The Patagon Story

A throwback to one of the biggest Argentine fintech startups during the dot-com bubble.

Welcome Avatar! While the market is riding the current AI bubble, let’s go over one of the first dot-com unicorns to come out of Argentina at the tail end of the 90s, and its inevitable crash.

Before Mercado Libre, Globant, Brubank, Ualá, Cocos Capital or Ripio, there was an Argentine company that surprised everyone. A company founded by two university students that went from being valued at $30,000 to $700 million over the course of just three years.

But as quickly as the company grew and was sold for hundreds of millions of dollars, it vaporized and ceased to exist just as quickly. Patagon.com was one of the biggest victims when the dot-com bubble finally burst.

Early Days

In 1997, two young entrepreneurs — Wenceslao Casares and Constancio Larguía —, created a financial portal called Patagon.com, featuring market news, expert articles, and discussion forums. Back then, forums were the backbone of the text-heavy dialup internet, way before social media even existed.

Patagon.com was created as the first online financial services company in Latin America, following in the footsteps of E*Trade in the United States. Patagon sought to revolutionize online banking and stock trading, opening the door to retail investors without the need for intermediaries.

In 1998, Federico Agardy who was the director of InvestCapital, the stock brokerage firm of his father and renowned Hungarian businessman named Zsolt, met Constancio Larguía and Wenceslao Casares and convinced his father to invest $1 million USD and become the angel investor in Patagon.com, in a merger with InvestCapital — the trading licenses of the latter allowed the company to start trading.

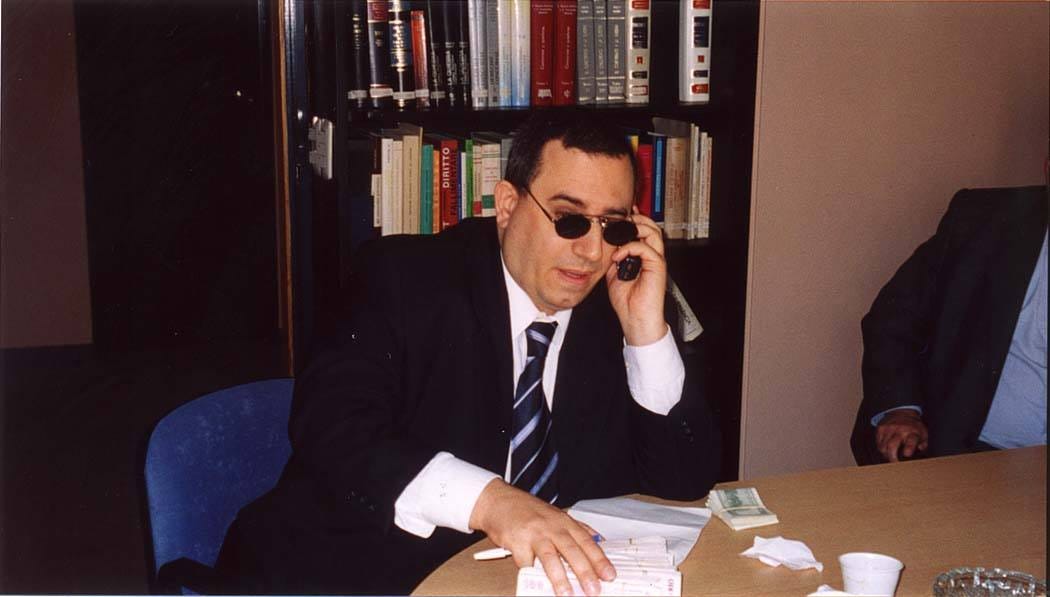

Meanwhile, in June 1998, a 40-year-old lawyer involved in Buenos Aires politics named Carlos Gustavo Maslatón joined the ranks of Patagon.com as an employee with stock options. Maslatón says that he was working at an old-school trading desk, and that they hired him to join the Patagon project.

Patagon established its headquarters in Miami, with offices in Mexico, Brazil, Venezuela, and Argentina. Carlos Maslatón was a key player in this rapid expansion process.

By the end of 1998, the company had moved operations worth $22 million, but profits were only 0.5%. Despite this, expectations were huge.

Soon the company would have thousands of clients moving millions of dollars. Patagon began to include derivatives such as mutual funds in addition to buying and selling stocks.

2000 Sale

In full dot-com fervor, the following year that expectation immediately turned into madness, as Patagon raised an $8 million round in March and then $53 million in December.

The company was ahead of its time, as making money transactions and purchasing products online with a credit card became easier.

After recognizing the growth potential, heavyweights like JP Morgan, Goldman Sachs, General Electric, and Irsa started piling in. The funding spree culminated on March 9, 2000, when one of the most important sales in Argentine history took place.

In 2000, Wenceslao Casares traveled to Madrid, to the offices of Banco Santander Central Hispano (BSCH), with the intention of selling the company. Santander itself had launched OpenBank in 1994, but saw Patagon’s potential in Latin America with great enthusiasm.

