RIGI: Will it Start Raining Benjamins?

Impact of the approval of the RIGI on energy and mining: projects for $80 billion USD

Welcome Avatar! One of the most important chapters of the Omnibus bill was the incentives for large investments, also known as RIGI. What is the fine print of the incentives and what projects are already in standby? Let’s dig in.

What is “RIGI”?

The acronym RIGI stands for Régimen de Incentivos para Grandes Inversiones, or Large Investment Incentive Regime. From the approved text (article 162-226), the most important parts are:

The RIGI establishes “incentives, certainty, legal certainty and an efficient system of protection of acquired rights” for “holders of a single project” of investments that exceed US$200 million.

Applicable to "Large Investments" in projects in any sector (forestry, tourism, infrastructure, mining, technology, steel, energy, oil and gas) that meet the established requirements.

The accession period is 2 years from the date the Omnibus Law is sanctioned, and the Executive Branch may extend it for a period of up to one year.

The regime offers tax, customs and exchange incentives for 30 years to attract large investments.

Income Tax reduction from 35% to 25%, accelerated refund of VAT and zero withholdings for exports originating from these investments.

The approval of this section of the Omnibus law in the Senate generated enthusiasm in the sectors and companies reached by the new promotion plan for the development of projects and investments in Argentina, particularly for energy and mining companies, that have announcements for almost $80 billion dollars in the pipeline for the next decade.

These kind of large investments would hardly be made in Argentina with the existing tax rules and regulations.

The RIGI will boost the economy, investments and employment, and the Casa Rosada expects that it will enable Argentina to triple the level of exports in a decade:

“Chile exports 52 billion dollars per year and Peru 42 billion, while in Argentina we export less than 4 billion dollars. With the right investments, in a decade this level could triple.” — Manuel Adorni

Since the RIGI will only be valid for 2 years (and could be extended for another year), this regime could potentially be a short-term — much needed — cash cow for the Milei administration.

Read more about all the sections of the Omnibus Law that were approved here:

And some investment projects were waiting for the RIGI to pass in order to time their investments:

Current Projects

At least four large energy and mining projects lead the spearhead of large investments that can apply for the RIGI. Together they add up to investments of no less than US$78.4 billion for the coming years.

The YPF and Petronas LNG project ($10 billion)

In the energy sector, the main project tied to the RIGI is the YPF and Petronas LNG plant. Weeks before the treatment of the Omnibus law, YPF deposited $180 million USD as a guarantee to start the project, out of a total of $360 million that Petronas should complete now that the RIGI is active.

Had the RIGI failed to materialize, the Argentine oil company would’ve had to consider that $180M sum as “lost”.

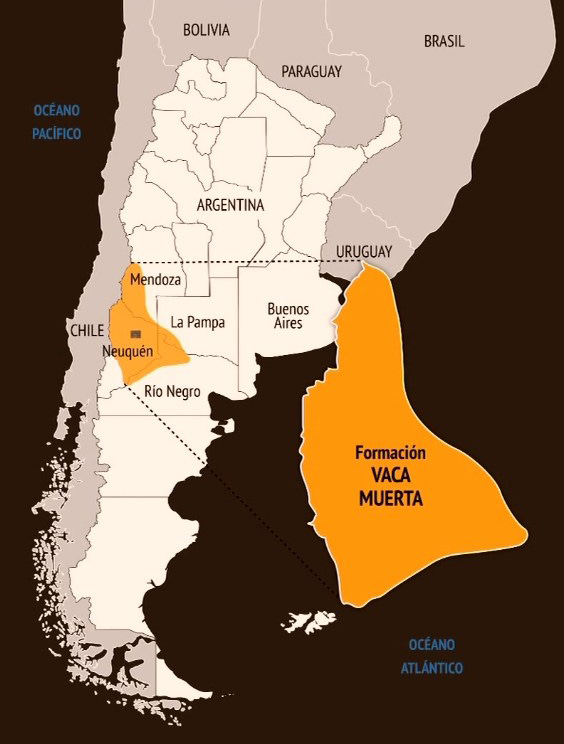

In March, Petronas confirmed the start of construction of a floating Liquefied Natural Gas (LNG) processing unit, known in the market as FSRU (Floating Storage Regasification Unit), to operate jointly with YPF and be able to export natural gas from the Vaca Muerta region in Neuquén starting in 2027.

The FSRU will be installed in the Argentine Sea, off the coast of Patagonia.

Offshore project off the coast of Mar del Plata ($40 billion)

The Mar del Plata energy cluster estimated that the drilling of the first offshore hydrocarbon well (Argerich) in the Northern Basin of the Argentine Sea and the discovery of conventional oil will open the opportunity to generate investments of $40 billion dollars and the hiring of 125,000 workers for the sector over the next three decades.

Read more about the specific details of the Argerich project here:

If the Argerich project manages to reach the exploitation phase, it could add about 200,000 barrels a day, worth $35 billion USD. Argentina would receive close to $4.7 billion in royalties and taxes. In total, the Northern Argentine Basin could host a dozen projects like Argerich and generate a production of $100 billion USD.

Fortescue's hydrogen "Pampas Project" ($8.4 billion)

In 2021, Fortescue announced a disbursement of US$8.4 billion to produce green hydrogen, and the creation of 15,000 new direct jobs and between 40,000 and 50,000 indirect jobs.

