Milei's Post-Midterm Proposals

A deep dive into some of the reform bills La Libertad Avanza has prepared for after October 26

Welcome Avatar! After the lukewarm reception in Washington this week that confirmed Trump’s support of Milei’s government, but at the same time placed an asterisk around the elections — “you better win, or else” —, it’s a perfect time to go over some of the bills that La Libertad Avanza plans to discuss in Congress after the midterms.

But first, let’s go over some of the latest developments in the relationship between the besties United States - Argentina.

After the already unprecedented support voiced by US Treasury Secretary Scott Bessent at the end of last month, last week the US Treasury directly intervened to stabilize the Argentine peso by buying up millions of the orange hornero birds:

Argentina faces a moment of acute illiquidity.

The international community – including IMFNews – is unified behind Argentina and its prudent fiscal strategy, but only the United States can act swiftly. And act we will.

To that end, today we directly purchased Argentine pesos.

Additionally, we have finalized a $20 billion currency swap framework with Argentina’s central bank. The U.S. Treasury is prepared, immediately, to take whatever exceptional measures are warranted to provide stability to markets.

The US buying Argentine pesos was not on this Mara’s bingo card, but here we are.

This is not just a bailout for one of Trump’s buddies — or of Bessent’s hedgefund buddies like Paul “Fax Machine” Krugman suggests, — despite some media outlets stressing this as being the main driver for the generous USD liquidity flow from north to south. That might be part of it, but the bigger picture here is that Argentina is one of the bigger economies in the region with a government that is fully aligned with the United States.

Of all the energy and resource rich economies in Latam, Argentina is the only country that is walking away from the BRICS, whereas Brazil, Mexico, Colombia and Venezuela are still very much aligned with a more anti-US stance.

In The $20 Billion Gamble, Brent Johnson also stresses why Argentina matters more to the US than most might think:

Zoom out, and Argentina isn’t just another Latin American economy…it’s a geopolitical jackpot.

As the third-largest player in the region with a GDP around $600 billion, it’s an agricultural titan exporting grains and meats that could rival global giants.

Its shale gas reserves rank among the world’s largest, offering energy independence vibes in an era of volatile oil prices.

Throw in massive lithium deposits…key for batteries in everything from smartphones to EVs…and you’ve got a resource powerhouse. Don’t forget renewable potential in wind and solar, plus abundant fresh water, which could become the new oil in a thirsty future.

Seems like the US got a pretty good deal for only $20 million.

What’s in it for Argentina

Looking at this deal from an Argentine perspective it also makes sense to strengthen the ties with the US versus China, despite the doomers on X saying that “now soybean exporters will not be able to sell to China anymore”. The funny thing is that when you run the numbers, China doesn’t really matter that much for Argentina in terms of commerce, whereas the US does.

