October 2024 BA Real Estate update

Mortgage and RE sales update for October 2024

Welcome Avatar! With over US$ 19 billion entering into the financial system through the tax amnesty, technically if this would all be used to buy real estate it could buy the entire supply of properties for sale in the Buenos Aires metro area. Let’s dig in to see what that means for prices and current supply.

Blanqueo

It does seem like wishful thinking that all of the $19 billion dollars that have entered in the tax amnesty will be converted into real estate, but at least 30% of that will, is my guess.

After seeing that $19 billion number and the fact that it could buy up practically all of AMBA’s real estate listings (Buenos Aires + Greater Buenos Aires), it does seem like prices still have ways to go.

This was the final result of the two month tax amnesty to launder previously undeclared funds:

Now, these tax amnesty numbers do have to be taken with a grain of salt, because initially the 0% tax on any amount up to $100k was valid throughout September, but later the government extended that for an additional month in October. What does this mean in terms of changes?

It means families could rotate the money they were declaring. See how this worked in practice:

Spouse deposits $100,000 USD cash in a special blanqueo bank account in September, cut off date is October 1st.

Spouse withdraws the $100,000 USD cash from the bank account on October 2.

Wife, friend, family member, whatever deposits those same $100,000 USD cash in a special blanqueo bank account in October, cut off date is November 1st.

Relative/friend withdraws the $100,000 USD in cash.

Now you see that because of this extra month, a lot of that money from the first month has probably been used twice to declare $200,000 in total whereas only $100,000 real dollars were used.

This rotation play was only possible with amounts below $100k, for amounts over $100k they had to stay in the account or face a withdrawal penalty of 5%. Still, it does seem that many declared more than $100k, and private sector dollar deposits have never been this high in Argentina:

In real ancap fashion, president Milei called for destroying the database of anyone who adhered to the tax amnesty, so it can’t be used against them in future administrations if they are short of cash and want to start auditing.

October Real Estate Overview

For October 2024, the average price/m2 remains in an uptrend.

In the table below you can see the VPM (Valor Promedio de Mercado), which is the average value at which properties sell over a period of time. Of course this does not take into account the individual characteristics of each property, and there can be many fluctuations depending on that.

The right column shows the total amount of listings for October.

Just in in 2024 alone, sales prices have accumulated an increase of 6.6% on average (and much more in popular neighborhoods like Palermo, Recoleta, Belgrano etc).

In the last 12 months, prices increased by 7.2%, registering the largest year-on-year increase since December 2018. Currently, the average price is 7.9% above the minimum recorded in June 2023 but 17.1% below the maximum reached in March 2019, in nominal terms.

One thing that is interesting to see is that the average prices for “used” properties is significantly lower compared to investing in a pozo or new construction development:

Taking into account that these are averages, you can be safe that a new development or construction project that just finished and is now on the market are easily $4k+/m2 in Palermo, for example, while the average m2 price in Palermo is $3,115/m2.

Pozo m2 prices actually increased by 15.3% in 2024 alone on average! This rodent is very happy with the bottom purchases in 2023.

The average m2 prices for new properties ready to move in (Estrenar) in Puerto Madero, Recoleta and Belgrano is actually higher than the pozo (under development) price:

This shows that there is high demand for new properties, with more modern amenities, and that older apartments and houses are sold at a discount.

Mortgage Trends

In April, May, June, July, August and September 2024, 114, 141, 115, 225, 416 and 705 mortgages were registered respectively, showing sustained growth. Mortgages are coming back and coming back strong, see the hipotecas column below for the numbers, with the previous peak in 2017:

