Argentina: The Currency Battleground

Currency swap overview, Chinese interests and election interference in Argentina

Welcome Avatar! Much ink has been spilled on Chinese interests in Argentina, and with the runoff around the corner foreign actors are investing to influence Argentina’s elections outcome. If today’s currency war between the West and the BRICS can be described as a new “Cold War”, then Argentina is Checkpoint Charlie.

In previous articles we discussed parts of Chinese influence in Argentina, but so far we never discussed the history behind this cooperation, and why China keeps piling in more crispy yuan in the black hole of Argentina’s fiscal deficit.

A History of Yuan Swaps

Argentina tends to be strapped for cash, and any creditor is welcome. During many years after defaulting on a percentage of its debt, Argentina was not able to access capital markets and even turned to Venezuela for credit from 2005 to 2009.

China's increased influence in Argentina really started with the first Yuan currency swap in 2009. The first agreement was meant to reinforce safeguards against possible international crises when reserves reached a record 15% of GDP.

The agreement in 2009 was for US$10.2 billion over three years, with the option to extend the term. Argentina negotiated this with Zhou Xiaochuan, and agreed on a currency exchange that both countries could request from each other, and that would then be repaid.

The operating permits for the Argentina Central Bank under the 2009 swap were extensive. Yuan could be converted into dollars in international markets, or directly used for bilateral exchange, or Argentina could hold on to the swap as part of its international reserves denominated in USD.

After this, there was a second swap agreement with China for US$4 billion in 2014. This swap agreement was justified under the beginning of the works on the Cepernic-Kirchner dam in Santa Cruz, which Chinese construction company Gezhouba Group had won in a tender in partnership with a local company.

The total for this swap agreement was $11 billion dollars, in successive settlements depending on the progress of the works.

The money from China had arrived at the right time to support the last stretches of the Cristina Fernández de Kirchner Government, when the lack of dollars was already worrying. Argentina's chances of resorting to international financial markets at reasonable rates were next to zero because the country was still in default.

A new agreement in 2015 included some interesting additional footnotes: China would get a military base in the middle of the Vaca Muerta region.

Vaca Muerta is the largest oil field in South America after Venezuela, located in the Argentine province of Neuquén.

As with many of these bilateral agreements for swaps, the fine print was not known to the public until it was already a done deal: China would have the rights to a 50-year lease of this military base, with no Argentine participation and without paying a single peso in taxes.

The construction of this Chinese military base on Argentine soil generated great concern in Europe and the United States.

The military use that will be given to the place is what raised the alarms in the highest circles of the European Union and Washington. Only specifically authorized personnel by Beijing (military and members of the CCP regime) has access to the facilities. No Argentines are allowed to enter to supervise or inspect the base, or to understand what happens there.

In 2015, Mauricio Macri's government decided to review the Gezhouba contract to build the Cepernic-Kirchner dam. The first decision of the new Government was to freeze the project, on corruption suspicions & negative environmental impact.

In 2016, Beijing reminded Buenos Aires that part of the money for the project had already been spent (and not precisely to advance with the dam), so that, if the project was cancelled, those funds would have to be returned to the PBOC coffers.

As you might suspect, the conditions of the "swap" were "renegotiated"; the project came back to life under another name (hereinafter it would be called Condor Cliff-La Barrancosa), and the existing swap was reactivated.

More recently in 2022, talks began about building a Chinese port in Ushuaia, a very strategic location in Tierra del Fuego, with access to the Pacific, the Atlantic, and Antarctica.

Autist note: Chinese fishing ships already fish right at the border of the Argentine Sea in international waters. This floating city is used for illegal fishing and moves through the limits of the Argentine maritime zone and can even be spotted on nocturnal maps. Read more about this phenomenon here:

The port in Ushuaia would allow China to control the passage between the Atlantic and Pacific oceans and monitor communications throughout the hemisphere, amounting to a clear and significant meddling in international affairs on the part of China.

However in June of this year, Chief of Staff Agustín Rossi, assured that China will not build any multipurpose port in the province of Tierra del Fuego, but that an Argentine company was already building a new port without Chinese involvement.

For another project (the North Patagonian train to link Vaca Muerta with the port of Bahía Blanca), the Government is in negotiations with China to obtain financing for almost 1.2 billion dollars.

Trade Deficit and Investments

Over the years, Argentina has moved from a trade surplus to a hefty 80 billion dollar trade deficit with China, further complicating its dependency.

If the recent pace continues, 2023 would easily exceed a 10 billion dollar trade deficit and in that case the accumulated deficit with China from 2008 to date will exceed 85 billion dollars.

