The Age of Tax Innocence

Argentina's tax office issued a new rule to increase the incentive to invest "mattress dollars" in the economy

Welcome Avatar! This week, the Milei government activated the Tax Innocence Law for individuals, which excludes tax controls on changes in net worth, and puts shorter limits on controls for previous tax periods. Is this another blanqueo under a different name, and what will this mean in practice? Let’s find out.

In the words of the Argentine tax authority ARCA, under the Tax Innocence Law:

[…] a persecutory regime is left behind. Decades of currency controls, high inflation, volatility, and a suffocating tax system pushed millions of Argentinians into the informal economy and tax evasion.

Under that system, everyone was considered a tax evader.

The Tax Innocence Law sets things right and gives Argentinians back the freedom to use their money without having to explain themselves to anyone.

Among the main points of this paradigm shift is that the threshold for simple tax evasion is raised to 100 million pesos, and the threshold for aggravated tax evasion to 1 billion pesos. The statute of limitations for the crime has also been modified, decreasing from 5 years to 3 years. This means that those who register for the RSG (Taxpayer Registry) in the coming months will not be subject to investigation starting in 2029.

Furthermore, tax evasion will no longer be a criminal offense. Anyone who fails to comply and is notified can resolve the issue by paying their debt without facing criminal charges.

Innocent until proven guilty is something more tax authorities should implement.

The new scheme establishes a legal freeze on the tax history of those who correctly adhere to the new Simplified Income Tax Regime, created by the new law, and file their tax return on time and in the proper format.

From that moment on, a tax freeze is created, and in this way, ARCA (the Argentine tax authority) cannot audit or determine tax discrepancies corresponding to previous tax years.

The regulation prevents the application of the concept of unjustified increase in net worth; which means that the tax authorities cannot presume tax evasion when a person shows an increase in assets or expenses that does not match their declared income, even when the agency cross-references information with other taxes.

After the announcement, Minister Luis Caputo said:

“Now, everyone should put their savings in the bank.

This would significantly accelerate economic growth, allow us to lower taxes more quickly, become more competitive, increase employment, and improve wages.

Plus, they would earn interest on their dollars. All benefits!”

Furthermore, the criminal thresholds for tax evasion were substantially raised, the statute of limitations for tax crimes was reduced from 5 to 3 years, and administrative regularization was prioritized over criminal proceedings.

All in all, it has the same effects as a tax amnesty, but in the form of a permanent regime conditioned on future compliance. The scope of the Tax Innocence regime is determined by two key conditions: who can adhere to the scheme and who is excluded based on income or net worth.

This new measure is part of a series of actions that Javier Milei’s government has been promoting in the areas of tax and macroeconomic policy. We have discussed the 2024 blanqueo (tax amnesty), which allowed tax payers to declare up to 100k USD of previously undeclared savings without paying any additional taxes. Anything over 100k was subject to 5%.

In total, close to $20 billion USD was declared in that effort.

This new law structurally modifies the relationship between the State and taxpayers, and it is Minister Luis Caputo’s strategy to get Argentines to take the estimated US$200 billion they are hiding from the fiscal authority to invest it in productive activities.

The regulations stipulate that up to $1 billion pesos (approximately US$689,000) will be exempt from income tax when depositing funds in banks. The aim is to reduce criminal and administrative pressure on taxpayers considered to be acting in “good faith” and to focus controls on serious and fraudulent schemes.

The threshold for simple tax evasion rises from $1.5 million to $100 million pesos, while the threshold for aggravated tax evasion increases from $15 million to $1 billion pesos.

But these new regs will not apply to everyone indiscriminately: the possibility of using undeclared savings without tax consequences is directly linked to voluntary enrollment in a new tax system.

Those who can use their dollars without any consequences are those who are registered for Income Tax and voluntarily enroll in the new Simplified Tax Regime. Those who do not join this system remain subject to standard tax controls.

The Monotributo / Autónomos Debate

The Monotributo regime was originally created in 1998 in an attempt to formalize a large portion of the working population that falls under small-scale contributors. As of 2026, there are approximately 4.7 million Argentines registered in this tax category.

Autónomos, on the other hand, is the standard/full tax regime for independent workers who don’t qualify for (or have outgrown) the Monotributo category. It is no wonder that this category only has around 420,000 registered tax payers.

