The Bessent Put

How last week's political crisis almost spilled over to an economic one and how Bessent saved the day.

Welcome Avatar! Milei’s visits to the US finally paid off after US Treasury Secretary Scott Bessent pledged an unprecedented support for Milei’s economic program. What is at stake and how much does Bessent’s announcement change the short to medium outlook for Argentina? Let’s find out.

This week started off with a bang after many thought that the peso was on an epic devaluation run, spiralling out of control after last week’s selloff in Argentine debt, equities and currency. Sovereign debt denominated in dollars slipped below 50 cents on the dollar, Argentina’s Country Risk spiked and started climbing towards 2000 points, and the dollar made a run up all the way to $1550 pesos at the peak.

The PTSD from the last months of Sergio Massa’s reign as presidential candidate in 2023 was palpable.

The outlook for Milei’s presidency started to look more grim as the opposition in Congress also started to overturn his veto’s meant to sustain the fiscal surplus at all costs.

Why, if Milei’s economic policies are bearing fruit, did the destabilization get this far? From the Tower of Maturities section in the Eyes on the 2025 Midterm Prize article, it was already clear that Argentina could potentially have a hard time meeting its debt repayments.

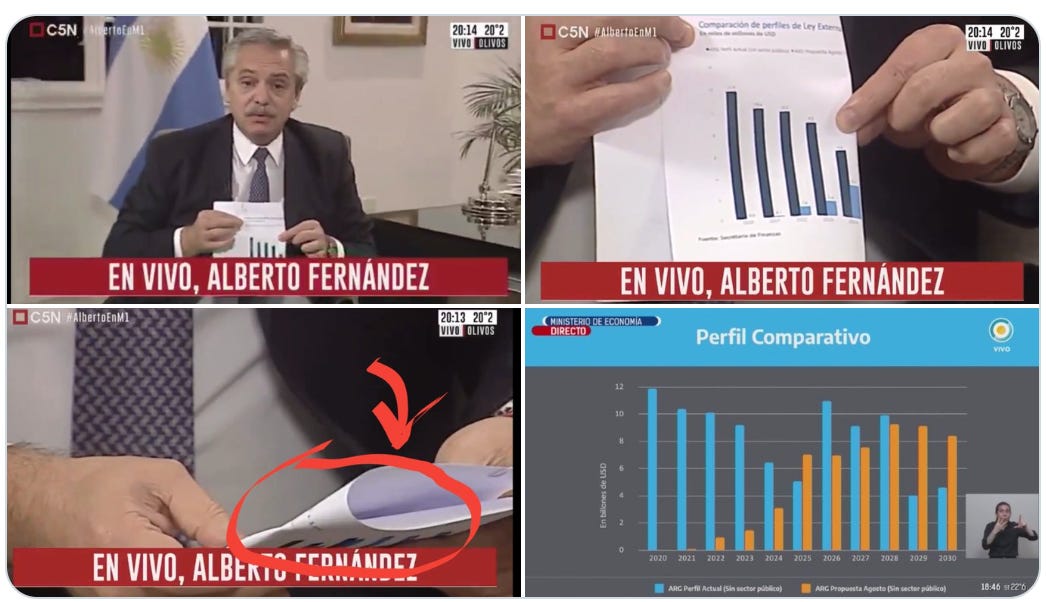

Argentina is now in the folded section of Alberto’s Fernández’s great restructuring agreement with the IMF, which basically meant kicking all maturities down the road for the next administrations to deal with:

This is why at the slightest danger of turbulence, things can spiral downhill very fast. The recent IMF loans have been used in part to bolster foreign reserves and pay off maturities, but if Milei’s economic team would use these funds only to defend a fictional peso value, they would burn through the BCRA dollar reserves very fast — this is what happened in the second half of Macri’s presidency, with the big difference that Macri was still running a big deficit.

The greater difference in the outcome of the congressional provincial elections in Buenos Aires between Milei’s La Libertad Avanza and Peronism — 14% vs expected 5% — scared the market and investors.

Frankly, international investors assigned too much weight to those elections, interpreting them as a potential blueprint for the national midterms in October, which further aggravated the selloff in bonds that started after Milei’s team increased reserve requirements for local banks.

Combine this dynamic with a decent chunk of pesos in fixed saving accounts, stocks and other vehicles denominated in pesos, combined with no currency controls, and you have a perfect cocktail of Argentines running for the dollar exit.

Trump & Bessent Save Milei

In It’s Raining Swaps I hinted at the possibility of a US Treasury swap in case it was needed after Secretary Scott Bessent’s visit to the Argentine capital:

Bessent’s visit could include increased financing for Argentina through a special US Treasury credit line, an idea that is on the table for discussions with the Argentine government.

This move has now become a reality, and it is not just to “help Trump’s buddy Milei”.

On Monday, when everyone expected the selloff to continue and the peso do devalue further into the $1600-2000 range, US Treasury Secretary Scott Bessent jumped in to calm the markets and to let everyone know the US has got Milei’s back:

“Argentina is a systemically important U.S. ally in Latin America, and the US Treasury stands ready to do what is needed within its mandate to support Argentina. All options for stabilization are on the table.

These options may include, but are not limited to, swap lines, direct currency purchases, and purchases of U.S. dollar-denominated government debt from Treasury’s Exchange Stabilization Fund. Opportunities for private investment remain expansive, and Argentina will be Great Again.

We remain confident that President Milei’s support for fiscal discipline and pro-growth reforms are necessary to break Argentina’s long history of decline. My April comments make clear our commitment to Argentina’s people and to President Milei.”

Shortly after, President Donald Trump also underlined the importance of backing Milei’s program, in a post on Truth Social:

It looks like Javier Milei’s frequent trips to the United States are starting to pay some enormous dividends. Argentine USD bonds started to pump on this news, stocks recovers, and the peso appreciated significantly without BCRA intervention:

In hindsight the BCRA short interventions in USD futures turned out to be a master stroke which netted nearly $3 billion USD. It almost makes you wonder whether Minister of Economy and former JP Morgan trader Luis Caputo knew that the Bessent Put was on the table since the visit back in April.

Today, Scott Bessent further underscored what “whatever it takes” means in the case of supporting Milei’s presidency:

“Yesterday, POTUS and I spoke extensively with President Milei and his senior team in New York. As President Trump has stated, we stand ready to do what is needed to support Argentina and the Argentine people.

Under President Milei, Argentina has taken important strides toward stabilization. He has achieved impressive fiscal consolidation and a broad liberalization of prices and restrictive regulations, laying the foundation for Argentina’s historic return to prosperity.

The US Treasury stands ready to purchase Argentina’s USD bonds and will do so as conditions warrant. We are also prepared to deliver significant stand-by credit via the Exchange Stabilization Fund, and we have been in active discussions with President Milei’s team to do so.

The Treasury is currently in negotiations with Argentine officials for a $20 billion swap line with the Central Bank. We are working in close coordination with the Argentine government to prevent excessive volatility.

In addition, the United States stands ready to purchase secondary or primary government debt and we are working with the Argentine government to end the tax holiday for commodity producers converting foreign exchange.”

This kind of support is truly unprecedented and is a very welcome lifeboat at such a crucial moment in Milei’s presidency.

Below we will go into the geopolitical aspect of the Bessent Put, the Soft Putsch attempt by the opposition in the last two weeks and the medium term prospects for Milei after this unprecedented show of support from the US Treasury.