That trade deficit doesn’t seem to matter much in terms of the growing Chinese investments in Argentina.

In 2022, according to the study by the Brazil China Business Council (CEBC) "Chinese investments in Brazil: 2022 - technology and energy transition", the amount allocated by China to Argentina was $1.34 billion USD, superseding the $1.3 billion received by Brazil.

However, many of the announcements of multibillion-dollar Chinese investments in Argentina have yet to materialize.

Argentina is still not very attractive for Chinese investors due to the numerous obstacles, such as the spread between the official exchange rate and the multiple black market dollar rates, and imports of machinery or specialized labor to speed up production.

As mentioned before: Argentina is not for the faint at heart and even the Chinese are not willing to ignore the obstacles that local politicians have thrown up in order to “protect” the local market. In fact it’s so protected, that almost nothing gets done unless it can be done with local inputs.

As we’ve seen above with some of the initial Yuan swaps, many of those projects did either not materialize, or are still under way after years of delay.

However, China has been omnipresent for Argentina's financial needs and urgent circumstances, such IMF payments or other reserve issues that need a quick fix with fresh stacks of crispy yuans.

ArgenChina

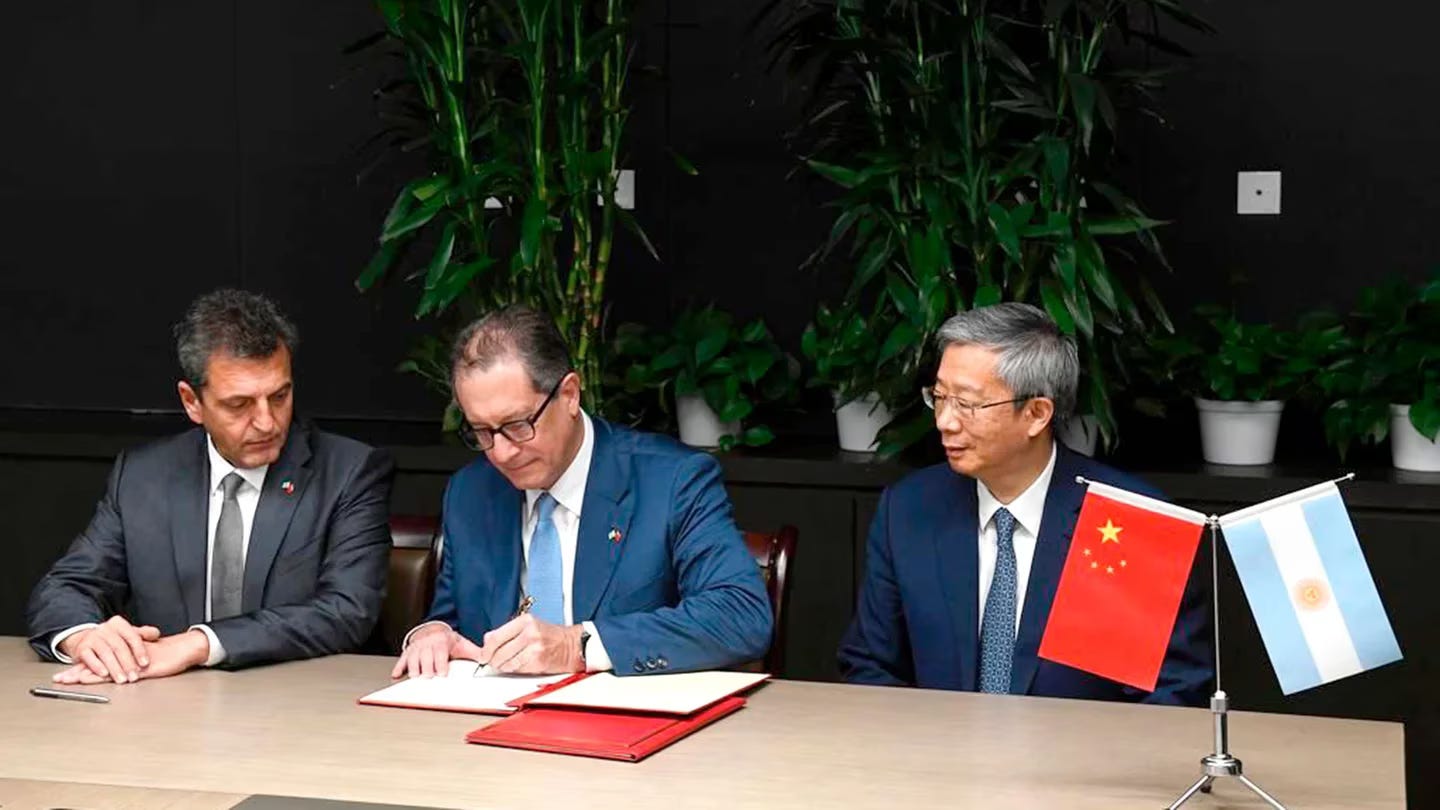

In June this year, Sergio Massa travelled to Beijing in order to secure more funds for his presidential campaign and to boost the heavily bleeding international reserves.