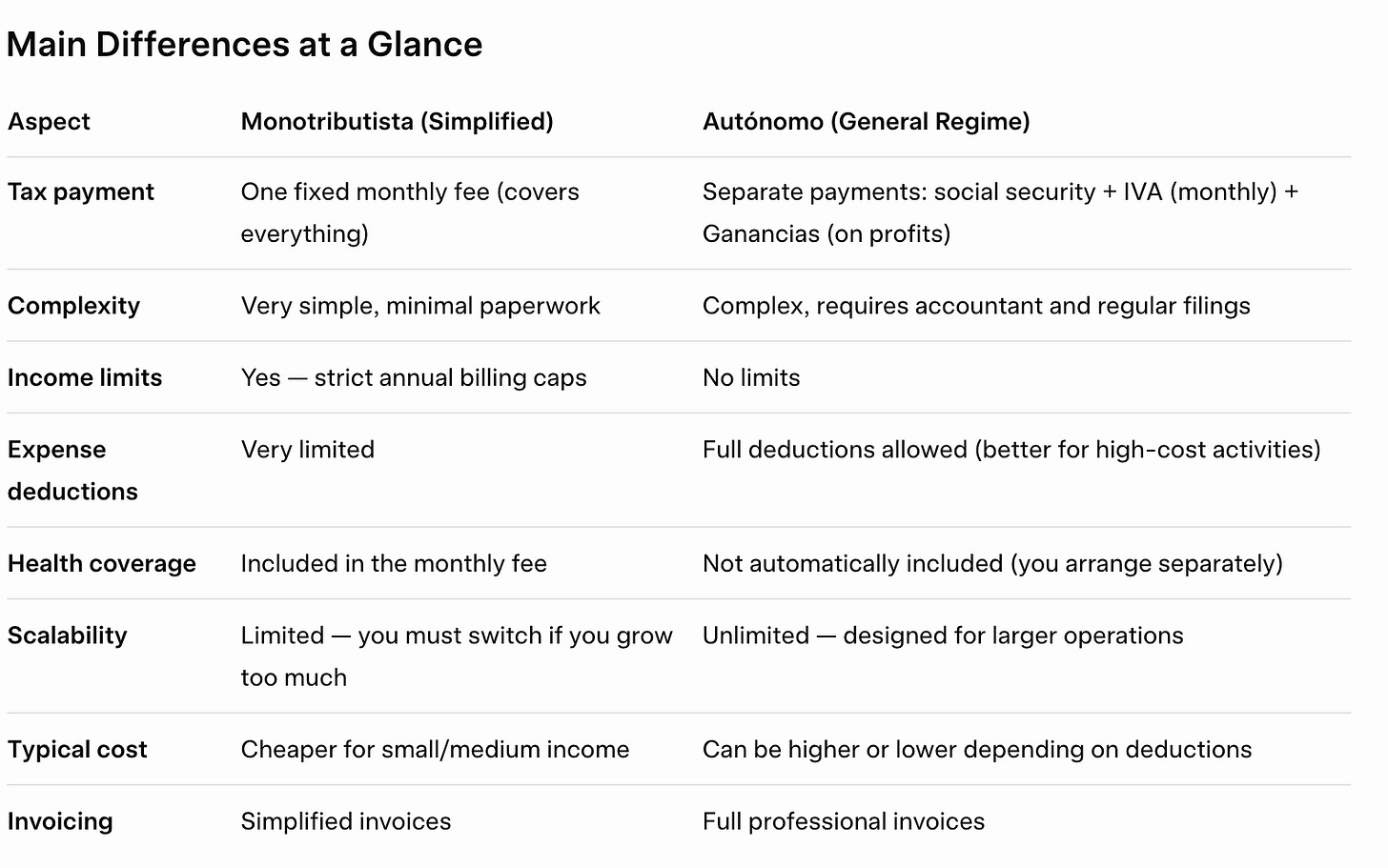

Monotributistas greatly outnumber Autónomos because the simplified regime is designed for smaller operations and has much lower barriers to entry and compliance. Many people start as Monotributistas and only switch to Autónomo if they exceed billing limits or need full deductions/scalability.

It allows freelancers to bill up to +/- 70K usd per year and only pay 15% tax by a subscription fee every month, without having to add VAT on their invoices.

Much better than the Autónomos category, which immediately triggers a 35% tax AND forces the tax payers in that category to add 21% VAT on every invoice. If you are a partner or own a company in Argentina, you are automatically placed in this category.

Needless to say that the vast majority of small contributors are all Monotributistas, and with Milei having changed the upper invoicing limit from roughly 18k to 68k, it makes less sense than ever to hop over to a much more tax heavy Autónomos category.

IMF & Monotributo

There has been a long debate from the IMF since its 2018 Stand-By Arrangement and 2019 reviews emphasized strengthening the administration of the Monotributo and addressing evasion/abuse, without proposing to eliminate the regime itself.

Last year, rumours spurred up once more that the IMF was gunning for an end of the 4.7 million Monotributistas who would all have to move to the Autónomos category, paying much higher taxes. This turned out to be fake news and was later denied by President Javier Milei as well:

“These are lies and operations by criminals who use the credentials of journalists.”

For now, it definitely looks like an impossible and very undesirable option to nuke the Monotributo category from the tax menu.

However, it is no surprise that the tax payers registered under the simplified tax regime (Monotributo) will not be able to access the new fiscal innocence system that launched this week. While Monotributo taxpayers receive benefits to avoid feeling targeted, they do not have the specific benefits of this law and its regulations.

With this Tax Innocence law, the government expects more Monotributistas to hop over to become Autónomos, but unless they are way over there skies billing wise, it does not make a lot of sense. Another downside is that they will not be able to switch back to the Monotributo regime for the next 3 years after making the change.

Final Thoughts

The Tax Innocence law sounds very reasonable, but it remains to be seen how this new law will be implemented in practice: what if monotributistas who cannot adhere to this new regime get more tax audits / controls because of it? This remains to be seen.

This tax innocence law is yet another attempt at getting Argentines to spend and invest their non-declared savings in the local economy. However, today there are little incentives to do so. About half of the economy is “off the books”, and this will remain unchanged unless the upcoming pension and tax reforms align incentives so that these savings can enter the official banking rails and tax filings.

The tax and labor reforms are still scheduled for Q1 2026, but it remains to be seen how much will effectively change in the final text that passes in both chambers.

Unless there will be much better tax structures for entrepreneurs, it is doubtful that more private undeclared savings will enter the system than has already happened under the blanqueo / tax amnesty.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

March 2026 Event: The Wandering Investor Live Group Trip: Buenos Aires 2026. Get tickets here. (SOLD OUT)

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

YouTube: Check out my channel for real estate info and more.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.