The May Pact & Omnibus Revival

The month of May will be of crucial importance for the Milei presidency

Welcome Avatar! The month of May 2024 will be a crucial one in the Milei presidency, since 2 big initiatives could be adopted that will boost the reforms his administration has in mind for the remainder of its term. If adopted, these initiative will remove significant roadblocks and accelerate Argentina’s progress towards a more open economy. Let’s dig in.

Revival of the Omnibus Law

After the initial version of the Omnibus Law got shot down in Congress as soon as votes around public trust fund transparency started and the majority voted against more transparency, Milei decided to pull the bill completely.

Now, a new and shorter version was filed (see full text below), and its articles will be treated in the upcoming weeks. The trust fund transparency articles were pulled (these roughly account for 2% of GDP), so governors and politicians can rest assured that no one will start combing through the destinations of those funds.

You can download a copy of the latest version of the Omnibus Law here:

This was the main item that started a breakdown last time, and unfortunately in politics concessions are inevitable if you want to get anything done without a majority (which Milei doesn’t have at the moment).

However, 9 the 29 trust funds included in the Omnibus Law text — worth $2 billion USD — have already been eliminated by Milei by Executive Order shortly after the first version of the Omnibus Law failed in Congress.

Autist note: if you want to read more about the background of the Omnibus Law and Milei’s initial deregulation decree (which is still in force), this article will get you up to speed:

Argentina's revised Omnibus Law focuses on fewer emergencies and privatizations than originally proposed:

Emergency Powers: Reduced from 11 to 4, with delegated powers to Congress for one year.

Privatizations: 18 state companies can be fully or partially privatized, including Aerolíneas Argentinas and partially Banco Nación.

Labor Reform: Not included, but a separate bill is expected.

Tax Reform: Creates a new income tax bracket for high earners and reduces tax burden for some companies.

Money Laundering: Includes tax amnesty program with incentives like debt forgiveness and freedom from legal actions.

This revised version seems less ambitious than the initial proposal, particularly regarding emergencies, privatizations, and labor reform.

No more GHG Emissions Nonsense

One very positive change in the new law text is that the “Energy Transition” chapter from the first version — see my breakdown and critiques here — was completely scrapped in the latest version.

This is one of the things which is great with this administration: it seems they actually listen when people complain. Many producers in the agricultural sector made noise about that chapter, and it was taken out completely.

The new version of the bill mentions the promotion of the opening of the international electricity trade, with the aim of increasing the number of participants in the industry (more competition) and modernizing current structures of the energy sector.

Additionally, it addresses the development of infrastructure for the transportation of electric energy through open, transparent, efficient, and competitive mechanisms.

These are all elements that focus on transitioning towards a more open and competitive energy market, but no longer on the measurement of Greenhouse gasses or a carbon credit index with credits assigned to businesses by the State, like in the previous version. Good.

The May Pact

In his speech before the Legislative Assembly, Javier Milei had launched a call for the "May Pact", to be held in Córdoba, which consists of 10 points to carry out the reconstruction of Argentina's fundamentals.

To this end, he called on the governors to attend the event on May 25 (a symbolic day for Argentina), to sign this "founding pact", subject to prior approval of the presented "Law of Bases and Starting Points for the Freedom of Argentines."

The May Pact consists of a ten-point agreement, and its main objective is to reconstitute the foundations of Argentina:

The inviolability of private property

A non-negotiable fiscal balance

The reduction of public spending to historical levels, around 25% of the Gross Domestic Product

A tax reform that reduces tax pressure, simplifies the lives of Argentines and promotes trade

The rediscussion of federal tax sharing to end forever the current extortionate model

A commitment by the provinces to advance the exploitation of the country's natural resources

A modern labor reform that promotes formal work

A pension reform that gives sustainability to the system, respects those who contributed and allows those who prefer to subscribe to a private retirement system

A structural political reform that modifies the current system and realigns the interests of the representatives and those represented.

Opening to international trade, so that Argentina once again becomes a protagonist in the global market.

The timeline to get the May Pact signed is very short, since in Milei’s view it should be signed after approving the Omnibus Law, which means that should be fully approved before the 25th of next month.

