September 2024 BA Real Estate update

Mortgage and RE sales update for September 2024

Welcome Avatar! The FOMO is here. Milei’s tax amnesty is a big success and many of those funds will roll back into the real estate market once the blanqueo window ends at the end of October. Mortgage issuance is also increasing and sales are at an all time high given the still nagging cepo currency restrictions.

Overview

Buenos Aires has now fully awakened from a five year down cycle, with record real estate sales under fx restrictions historically:

The last time the Buenos Aires property market saw that kind of volume was under Macri’s presidency, at the absolute height of UVA mortgage issuance.

Two things are fundamentally different now under Milei:

Mortgage issuance is not even close to taking off (just a few dozen per month)

The government still hasn’t lifted fx restrictions (cepo)

Historically, under cepo market conditions with restrictions on dollar rates and access since 2011, sales have hovered around 3,000 a month in good months. When Macri took the fx restrictions off at the start of his presidency, that number increased considerably, almost doubling at the height in 2018.

So the fact the cepo is still there, and despite that sales are at 2018 levels, is a very bullish sign.

The average sales price for a studio apartment (monoambiente) in Buenos Aires is now $101,909. In popular neighborhoods (Palermo, Colegiales and Recoleta), this is closer to $106-115k or more for new developments, depending on the area and building amenities.

On average, a one bedroom apartment of 50m2 is closer to $123k USD while the average two bedroom, 70m2 apartment costs 168.6k USD.

Neighborhoods

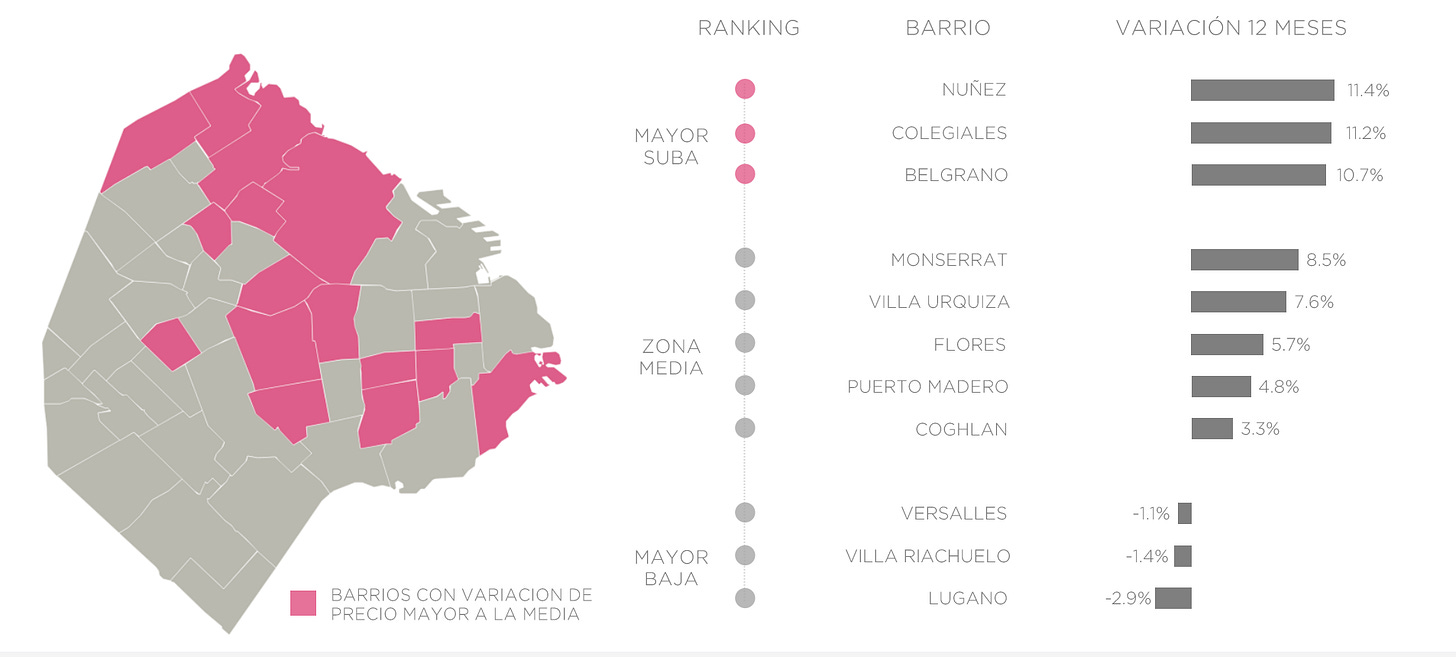

When looking at the zoning heatmap for average price/m2, the northern corridor of the city (Recoleta, Palermo, Belgrano, Nuñez and Puerto Madero) saw an increase of 7-8% YoY and around 1% in the last 2 months since our last update.

