Argentina's Citizenship Gold Rush

Six global firms have applied to become Argentina's Citizenship by Investment master agent: bids range from $50K to $100M

Welcome Avatar! So far, six firms have submitted bids to become the master agent for Argentina’s upcoming citizenship by investment (CBI) program, with government compensation proposals ranging from $50,000 to $100 million for handling up to 5,000 approved applications. Let’s go over the details.

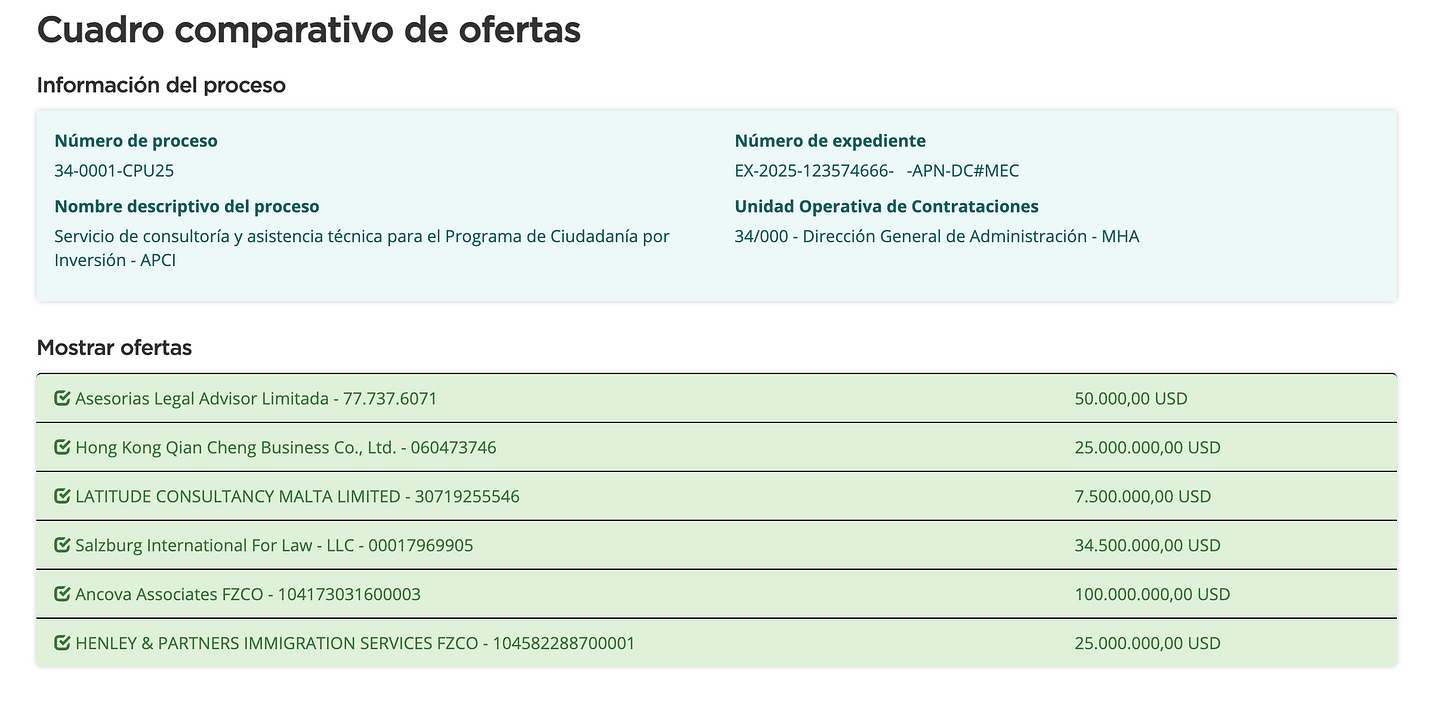

Argentina’s completely transparent CBI tender (34-0001-CPU25), managed by the Ministry of Economy, closed on January 20, 2026, attracted interest from 11 firms, though only six finalized their offers.