Credit & Capital Investment

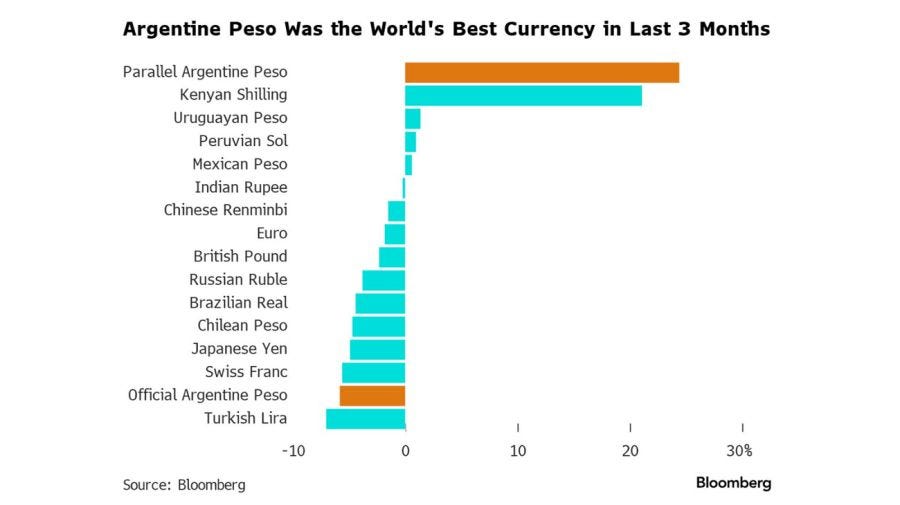

Private credit seems to be making a comeback. However, as Banco Supervielle and Banco Hipotecario announced new private loans and mortgages and Bloomberg placed the Argentine peso at the top of the list for currencies that appreciated most in Q1 this year, the negative short term impact of the austerity measures are not over yet.

Since Milei took office, Argentina has seen a drop in gross capital investment of around 12-13%. The first three months of his presidency have seen the least investment compared to Alberto Fernández, Macri and Cristina.

Of course this is not on Milei, but it does give an indication of how fast capital is flowing back to Argentina — spoiler: not fast.

If Milei’s plan stays consistent and gains in reputation and credibility, inflation will drop much faster. One issue to keep a close eye on is the Central Bank debt, which is piling up fast in order to prop up USD reserves. If this dynamic continues, that would mean more future devaluation if there are no other profound changes.

What will see an uptick sooner are property prices, since construction costs are at all time highs and demand is also picking up.

YPF / Burford

In November of last year, Judge Preska who is the lead in the YPF/Burford case indicated that YPF shares belonging to the State, but not those assigned to the provinces, could be used as collateral to avoid future seizures.

Argentina did not provide a guarantee in January as planned. Because there are no negotiations with the beneficiaries of the ruling, as far as Burford is concerned, the 51% State stake in YPF is definitely on the menu in order to cancel part of the $16 billion USD fine for nationalizing part of YPF in 2012.

Judge Preska won't make a decision until the first week of June. Argentina’s laws around the expropriation of YPF states that the “future transfer of [the YPF shares] is prohibited without authorization from the National Congress voted by two-thirds of its members,” which is also the reason why I indicated that YPF would probably not make it to the proposed privatizations in the Omnibus Law, which turned out to be correct.

Can Preska rule in favor of Burford and demand the transfer? She sure can, but then again this would have to be voted on in both chambers, and a negative vote is the most likely outcome, meaning: Burford will have to get its $16 billion by other means.

In the last days of 2023, Milei spoke about the case. He assured that “there is a problem because we don't have the money. We do not have USD 16 billion to pay but we do have the willingness to pay.”

The president said that he is going to propose a new tax to pay the debt with Burford, which he coined as the “Kicillof rate”, after the Buenos Aires governor who was Minister of Economy in 2012 and was one of the promoters of the expropriation.

The YPF disaster will have to be dealt with sooner or later, and it is still anyone’s guess how this administration (or the next) will come up with the $16 billion for Burford (even if the 51% of YPF got transferred, that would still not cancel out the debt completely).

Final Thoughts

The timeline to get both the May Pact and the Omnibus bill through Congress before the 25th is very tight, but that is the deadline Milei assigned when he gave his speech in front of Congress.

It’s positive to see that all the environmental bs has been stripped from the Omnibus Law, and the remaining privatizations and proposed changes to the energy market all make sense.

Now let’s see what happens in Congress in the upcoming weeks and if these articles will make it through unscathed.

See you in the Jungle, anon!

Your detailed updates are much appreciated. More power to Milei, damn it!

Thank you for the summary!