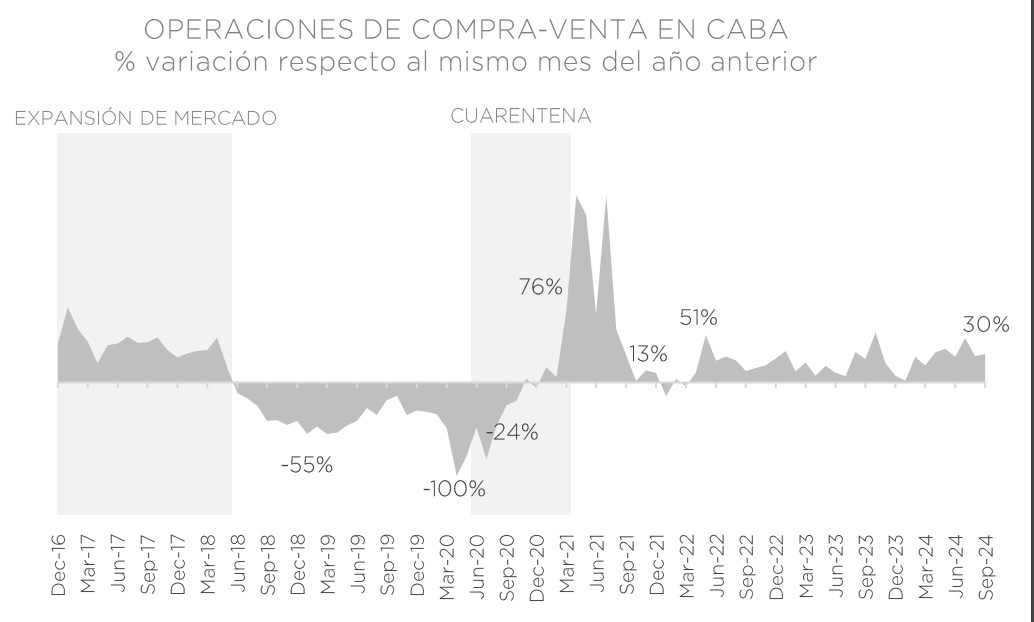

As you can see in the graph above, the biggest boost in recent times for escrituras (sales deeds) was seen in September. The highest number of deeds in the last six years was recorded and the barrier of 5,000 deeds was broken.

Cristina Kirchner started with the cepo restrictions at the end of 2011, and you can see that in 2012 sales volume tanked almost -50% compared to the previous year. When Macri took off the currency restrictions in 2016, volume started to boom in combination with mortgages, only to sizzle out again — he reinstated the restrictions a few months before his term ended in 2019.

Given the fact that this year’s number is with currency restrictions still in place, this number is quite remarkable.

Now in this deed overview for real estate sales in Buenos Aires it’s important to take into account that pozo investments usually do not show up here, because you cannot “register” the property yet since it doesn’t exist yet. So all these unit contracts are not taken into account. With those added, these numbers would be many times higher.

Read more about the mortgage credit dynamics and the impact on prices in the short to medium term:

Looking at sales, Buenos Aires saw +30% in real sales compared to the same period last year:

Reminder that these numbers do not include “boletos”, which are the contracts signed for new developments that are still under construction.

Autist note: you can find some additional articles below that shed some more light on Argentina’s real estate market:

Conclusion

Since it’s just one of the main ways Argentines prefer to store their wealth, average m2 prices in Buenos Aires still have a long way to go, and a lot of the blanqueo billions will eventually end up in property.

Even after the 2024 increases, average prices are still -17% below their historical peak in nominal terms, so it is definitely not “too late” in terms of buying.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

Great analysis as usual! Spot on target. TONS of properties were purchased in pozos as you mentioned that aren't reflected in these escritura #'s. Our company called the bottom last July and predicted it was absolute bottom. We jumped in a lot of pozo properties that are finishing now. Some owners have already flipped for a 20% to 25% increase from just last year.

I agree not all the amnesty funds will all go into real estate but our guess is probably 40% will end up going into the real estate market by the end of 2025. Your estimate of 30% is also great. Probably somewhere between 30% to 50% will find its way into the real estate market. Either way that is a HUGE number and should push up property prices tremendously in 2025.

Those that bought last year or that buy this year will be very happy.

I still remember that dinner we had last year when we predicted all of this explosion in real estate. Everything we both predicted is playing out now. It's never easy calling the bottom when real estate prices fall 4+ years in a row but I have to admit we nailed it!