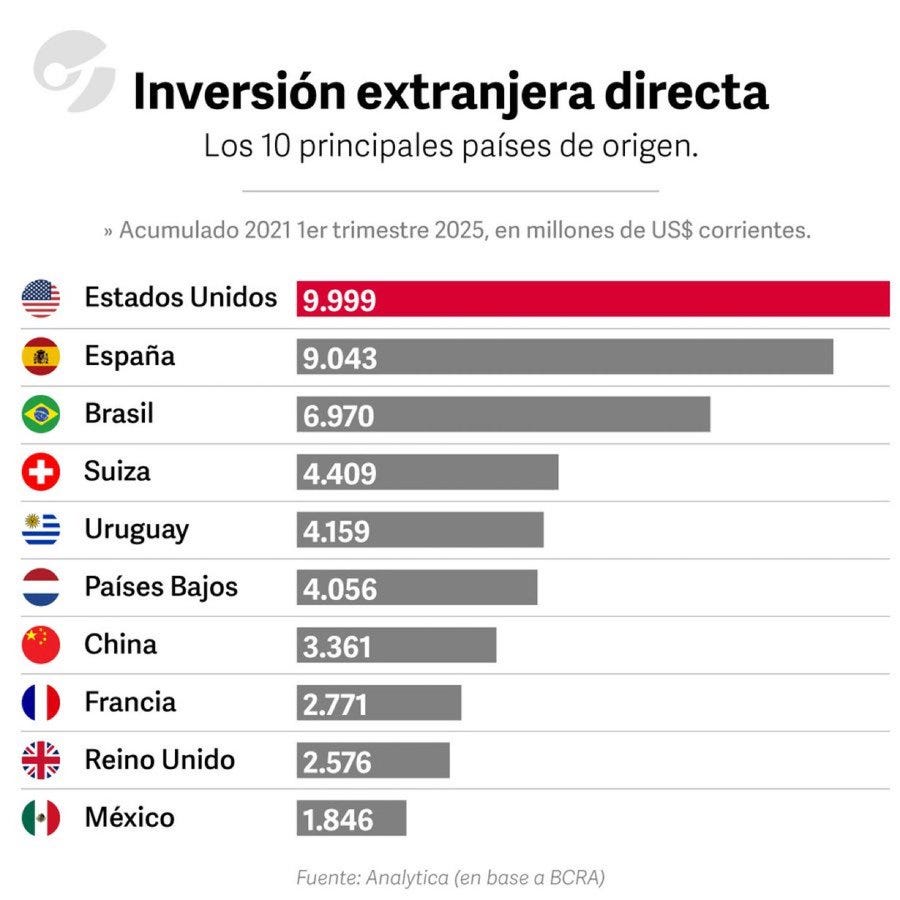

The US is the #1 country with Foreign Direct Investment in Argentina, with an impact that is 3x that of China. Even the Netherlands invested almost $1 billion more in Argentina compared to China over the 2021-2025 period:

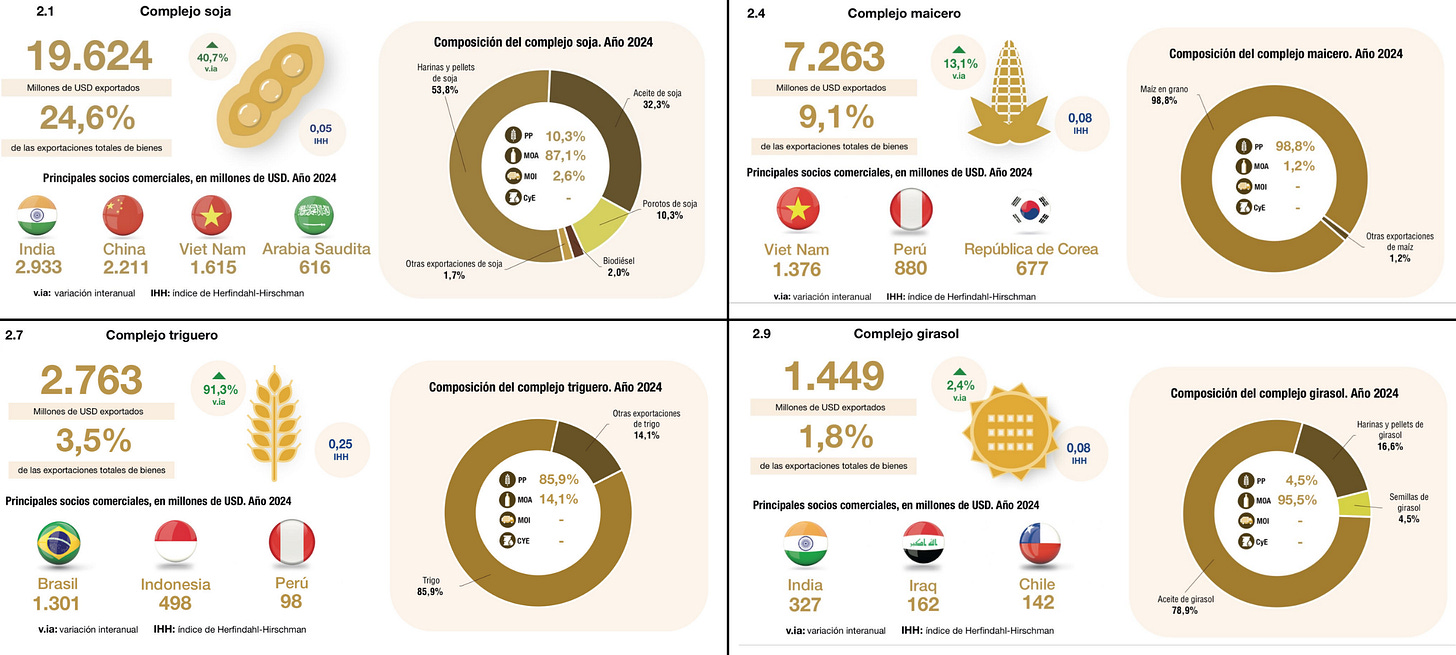

When looking at exports, it becomes clear that China plays only a marginal role when it comes to agro export purchases:

Only in the soybean purchases does China appear as a bigger buyer, after India. In the other important markets, China does not appear among the big export countries. Now that the myth of only the Middle Kingdom buying up Argentina’s agro exports has been put to bed, it is important to keep in mind that the deal between the US and Argentina will likely not get in the way of commerce at all.

Far more important from a US perspective is to have guaranteed access to natural resources like the ones described in the Brent Johnson quote above.

Those resources combined with a decrease in Chinese influence politically — for example by cancelling the Yuan swap — and making sure that the CCP does not continue to invest in infrastructure projects under its Belt & Road initiative to ensure more streamlined exports to mainland China from Argentina, are a key geopolitical motive for the US directly buying pesos and offering a USD swap line.

