Timing the 2023 Argentina Elections

Duration risk and investment strategies during what could be the most turbulent months of 2023 until December

Welcome Avatar! 2023 promises to break many records in terms of making sure that no one in Argentina is crying from boredom not even for a single day, and the upcoming months will be no exception to that cadence. There are however specific dates to pay attention to if you hold Argy assets or plan on investing in local assets.

The land of eternal promise

“If Argentina only gets its act together, then the potential is unlimited”.

This is true, Argentina is gifted with a phenomenal set of resources and geographical benefits, that could make it an absolute winner this century.

However, this has been true ever since the country was founded. If the past 90 years are an indicator, you shouldn’t get your hopes up regarding significant economic changes any time soon.

Until substantial changes in economic policy and deficit spending occur, my posture is that Argentina is a trade, not an investment.

I go against my own portfolio here in terms of local expsure to real estate, but since I live here, have a family etc, that is a bit of a different story.

The properties I use to live in (or rent out), but stocks and bonds are trades.

In the excellent article “Argentina…” that appeared on the Praetorian Capital website a few weeks ago, Kuppy’s underlines this as well (emphasis added):

Recognize that we’re the very definition of Macro Tourists here in Argentina, and also recognize that these are trades, not investments.

However, we wanted to get you a look at this before the PASO (primary) on August 13.

August 13 will be a big date, which is the day of the primaries here in Argentina where the final candidates for each party will be defined.

It will also serve to see if the potential swing to a more liberal economy is just a pipe dream, of if this is actually happening (like many suspect on the X app).

Autist note: Argentina… is a great article with many good company names if you are thinking about exposure to Argentine stocks, so I recommend to give it a read if you haven’t already, and it also goes over Milei’s electoral program. It would be very promising if even just 10% of it would have any chance of being implemented.

The 2019 PASO Outcome

In 2019, the PASO pre-elections were key. Everybody and his mother was convinced that Macri, even though he didn’t have a great government, would be voted in office for a second term.

More than voting Macri in office again, people were convinced that nobody wanted to vote Kirchnerism back into office.

Of course we all know what happened next, and the market completely dumped everything related to Argentina. It was so bad that the 2019 post-PASO decline made it to the top 5 biggest daily stock market declines in history (#2):

Safe to say that many people got completely rekt, and investors who bet on Macri’s second term saw their Argy portfolio cut roughly in half in the course of a day.

I had more bond exposure vs stocks, and some peso balances and my wife’s salary in pesos at the bank. Luckily for us, deposits to local peso exchanges worked over the weekend.

So after seeing those results on Sunday night, we immediately wired all of our peso balances to a local exchange, and bought Bitcoin.

This was the only way to quickly get out of pesos, and it turned out to be a live saver. The next day when the official markets opened, the peso nuked 20% against the dollar.

Exactly how empty are the coffers right now?

As I wrote a few weeks back in Plan Bonex II: another default on the horizon?, the economic outlook for Argentina is grim, to say the least. At least for the public and Central Bank reserves, it is an outright disaster.

In that same article published on June 13th, I wrote:

Will the current government last until December?

That really depends on foreign creditors at this point. China has already agreed to another $19 billion USD swap, but as of today the IMF still hasn’t given the okay on the $10 USD billion advance that the Argentine government so desperately needs to tap the -$7 billion USD hole in the liquid reserves of the Central Bank.

Not much has changed since then, except that the deficit hole has only grown bigger, now to the tune of -$11 billion (with a record of -$15 billion 2 weeks ago).

The IMF finally agreed to a Staff Level Agreement last week. From what it looks like at first glance, it does seem that Minister Sergio Massa will have to start unifying exchange rates before further disbursements, even if the IMF already agreed to dropping another $10.8 billion USD in the black hole (emphasis added):

A strengthening and harmonization of the FX regime remains fundamental to durably improve reserve coverage and external stability, and measures have been taken to encourage export liquidation and contain imports in the near term.

The rate of crawl will continue to be used to preserve competitiveness and support reserve accumulation goals.

If you follow me on X, previously known as the Bird App, you might have seen the weekly BCRA Central Bank liquid reserve overviews which are absolutely abysmal.

The need for dollars is so dire at the Central Bank, that it was forced to create a repo on the gold certificates held at the BIS (Bank for International Settlements) last week.

In other words, gold was used as collateral to receive more dollars, which will primarily go towards the outflow from private deposits (depositors have been withdrawing en masse lately).

This operation will be canceled against the disbursement of the IMF, in the coming days. It is a bridging loan to pay the Fund. Argentina is literally pawning grandma’s jewels at this point.