The aim of this initiative is to turn the province of Río Negro into a global export hub of green hydrogen. In 2050 it would have a production capacity of 2.2 million tons per year, which would cover an energy production equivalent to, for example, almost 10% of the electrical energy consumed by Germany in a year.

The prospecting that the company began is based on analyzing the quantity and quality of wind, the main energy source for production.

This project has the following stages: 1) the pilot stage, to confirm the planned capacities, with an estimated investment of US$1.2 billion, 2) the first productive stage, with an estimated investment of US$7.2 billion, will produce about 215,000 tons of green hydrogen, equivalent energy capacity to cover the electricity consumption of 1.6 million homes, and will last until 2028.

To carry out the project, FFI will install three wind farms with a total power of 2,000 MW, which will be responsible for generating the energy for the production of green hydrogen.

Copper mining projects in San Juan, Catamarca, Salta and Mendoza ($20+ billion)

The six most advanced copper projects in Argentina will generate investments of $20 billion, exports of almost $9 billion a year, a trade balance of almost $7 billion and generate more than 40,000 new jobs.

The demand for copper for the “energy transition” will intensify and raises shortage hypotheses in all scenarios (by 2035, copper shortage could reach 10 million tons). This is very good news for Argentina and Chile. Argentina is still largely undeveloped in terms of copper mining:

The six copper projects are located in four different provinces and would guarantee copper production for the next 50 or 60 years. Some projects already have a tentative start date for construction:

Josemaría (San Juan) in 2024/2025

San Jorge (Mendoza) in 2025

Taca Taca (Salta) in 2025

Los Azules (San Juan) in 2026

El Pachón (San Juan) in 2027

MARA Project, also called “Agua Rica” (Catamarca) in 2027 (this is mine, lol)

With these projects underway, Argentina would reach an average level of 1,066 thousand tons per year, equivalent to 10% of the global copper deficit in 2035.

These mines alone would 3x the total exports of the Argentine mining sector, and could add much needed dollars to the BCRA’s foreign reserves (equivalent to 50% of yearly agro harvests).

Hydrocarbons: investments in Vaca Muerta ($11+ billion)

Investments in hydrocarbon exploration and production by companies will reach $11.4 billion in 2024 alone, which is roughly $400 million less than in 2023.

The province of Neuquén will concentrate 76% of the total upstream investments for this year with a total of $8.6 billion, followed by Chubut with $1.08 billion.

Keep in mind that these investments may not be included in the RIGI because they are not for a specific project and are already underway.

However, Vaca Muerta does demonstrate the investment potential of the sector for the coming years and the RIGI benefits for the oil and gas sector. There’s still plenty of untapped potential in the region.

Read all about Vaca Muerta here:

The current ranking of energy companies in Vaca Muerta in terms of investment amounts in USD is as follows:

YPF: $4.4 billion

Pan American Energy (PAE): $1.6 billion

Vista Energy: $945 million

Tecpetrol: $523 million

Shell: $421 million

CGC: $366 million

Chevron: $319 million

Pampa Energía: $239 million

Capsa-Capex: $211 million

Exxon: $191 million

Equinor: $190 million

Phoenix: $175 million

Tech?

So far, the Argentine President has met twice with Elon Musk.

In May, Milei and Reidel held private meetings in California with CEOs including Sam Altman (OpenAI), Mark Zuckerberg (Meta), Sundar Pichai (Google) and Tim Cook (Apple), and hosted a summit with AI investors and thinkers, including venture capitalist Marc Andreessen and sociologist Larry Diamond.

From these meetings, no direct investments have materialized yet, but the Casa Rosada’s expectation of tech companies investing more than $1 billion dollars in Argentina was mentioned last week.

Potential investments deriving from Milei’s thumbs up initiatives in California could all apply for the benefits of the RIGI if investment amounts are over $200 million.

Other RIGI Examples in the Region

Many other countries have similar large investment incentives to attract capital. Some successful examples in South America have been Chile, Peru and Colombia.

In Chile, the Augusto Pinochet dictatorship sanctioned Executive Order 600 in 1974, with the mining industry as a main protagonist. This regime was in force for more than 40 years (cancelled in 2016), and made a series of instruments directly available to foreign investors.

Investors gained access to the formal exchange market and the right to offshore capital. This remittance was exempt from any contribution, tax or lien, up to the amount of the investment materialized.

Peru, with its sights set on the mining industry — especially copper, like its neighbor Chile — promoted the General Mining Law in 1992, which in Chapter V includes a Tax Stability Regime for large mining projects.

The Peruvian regime includes tax stability for 15 years. During this period, investors are only tied to the tax regime in force at the time of approval of the investment program.

Another country in the region that has a series of regulations to encourage foreign investments is Colombia. Specifically, Decree 2080 filed in 2000. It establishes that the conditions of reimbursement of the investment and the remittance of profits legally in force on the date of registration of the foreign investment, may not be changed in a way that adversely affects the investor.

Unlike the Chilean regime, the Colombian one does not offer any type of tax invariability.

Final Thoughts

The approval of the Incentive Regime for Large Investments (RIGI) is a very important step for Argentina to start attracting foreign investments during the remainder of the Milei administration.

It generates a great signal and renewed expectations for the planning and implementation of important projects, mainly in the field of hydrocarbons and mining (and potentially tech).

The RIGI approval does not mean that it will immediately start raining dollars in Argentina, but without it most bigger projects would probably not materialize.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

When I went long $YPF in 2022 I meant decades long. Thank you Milei :)

La entrada es Ezeiza