During this visit Massa renewed a $19 billion dollar swap with China, $10 billion of which Argentina could use for whatever purpose.

"We are going to found the republic of ArgenChina"

— Sergio Massa

In a typical example of using Peter to pay Paul, Argentina proceeded to cancel IMF obligations. Mainstream media did not hold back and started yelling “dedollarization” from the rooftops, lol.

Part of this swap deal was to give Argentines the option to open up a yuan account in Argentina:

Argentina’s central bank will allow the country’s commercial banks to open customer accounts in yuan, as it seeks to address an acute shortage of dollar reserves and encourages local companies to make payments abroad in the Chinese currency.

In Argentina it’s pretty common to have a savings account denominated in USD, but Yuan accounts were non-existent.

In a push for the “dedollarization” narrative, China made sure to include this in the clauses for this particular swap line. It served as a great story for the propaganda narrative that “the dollar was losing ground”, and soon many news outlets regurgitated this “success story” of the yuan in Argentina.

However, on the ground there is zero demand for yuan (except as an indirect vehicle to get more dollars), and it would be interesting to see the stats for yuan account openings in Argentina. My guess is it will be close to zero.

After the IMF payments were made using the June swap and the BCRA participated in some more intervention rounds in the local currency market to keep the peso artificially high, funds were running dry again a few months down the road.

In order to secure more funds, President Albert Fernández travelled to China this month to amplify the existing yuan swap.

According to Massa, this latest swapline is:

“[…] enormous news for the strengthening of Argentine reserves, to somehow accelerate everything that is the payment of SME imports, and it will also give us the capacity to intervene in the market.

As of today, we go from USD 5 billion to USD 11.5 billion of free availability of the swap with China.”

Now surely the CCP candidate Sergio Massa will have enough firepower to interfere in the currency markets and secure his victory in the runoff.

With Milei’s dollarization plans and anti-CCP stance, it makes sense that China is trying to back its candidate Sergio Massa in the weeks leading up to the runoff on November 19.

So far, we have seen some online examples of this, with a growing number of online political ads in favor of candidate Sergio Massa that seem to be funded directly with the yuan swap:

These YouTube ads are all paid for from multiple companies domiciled in Hong Kong (logical since Google does not have a presence in Mainland China).

From a cost perspective it makes no sense to pay these ads from a Hong Kong entity, since they could easily be run from Argentina where service costs for ad agencies are lower.

Unless it is easier to spend the funds for these ad campaigns closer to their source without leaving a paper trail, of course.

Most of the demographic for these ads will not have a YouTube premium account so they will be served ads, and that is exactly the target audience that needs to be persuaded before the runoff.

Final Thoughts

China is Argentina's second most important trading partner after Brazil. Only 30 years ago in 1992, China ranked 14th.

Argentina is an agricultural power that can provide China with a number of important resources such as meat, wheat, corn, soybeans, oil, gas and lithium.

Argentina is also structurally broke, and needs a helping hand to patch the gaping holes in a bucket that never stops leaking. This is where China comes in.

The historical dollar shortage in Argentina due to high fiscal deficits, defaults and towering external debt has only increased the country’s dependence on China.

The dollar is not going away, but neither is China. Argentina’s dependency on China as a lender of last resort is too important, and Milei’s calls to distance Argentina from China are a pipe dream. China will play an important role in Argentina, whether politicians like it or not.

The fact that Argentina’s trade deficit with China keeps growing over time and the clauses around the currency swaps are all but transparent, is cause for worry.

The examples of election interference by the CCP seen in the last few weeks would be headline news in any other region, but since it is in Argentina, no one seems to care.

Pumping a few million in YouTube ads through might not change the course of the election, but all in all the accumulated efforts to make sure Massa wins the runoff will likely pay off.

See you in the Jungle, anon!

Excellent and spot on analysis as always. EVERY country is going to want a piece of Argentina for obvious reasons. As you correctly mentioned, "Argentina is an agricultural power that can provide China with a number of important resources such as meat, wheat, corn, soybeans, oil, gas and lithium ".

You are going to see more and more countries around the world wanting an interest in Argentina because of it's bountiful natural resources.