The northeastern corridor (Villa Crespo, Chacarita, etc), is 5.5% YoY.

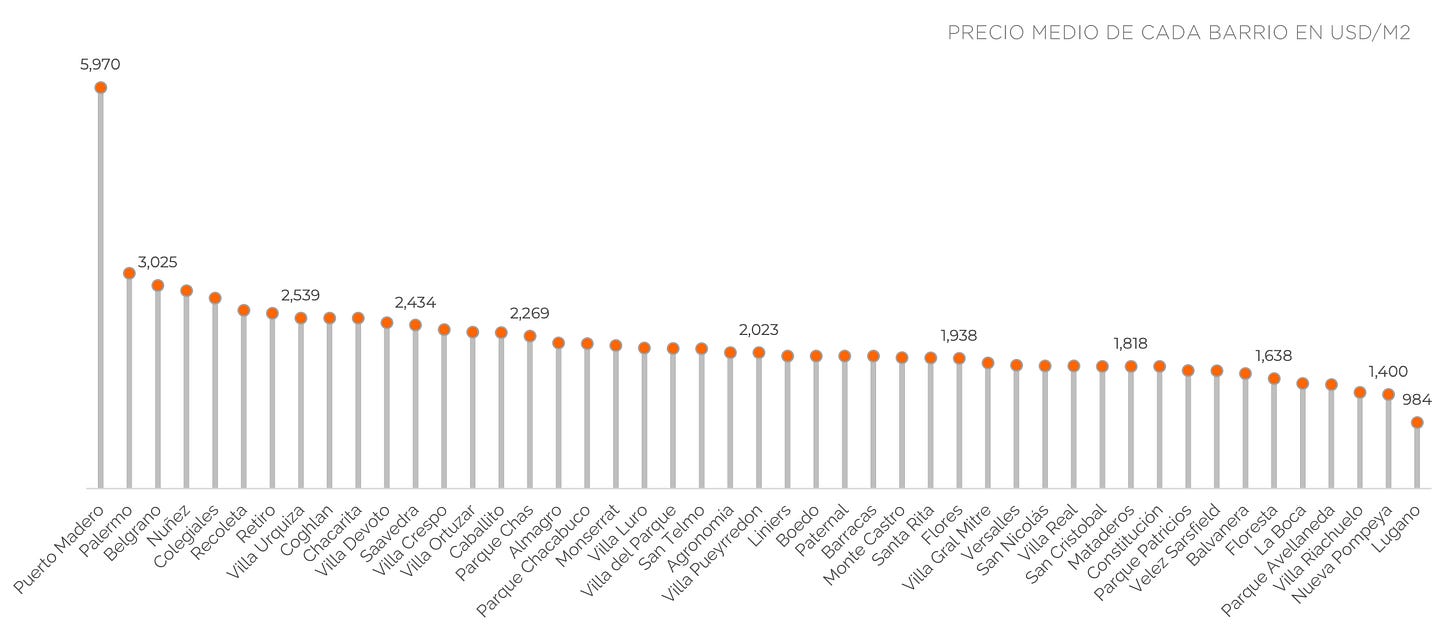

For the detailed prices per m2 per neighborhood, the bars look like this:

Palermo has finally crossed the $3k/m2 price on average and currently for new developments with interesting amenities, prices are closer to $4k/m2.

Colegiales really stands out, together with Núñez (north of Belgrano), with YoY changes of 11%+ on average listing prices.

When looking at individual deals and final closing prices, which have a 5% difference from listing prices now vs 10-15% last year, there are some types of apartments in neighborhoods that have done a 20%+ YoY, like the ones in Recoleta discussed in this excellent overview video by Santiago Magnin.