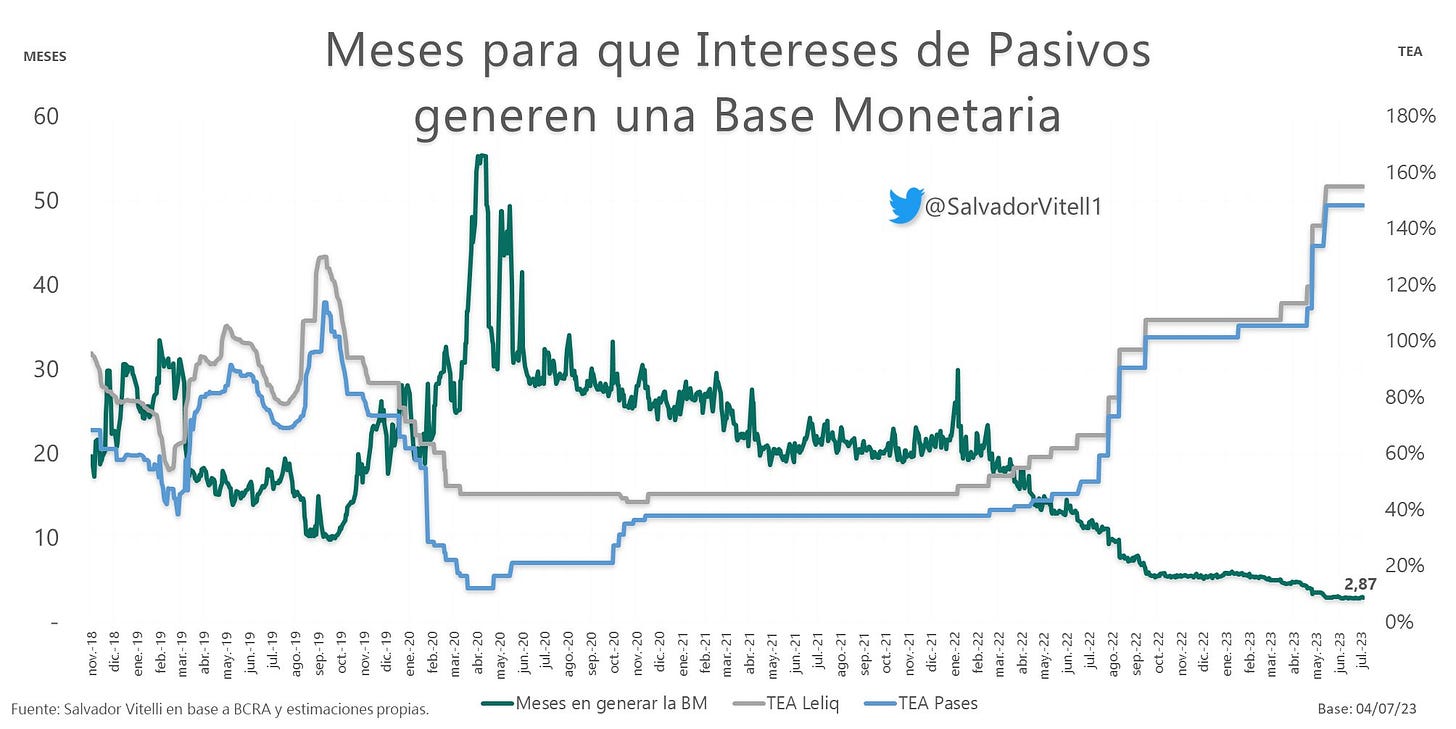

Call me a doomer, but the fiscal and monetary situation will not solve itself anytime soon, and is likely to continue with further peso devaluation (since the IMF is also pressing for more competitive saving rates and it now already only takes 2.8 months to generate a new monetary base, just out of the current interest of 97% YoY)

Besides the peso pulverizing further, the dollar scarcity is also likely to continue. Even with record export liquidations for this year due to a new, more favorable agro dollar rate, those did not move the needle significantly enough to revert the situation of the Central Bank reserves.

The 2023 PASO Elections in August

With that out of the way, let’s dive into the electoral landscape for the 2023 presidential elections.

