This Time Is Different

Will the Argentina rollercoaster keep on climbing without the vertical drop afterwards?

Welcome Avatar! The Argentina rollercoaster goes up and down in almost perfect cycles, will this time under a Milei administration be any different or will we see the inevitable vertical drop that seasoned investors are expecting at some point? Let’s dig in.

“To lower inflation I will be a monetarist, a structuralist and whatever else is necessary; and if I have to resort to macumba, I will do so as well”

— Adolfo Canitrot

This quote by president Alfonsín's Deputy Minister of Economy from 1983-1989, is a perfect reflection of the mindset of most Argentine politicians when dealing with inflation: the root of the problem is swept under the rug, and the best they could do is resort to Brazilian voodoo to see if that could have a positive effect on lowering inflation rates.

To absolutely no one’s surprise, Canitrot’s macumba did not yield positive results: eventually inflation reached 3,079%+ in 1989 at the peak of the hyperinflation.

Sorcery or Meditation? ¡AFUERA!

Given the norm of resulting to macumba and meditation whenever dealing with inflation and currency devaluations, it was a pleasant surprise to see a complete shift towards an honest breakdown of Argentina’s structural problems at the start of Milei’s government.

Minister of Economy Luis Caputo synthesized these persisting issues perfectly in the introduction to his plans to get the country’s economy back on track:

“In Argentina, there has always been a political attitude of always spending more than what is collected, regardless of what is collected. When 100 was collected, 120 was being spent, when 120 was collected, 140 was being spent, when 140 was collected because we continued to raise taxes, 160 was spent, and we have always followed that pattern.

If you want more data, of the last 123 years, Argentina had a fiscal deficit in 113. That is, we have lived with deficits constantly, practically every year. This means that Argentina always had to find a way to finance that deficit.

As we have seen, this was financed with debt or by issuing more currency. This is what is very important to understand, because in Argentina this relationship between the deficit and its financing, for the great majority of citizens, is misunderstood. For many, taking on debt is almost interpreted as if it were a whim of the Minister of Economy on duty. It is not like that. The problem, again, is always the fiscal deficit, spending more than what is collected. That is the reason for our problems.

That is why what we are here to do is the opposite of what has always been done. What we are here to do is to solve this problem at its root, precisely so that we do not have to suffer these consequences any more, so that we do not have to suffer more inflation, so that we do not have to suffer more poverty.

For this, it is essential to solve our problem of addiction to the fiscal deficit. And today this represents an opportunity for everyone because it is the first time in more than 100 years that a candidate comes to power who explains this, and the people understand it and voted for him in a very large majority. When I was a child and for many years there were always candidates who tried to explain this but they never had more than 5 or 6 percent of the votes.

Today we are back in front of a historic opportunity because finally a candidate achieved an absolute majority and managed to make society understand that this is the problem, to understand that there is no more money, and that we cannot continue spending more than we collect.”

What is so unique about this introduction, is that it is the first time that any government official has addressed the elephant in the room: Argentina’s deficit spending.

Argentina does not have a dollar printer, and it’s structural problems have always boiled down to this dynamic: devalue the currency through printing frenzies to fill up the deficit holes left and right.

Autist note: read how Argentina went from one of the richest countries to one of the most problematic countries economically in the last century:

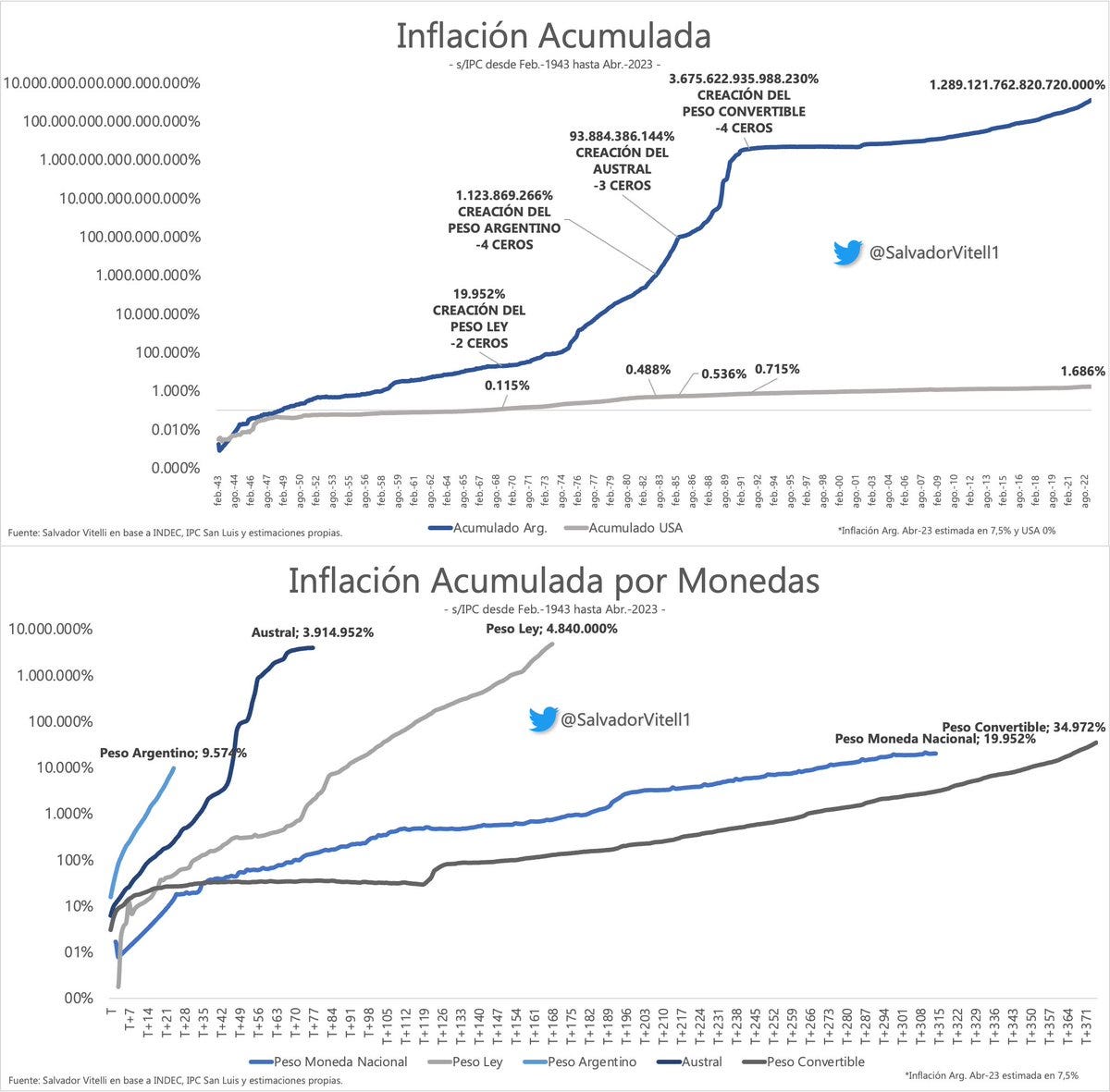

The evolution of 80 years of Argentine inflation has averaged 105% per year, and 1.3 quintillion percent accumulated. Argentina switched currencies five times and removed 13 zeros from its currency.

Differences Between Macri and Milei

Last time that the tradfi financial world had high hopes for an Argentina recovery was as recently as 2015, when Mauricio Macri won the presidential elections.

Many of the team members from Macri’s presidency — like Caputo and Sturzenegger — are now in key positions in Milei’s government. So is there any difference or is this structurally the same presidency with a different frontman?

Autist note: read more about the issues with lifting the currency restrictions (cepo) too soon under Macri, without making profound structural changes in terms of government size and deficit spending:

At the end of 2016, shortly after completing one year of government, Argentina’s Merval had gained close to 31%. The Country Risk index had dropped -35% compared to the year before. Since Macri lifted currency restrictions on day 1, and the peso strengthened 13% against the dollar that year and inflation also dropped significantly.

In November 2016, inflation was 1.6%, against the 4.6% MoM in January of that year. The numbers Milei started with were significantly higher: 20.6% MoM in November, which is now down to 2.7% monthly inflation.

The S&P Merval also showed bigger increases under Milei: almost 100% in dollars, while the Country Risk has decreased -60%. The blue dollar rate has dropped 42.8% and is now practically the same as the official rate:

An additional similarity with Macri’s first year is that the economy initially entered in a mini recession during the first half of the year, to recover in the second half of the year.

The economy under Milei is finally rebounding in Q3/Q4 after a brutal first two quarters which will result in a -3% hit to GDP for 2024 — better than the initially estimated -5.5%, but still.

It is no wonder that many opponents point out these similarities and say they are proof that Argentina is on a similar path which ended up being unsustainable, with Macri’s team running to the IMF in 2018 to get the biggest loan to a single country in the fund’s history.

However, there is a substantial difference: there is no fiscal deficit this time around.

As we can see below and also in the earlier graph over 60 years, the Macri administration had deficits throughout the whole term (2015-2019):

Minister Caputo and Milei have been directionally working towards avoiding deficits at all costs, and the results are nothing short of impressive:

Final Thoughts

The surpluses generated month-over-month during the Milei administration could finally prove that the structural problems like hyperinflations, bank runs, capital controls and currency restrictions in Argentina were always the result of previous deficits.

On the one hand, this means that the Milei admin does not have to run to get more credit in order to cover deficit spending, or let the BCRA printer run into overdrive with a peso printing spree causing more inflation.

Furthermore, thanks to these surpluses and the monetary policy of not issuing more pesos (or not a substantial amount compared to the previous administration), inflation is now at single digits monthly and will drop to levels not seen since 5 years ago. In tandem, exchange rates are converging despite the fact that the cepo (currency controls) are still active.

Once these restrictions are lifted, that will be the starting sign for foreign investment to start pouring in. This is still relatively low except for the $200M+ RIGI projects at the moment, but that will change quickly once the cepo is gone.

If the fiscal and financial prudence is maintained by Milei & Co, it will significantly decrease the risk of another vertical drop like we’ve seen under Macri and Alberto Fernández in 2019.

Does all this mean that the country is free of any potential crisis from now on and that the rollercoaster is locked on a horizontal track for decades to come? That will be hard to tell with absolute certainty, and in Argentina, things can change abruptly without a second’s notice.

Always a good idea to keep those seatbelts fastened just in case, but so far, things are looking better than most expected.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

Respectfully disagree. There is no surplus, because the financial deficit does not account for capitalized interest. If a US GAAP or IFRS company does not record capitalized interest on the income statement that is called fraud. If you account for capitalized interest, total deficit is closer to 10% of GDP.

You do not mention the massive instability of the peso when the Central Bank has negative reserves while the aggregatr monetary base has grown 100%+ YTD. It only takes a dollar sneeze to generate a Minsky moment, and the closer you get to the midterms the riskier this will get.

For an investor doing carry the question is super simple: do I keep two months more of carry to make 5%, or dollarize now at the lowest FX on record?

What happens when people start making that question to themselves?

This time is different are the most dangerous words in finance.

timing on Vaca Muerta development couldn't be better. Assume that provides a substantial tailwind to fiscal/monetary balances.