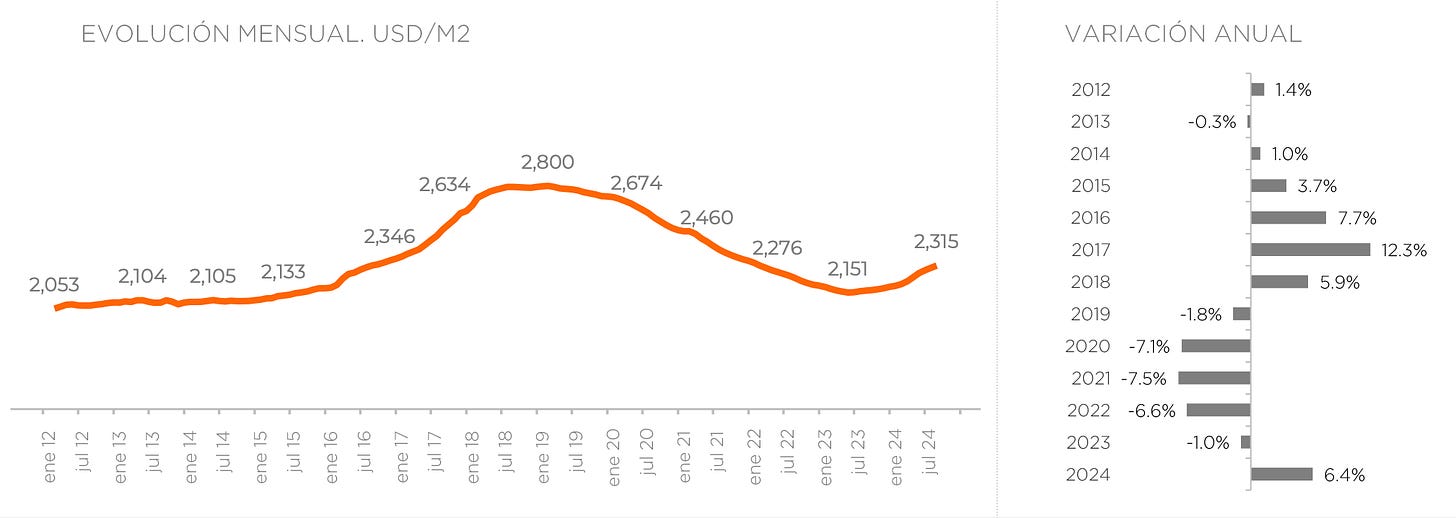

The average price/m2 in the city is still hovering around $2,269/m2, with a 4.3% YoY change:

Mortgage Trends

In mid-September, it was four months ago that financial institutions began offering UVA mortgage loans again after a break of more than six years.

Read more about the mortgage credit dynamics and the impact on prices in the short to medium term:

September data is not in yet, but in August, banks issued US$ 50 million in mortgages, almost triple what was recorded in July, which was closer to US$ 16 million.

In July, of the close to 5,000 deeds of sale, those made with a mortgage were just over 200, that is, less than 5%. When compared to Macri’s period in the previous peak in 2018, that number was closer to 40%.

This tells me we haven’t seen nothing yet.

Looking at sales, Buenos Aires saw +28% in real sales compared to the same period last year:

Reminder that these numbers do not include “boletos”, which are the contracts signed for new developments that are still under construction.

Autist note: you can find some additional articles below that shed some more light on Argentina’s real estate market:

Conclusion

The downturn for Buenos Aires real estate is officially over, and properties are selling like hot cakes at the moment.

There is more demand than supply coming back on the market, and good properties for a reasonable price are sold very fast if you benchmark it against the norm of the last couple of years — in less than a month.

The dollar deposit frenzy from the private sector fuelled by Milei’s tax amnesty will continue during the rest of October (cut off date is the last day of October), and from November onwards my guess is we will see a reversal of this flow, streaming into properties and other assets, or back under the mattress:

Up to $100k USD there is no penalty to withdraw the funds from the special blanqueo account after the cut off date, for everything over $100k there’s a 5% fee.

Mortgage issuance is also accelerating every single month, which is a trend that will continue and go parabolic at some point — the same thing happened during Macri, and conditions were less favorable to take out a loan back then as we have seen before.

The blanqueo money from the tax amnesty for a downpayment in combination with more available mortgage credit at banks is a great cocktail for much higher m2 prices in Buenos Aires.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

Spot on analysis. The numbers don't lie. Actually there are far more transactions than this. As you correctly mentioned, boletos aren't included in these property closings and many, many did boletos (down payments) toward property purchases.

When real estate prices go down for years and years it's difficult to call a bottom. But we did last year when we gave the buy signal to buy. Real estate prices have much further to go up in Buenos Aires. Once you see the mortgage market moving again at higher % and also these tens of billions of dollars finding it's way into the real estate market you will see more sales volume and higher prices.

Cha Ching.

Great article. Do you ever do this type of analysis for other cities like Mar del Plata?