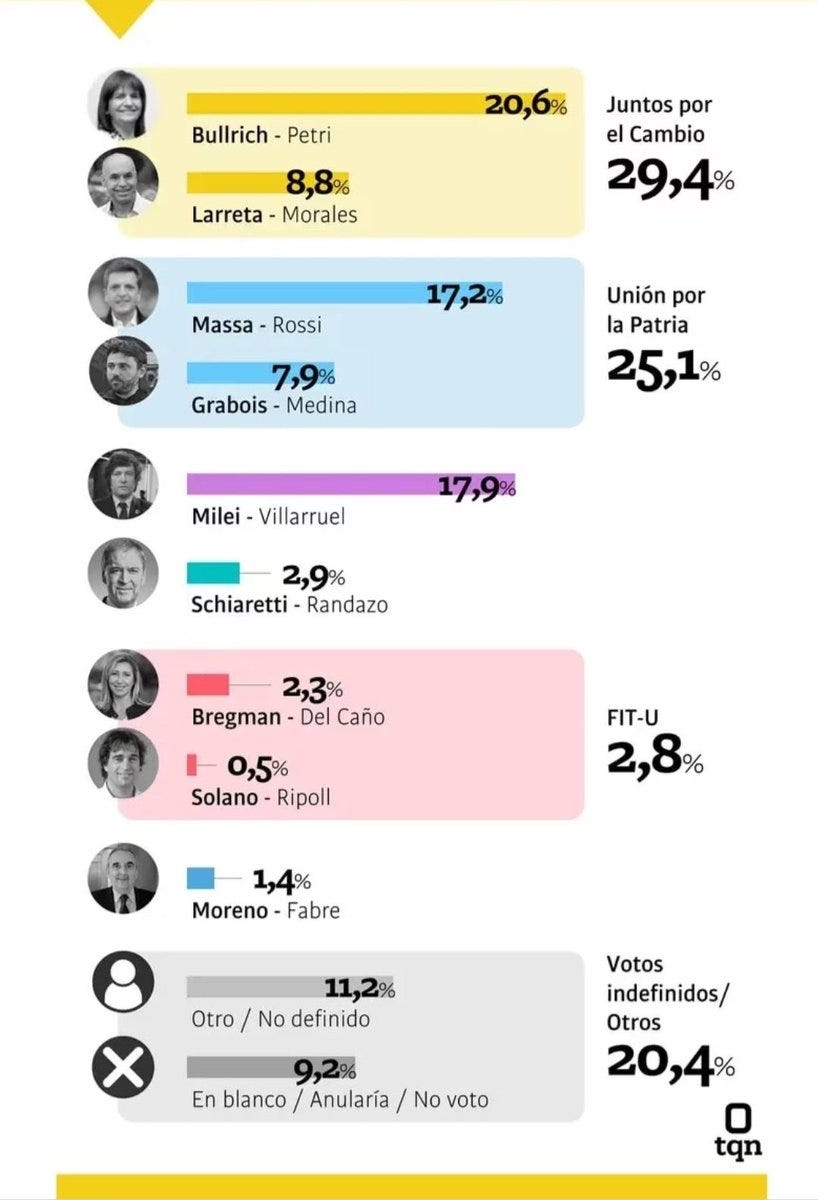

If we were to believe the polls, the current nationwide voting preferences are roughly as follows:

🟡 Bullrich (JxC): 20.6%

🟣 Milei (LLA): 17.9%

🔵 Massa (UxP): 17.2%

🟡 Larreta (JxC): 8.8%

🔵 Grabois (UxP): 7.9%

🟢 Schiaretti (HxP): 2.9%

Blue is the current government, which are votes that will join after the PASO, so that gives the current Peronism about 25% of the votes.

Yellow is Macri’s party, with a division between Larreta (current mayor of Buenos Aires), and Bullrich (more right wing). It seems like the PRO (Juntos por el Cambio) party will get the majority of the votes at least in this PASO elections.

However, the votes for Larreta are very likely to move to Massa, and less to Bullrich. Larreta is much more of a socialist and a consensus guy, and even some Kirchnerists would not mind voting for him if they had to choose between him and Milei or Bullrich.

Milei (Libertarian), is a total outsider without much political infrastructure compared to the rest, and even getting that 17% would be absolutely massive and cement the seed for change in Argentina. Also many of those voters are younger, and I expect this trend to continue the longer protectionist policies are in place.

How to play this PASO in terms of investments?

Personally, I plan to de-lever a bit before this years PASO results. Polls are usually off as we’ve seen in 2019, and it wouldn’t surprise me in the least to see the official candidate Sergio Massa gain much more votes than anticipated, just because he is now part of the official apparatus.

Even though most Argentine assets are still undervalued compared to previous periods, they have already rallied significantly in 2023 (YPF almost did a 4x in 1 year).

Bad PASO results that show Argentina will likely not change and have more of the same economic policies going forward, could send those assets back down again really quickly.

If Milei and Bullrich can get a decent percentage of votes, that would be an indicator for me to increase exposure after the PASO outcome but I lose nothing taking some chips off the table and reducing exposure when it comes to stocks.

For bonds, this is a different story. I expect that the next government will be forced to restructure, and that is the whole bet.

So I will hold on to those at least until that moment, meanwhile getting 10% on the full parity amount for the bonds that I bought at 23 cents on the dollar. Read more about my reasoning on that trade in Plan Bonex II: another default on the horizon?.

The next few months will be an epic, but turbulent ride, so better fasten your seatbelts.

See you in the Jungle, anon!

Hey Bro! Im Argentinian living in Buenos Aires. I would like to connect with you. I tried sending you a twitter DM but i can’t because im not verified.