The way the tender text was structured already excluded many CBI firms from even applying, and the prerequisites were so specific that virtually only these six firms (and potentially less) could qualify as the Master Agent, like I mentioned in a previous article:

To qualify, firms must showcase established experience in residency and citizenship by investment (RCBI) programs. A key mandatory criterion is at least one government mandate in the field over the last 10 years.

As of this moment there are at least four firms that I know of that will be applying, and this number will likely increase over the upcoming days.

The senior leadership team must include at least five directors or executives, each with a minimum of five years dedicated to RCBI projects. Bids must include comprehensive CVs detailing specific roles and achievements in past initiatives.

Bidders and Government Compensation Proposals

In an act of total transparency, the Argentine government published some details of the bids online:

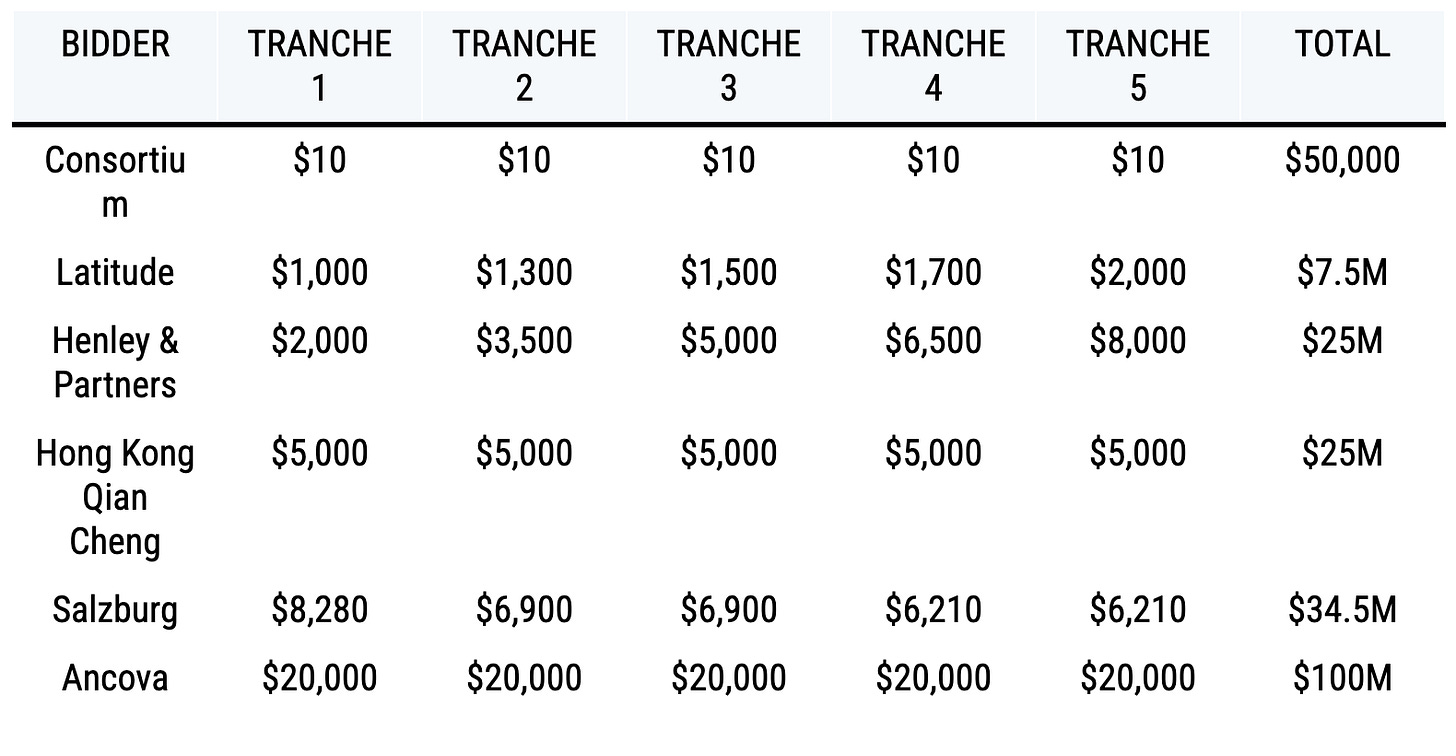

The bids specify payments from the government for 5,000 approved applications, structured in five tranches of 1,000 each:

Consortium (Apex Capital Partners, AIM Global, Passport Legacy, Arton Capital): $50,000 total ($10 per application across all tranches)

Latitude Consultancy Malta: $7.5 million (from $1,000 to $2,000 per application)

Henley & Partners: $25 million (from $2,000 to $8,000 per application)

Hong Kong Qian Cheng Business Co.: $25 million ($5,000 flat per application)

Salzburg International For Law: $34.5 million (descending from $8,280 to $6,210 per application)

Ancova Associates: $100 million ($20,000 flat per application)

Three bidders opted for flat rates, while the others used variable structures that adjust over tranches (averages shown):

Flat pricing:

Consortium: $10 per application

Hong Kong Qian Cheng: $5,000 per application

Ancova: $20,000 per application

Variable pricing:

Henley & Partners: 300% escalation from $2,000 to $8,000 (average ~$5,000)

Latitude Consultancy Malta: 100% escalation from $1,000 to $2,000 (average ~$1,500)

Salzburg: 25% reduction from $8,280 to $6,210 (average ~$6,900)

The Consortium’s ultra-low $10 bid seems like a bit of a joke: it is 100 times lower than Latitude’s starting rate and far below others.

This approach likely relies on direct fees charged to investors for processing, due diligence, and services, rather than government payouts, and is not unusual in the industry.

Argentina’s tender allows contractors to collect such fees separately, enabling the consortium to prioritize market control and investor relationships over maximizing state compensation.

In order to explain the tiered or tranched approach, this IMI Daily article gives a great overview of how Argentina structured the contract across five tranches of 1,000 applications each:

Key Tender Features

One of the most interesting details in the tender is the payment restriction for applications submitted directly by the agent:

“The tender compensates contractors only for applications that independent certified agents submit, not for self-sourced cases. This clause prevents market monopolization while requiring ecosystem development.

At the Consortium’s $10 rate, government payments generate just $50,000 across the full contract. At Latitude’s rates, agent-submitted applications produce $7.5 million. Henley’s structure yields $25 million. Salzburg’s descending fees collect $34.5 million. Ancova receives $100 million.

All bidders must charge investors directly for processing and due diligence to cover operational costs. The payment restriction forces this dual revenue model.”

Furthermore, all bidders were required to provide 5% bid bonds in USD, totaling $9.6 million across the bids, with most secured via insurance, one through a cash deposit, and another via a bank guarantee; the winning bidder’s bond will convert to a 10% maintenance guarantee.

More public details about the tender remain limited beyond the disclosed pricing, bonds, and guarantees. So we still don’t know more about the proposed structure of the CBI program by the bidders.

Investment options, minimum thresholds, eligible sectors, and other program specifics are still awaiting finalization by the winning master agent and the Agencia de Programas de Ciudadanía por Inversión (APCI).

Final Thoughts

This tender reflects Argentina’s innovative approach to launching its CBI framework, outsourcing core design and operations to a single expert provider while balancing technical capability with economic incentives. As far as I know, this is a first in the CBI industry.

The selected CBI firm will design, launch, promote, and operate Argentina’s first CBI program over a four-year period, working under the Agencia de Programas de Ciudadanía por Inversión (APCI).

This is no small task, and it will be the first CBI in Latin America after Peru terminated its $25K CBI program, which was closed in 1993 following public outrage and controversy.

So far Argentina’s potential price tag, source of funds and due diligence process already shows how much the CBI market has matured over the years, and the fact that the country is calling on experienced mobility firms to help structure the program underscores that this effort is not just a whim from the Milei administration to score a few headlines.

By the end of Q1 2026 it should be clear which firm will end up structuring the CBI program. The winning bid will shape one of Latin America’s first direct citizenship-by-investment pathways.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

March 2026 Event: The Wandering Investor Live Group Trip: Buenos Aires 2026. Get tickets here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

YouTube: Check out my channel for real estate info and more.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.