On March 9, it purchased 75% of the company for $548 million. This sale gave Patagon a total valuation of $705 million, right before the dot-com bubble finally bursted.

On March 20, 2000, Right after the sale, in an interview with La Nación, Wenceslao Casares mentioned:

“I think it's important that people, especially younger people, don't take what happened with Patagon as a lottery, like we hit the jackpot. Moments like last week's (referring to the acquisition by Santander) are exceptional, rare. Everyone congratulates you, takes pictures, etc. But most of the time, this is very hard.”

And Then The Bubble Popped

Patagon fizzled out in 2001-2002, it was a clear case of being “too early”, coupled with over the top valuations, a change in staff and a shift to a corporate mentality after Santander took over. It simply failed to become profitable and losses started piling up. The 2002 stock market crash was the final straw.

In a 2007 interview, Casares said of this period that:

“They gave us a blank check and we didn't know how to take advantage of it. Today I can say that in two years we threw away $270 million.”

The Maslatón Stock Option Case

Some depositors at Patagon were prevented from accessing their funds, and a series of multi-million-dollar lawsuits were filed by clients and employees.

One of the most famous lawsuits was around employee Carlos Maslatón himself. Patagon had also distributed stock options among its employees, but when the company sold to Santander, those stock rights were exercised, and therefore they had to pay them for those shares. During all the changes that were taking place, in March 2001, Maslatón had been fired from Patagon. His termination withheld owed compensation, offering only 39% of the total amount due for his stock options.

He recounts the full story here on Facebook and on X, but in summary Patagon's legal team preemptively sued him in New York courts in April 2001, betting he wouldn't risk his reputation or afford the $200,000 in legal fees in that elite jurisdiction.

They were wrong. Maslatón assembled a stellar legal team and traveled to New York to hire local counsel and launch aggressive counter-litigation in Buenos Aires, winning the cases and having the additional luck that all the funds were outside of Argentina’s jurisdiction while local Argentine banks were undergoing the corralito crisis.

Autist note — the reference to “Las Fuerzas del Cielo” (Forces from Heaven) used by Milei supporters to wrap some more mysticism around the Javier Milei movement, is directly sourced from Maslatón’s 2016 explainer post on Facebook about the Patagon lawsuits. He ends the post with: “But I decided to fight anyway, inspired by the Jewish maxim from the biblical First Book of Maccabees, Chapter 3, Verse 19, expressed in the year 166 BC, which says that "victory in battle does not depend on the number of troops, but on the forces that come down from Heaven," and which has inspired since I was a child and inspires every act of my life and which will continue to inspire me for ever and ever and for the eternity of the universe.”

Aftermath

The Patagon.com brand was discontinued in 2005, both in the Americas and Europe, and Santander revived Open Bank.

After the Patagon bankruptcy, Wenceslao Casares founded Banco Lemon in 2002, a bank based in Brazil, which was acquired by Banco do Brasil in 2009. He was also the founder and CEO of Lemon Wallet, a digital wallet platform that was acquired by US firm LifeLock in 2013 for about $43 million.

Casares became well known in the Bitcoin community as one of the earliest adopters around the protocol, from way back in the Satoshi Nakamoto days. He is known as “Patient Zero”, and Quartz reported that Casares was the entrepreneur to convince Bill Gates, Reid Hoffman, Chamath Palihapitiya, Bill Miller, Mike Novogratz, Pete Briger and other tech veterans in Silicon Valley and Wall Street to invest in bitcoin.

Casares is also the founder of Xapo Bank, a private bank for Bitcoin whales worldwide based in the UK. After Coinbase, Xapo is said to be the largest custodian of bitcoin in the world, with distribution in underground vaults on five continents, including in a former Swiss military bunker.

Carlos Maslatón grew out to be one of the earliest influencers online in Argentina, and amassed a large following first on Facebook since 2011 with his posts which are always original. Today he is more active on X, and he is often compared to Jim Cramer in Argentina for his market call, serving as a perfect counter trade.

Maslatón was closely linked to the start of the Milei campaigns of 2021 (deputy) and 2023 (president), only to jump ship a few months before the presidential elections and later have his coming out endorsing Sergio Massa. After Milei won the elections in 2023, nearly every political post by Maslatón has been against Milei and his government.

Final Thoughts

The story of Patagon.com inspired many entrepreneurial Argentines at that time that a very large business on a regional scale could be started from Argentina. The Patagon founders became the first digital millionaires, well before Mercado Libre and OLX.

In a way, Patagon laid the foundation for the Argentine unicorns that exist today, despite the fact that it didn’t live up to its promise like so many other startups that were part of the dot-com bubble. Through Casares and Maslatón, the company also produced two of the earliest Bitcoin adopters.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

Propertyinbuenosaires.com: 360 solution for foreign buyers interested in Buenos Aires real estate.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

YouTube: Check out my channel for real estate info and more.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.