperinflation, followed by a call for early elections.

2023 Elections

As I’ve mentioned before in A Tale of Two Currencies, the year 2023 promises to be a rocky ride.

In August the pre-elections are held, called the PASO, which will define the final candidates for each party. The final elections will take place in October, with the new government starting on December 10th.

Will the current government last until December?

That really depends on foreign creditors at this point. China has already agreed to another $19 billion USD swap, but as of today the IMF still hasn’t given the okay on the $10 USD billion advance that the Argentine government so desperately needs to tap the -$7 billion USD hole in the liquid reserves of the Central Bank.

As a general rule of thumb: don’t be the guy holding the peso bag that gets rugged.

For most non-residents in Argentina this will not be a potential threat, but you’d be surprised at the amount of locals that still have part of their savings locked up in the 97% yield, just waiting to get rugged.

Potential Bond Play

Just as an initial disclaimer before we get started: This is not investment advice, and I view these bond plays as very high risk, high reward.

With the current Argentine Central Bank liquidity crisis, IMF debt repayments starting next year, and the fiscal deficits that are far from being resolved (not even a hint at privatizing some of the black hole public companies this time around), it is all to clear that the most likely scenario will be another sovereign default and debt restructuring in 2024-25.

The bond trade I am personally pursuing before a new government is in place, is Argentina sovereign USD debt. It can be short or long duration, but I don’t plan on holding these until maturity.

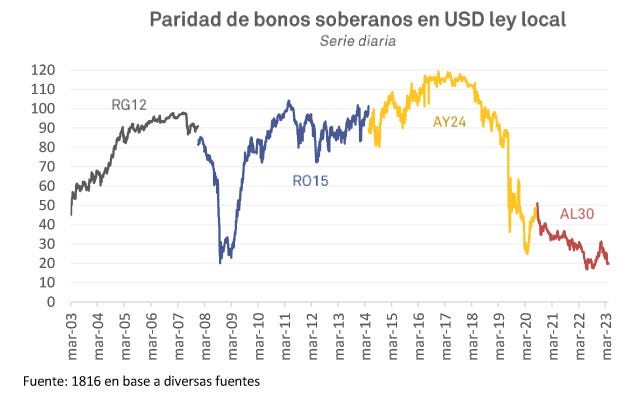

Right now most of these bonds are trading at a very steep discount of 23 to 30 cents on the dollar, like the AL30:

If Argentina doesn't pay, the bond is already trading at 25-30% of PAR, so it's hard to imagine coming out any worse in a renegotiation.

Currently my 22 cent buys are trading at 27 cents. The worst scenario from a long term bond holder’s perspective is a debt restructuring at about 50 cents on the dollar. That would mean that my 22 cent buys at least double, besides raking in 8-10% in interest payments in the meantime.

I’ve bought Argy bonds both on Interactive Brokers (search for Argentina, then Argentina Republic and check which bonds are available, for example AR Govt 0.125 Jul09'35) and on local Argentina exchanges (AL30). Internationally these bonds are very illiquid, on national Argy exchanges the liquidity is better.

Real Estate Investments?

Most real estate in Argentina is priced in US token, and it is used as another savings vehicle besides USD cash.

Autist note: To learn more about general real estate conditions in Argentina I recommend you read these articles if you haven’t yet:

Credit and mortgages in Argentina are scarce, and therefore this particular market suffers less in relative terms whenever a peso devaluation occurs, or with a general deteriorating of local market conditions.

The current price ranges are still competitive and around -20% in Buenos Aires compared to the peak in 2018. That does not mean they can’t drop further, but in my opinion there is a baseline that will not be breached, unless a seller is in desperate need of cash and absolutely has to sell no matter what.

If you actively search on the current market, you will find many deals (more with boots on the ground to get a sense of the seller’s financial situation), especially if you have the cash to deploy. Listing prices have room for an additional -20% or more in those cases, amounting to an almost -50% from the peak.

Much lower than that will be tough, especially for real estate in prime areas that will provide a 8% YoY return in USD as a temporary furnished rental.

A survey carried out by the firm Re/Max Premium revealed that 2 out of every 8 inquiries to buy a property in Buenos Aires are made by foreigners. The interest of foreigners to buy in Argentina has increased by 10% compared to last year.

Now, do you need to be in a hurry? Not so much. Even though our Russian friends seem to be scooping up a lot of RE deals lately, there is still plenty to go around.

A lack of liquidity and the uncertainty around this year’s elections only contribute to investors holding off on bigger investments until it’s clear what kind of government will be starting this December.

See you in the Jungle, anon!