LLA Better Win, or Else

This week President Milei travelled to Washington with his economic team for a lunch with President Trump, which ended up being cancelled and transformed in a shorter press conference. On social media speculations about an inevitable trade agreement or even a potential dollarization of the complete Argentina economy ran wild ahead of the encounter between the two heads of State.

Unfortunately, there were no new economic announcements during the conference, apart from President Trump’s answer on this valid question by a TN journalist:

TN: “Will the US’s continued support of Argentina depend on the results of the upcoming legislative elections and the ability of the government to pass long-lasting reforms through Congress?”

Trump: “Well, I think if they don’t do that we’re not going to be around very long. Scott, can you handle that one, please?”

Bessent: “We’re confident that the President’s party and the coalition will do well in the election, and this aid is predicated on robust policies, and going back to the failed Peronist policies would cause a U .S. rethink.”

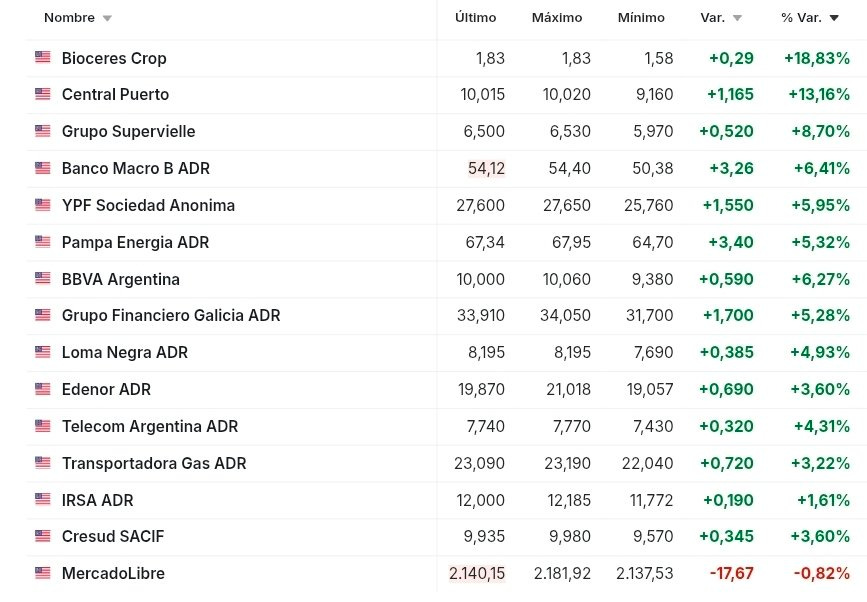

That little colloquy was responsible for nuking Argentine stocks and bonds almost instantly, lol:

However, from a US perspective these remarks makes total sense and should not have surprised anyone in terms of not throwing good money after bad. If Argentina decides to reinstate Leninist-Marxists these midterms belonging to the Kicillof camp, they can probably knock on Xi’s door but forget about US Treasury bailouts.

But it was not the news the market expected, and apparently the investor community does not have high hopes for Milei’s party’s chances in the upcoming midterms. This will likely prove to be an overreaction, and Bessent is probably right in his confidence. More about that below.

Today, Bessent made sure to keep the euphoria going by announcing that his department is working on a partnership with the private sector and other entities that would provide an additional $20 billion in financing for Argentina:

Bessent, speaking with reporters at the Treasury building, said the effort, which they have been exploring for weeks, would be “adjacent” to the $20 billion in financing that the Trump administration has announced it is providing through a currency swap line.

“So that would be a total of $40 billion for Argentina,” he said, adding that banks and sovereign wealth funds have expressed interest.

This $40 billion dollar announcement calmed the waters on Wall Street a bit:

These pumps and dumps show that the Argentina stock index almost resembles the illiquid crypto market, where shitcoins apart from Bitcoin can flash crash to close to zero based on a single tweet.

Trading or investing in Argentina it is almost impossible not to let emotions take over, since it feels like things can turn sour on a dime, and it’s a clear example of the volatility a country can introduce into its markets after so many failed attempts at climbing out of economic turmoil.

Building confidence takes decades, and once it is gone it is almost impossible to regain it. Bessent’s billions will definitely help in that regard.

Post-Midterm Initiatives

Last week, President Javier Milei presented the “Argentina Great Again Plan” in San Nicolás. It’s a comprehensive reform plan in an attempt to boost the economy and “permanently change the country.”

The rest of this article will go over the details of the changes Milei plans to implement regarding Labor Laws, Tax Reform and the Penal Code. The latter has some particular details that could become a serious danger for freedom in the hands of the Peronists — and even under Milei — if they do return to power in 2027.