Welcome Avatar! Some things are better left unsaid, and potential debt landmines on the BCRA balance sheet work in the exact same way. Did the Milei government really turn off the peso printer, or are there different dynamics at play? Let’s find out.

As you might remember from The Milei Starter Pack, the new administration in Argentina really received one of the worst inheritances in recent history with regards to outstanding debt, and the country was very close to a potential hyperinflation. Even diametrically opposed Peronists like Guillermo Moreno admit this.

One of the bigger issues the Milei government was facing, was the importer debt in dollars. This was estimated at approximately $60 billion dollars, and to postpone payment since foreign net reserves were already negative, the BCRA created a new instrument: BOPREAL.

In the words of the BCRA, the characteristics of these BOPREAL bonds are as follows:

The Bonds for the Reconstruction of a Free Argentina (BOPREAL) are securities issued by the Central Bank of the Argentine Republic in US dollars for importers of goods and services with pending payment obligations for imports of goods with customs registration and/or services actually provided prior to December 12, 2023.

The BOPREAL are the instruments designed and offered by the BCRA to offer a solution that is as orderly, transparent, indiscriminate and effective as possible in the face of the historical growth of commercial debts abroad arising from the exchange delay and the consequent lack of foreign currency that makes it unviable. the possibility of meeting said obligations immediately.

These BOPREAL bonds are denominated in dollars, with an annual rate of 5% and may be subscribed in pesos, and a duration between 1 to 5 years.

You may have not noticed a tiny detail here. These bonds are denominated in USD. This must be one of the first times in history that a Central Bank —not the Treasury— is issuing a bond denominated in a foreign currency it cannot print, and much less at 5% interest (higher than the current Fed rates).

This is a potential issue, depending on how much USD flows into Argentina in the next 5 years.

Foreign Reserves Accumulation

The BCRA is buying dollars daily in order to get the liquid net reserves back in the green.

So far, the Milei admin has propped up BCRA reserves with over $12+ billion USD, a total record in the first 75 days of a new government, but with what funds? This is where new peso issuance comes into play.

In this short term economic outlook in January, the monetary base was trending downwards, but that dynamic has since reversed.

Up until the end of March, $9.4 trillion pesos was issued to buy $11.4 billion USD in foreign currency.

Just to give you an idea, the total monetary base is around $10.5 trillion pesos, which means that the Milei admin issued close to 85-90% of the monetary base to buy those $11 billion dollars.

Now, if that’s the case, why is inflation trending downwards? Since this is little over half of the issuance that we were seeing during the final stages of Massa’s disastrous LELIQ peso debt bomb, you would expect inflation to accelerate.

This is where Pases (REPOs) come in:

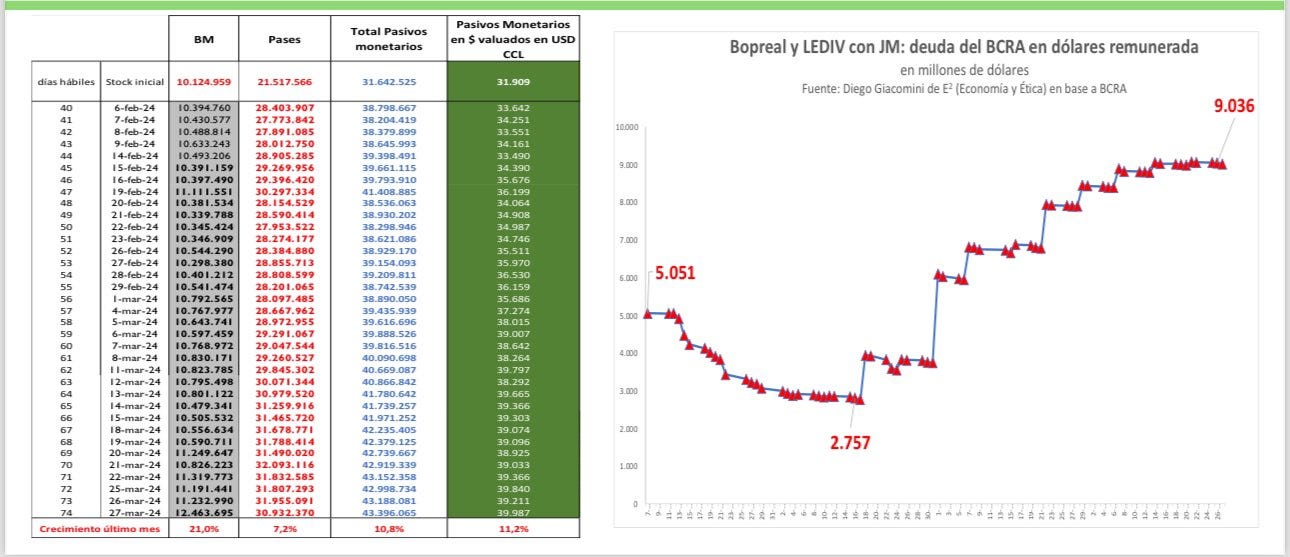

With the initial exchange rate jump and peso devaluation in December, Pases dropped in dollar terms. Then issuance picked up again, to the point of being just USD 1.16 billion below the initial level after the devaluation.

Just because Repo rates are negative versus the current inflation rate, doesn’t mean that monetary issuance stopped or reversed.

So far, the economic team has not managed to “liquefy” these remunerated liabilities. In addition, to that figure we must add about USD 10 billion in BOPREAL mentioned earlier (debt with importers), so BCRA debt reaches the equivalent of USD 48.3 billion.

This amount is the equivalent to a 3-year commercial surplus. All in all: very far from any possible dollarization without moar debt.

New USD Inflows

This year looks primed to be a record year of USD inflow after the harvest export cycle is completed, which starts in April and last up to June-July.

Since the Milei administration still hasn’t filed a tax bill to lift export tariffs, this means that the BCRA will see a spike in foreign currency inflows, estimated at around $20 billion dollars.

How much of those $20 billion will end up forming part of the reserves at the end of the year?

This is a bit harder to estimate, but with the 4 installments for the BOPREAL debt that are due in that same timeframe, roughly -$16 billion will go just towards those payments, which leaves about $4 billion.

Another $1 billion in plazos fijos (locked peso savings) could potentially run towards the dollar as soon as dollar restrictions are lifted and exchange rates unified.

V-Shape Recovery?

After the current recession, the goal is to reach a V-shaped recover after the second half of this year.

As mentioned in depth in The Return of the Jaguar, there are less pesos available in the economy and many Argentines are forced to sell dollar savings after the price increases seen in Q1 of this year.

As there is more supply of dollars, the dollar value decreases versus the peso — even despite the BCRA still printing them to buy dollar reserves. Terra/Luna UST vibes intensify.

If business owners have to pay for current expenses by burning through their dollar savings, those dollars will not be used to invest and increase their production capacity that would contribute to a v-shaped recovery.

This dynamic cannot hold for much longer and it is key to reverse this dynamic sooner rather than later. Economic activity in the real economy keeps slowing down, which means less tax collection, depleted savings and increased social tensions.

There will come a point where dollar savings to sell run out, and the trend reverses, which will probably be in June/July of this year, perhaps even sooner depending on when dollar limits get lifted officially.

Final Thoughts

As you can see, nothing is ever easy in Argentina. For now, inflation is dropping mainly due to a slowdown in the economy and taking liquidity out of the market (more about that here), and spirits are still high.

But even though it looks, walks and talks like an angel, it will be the devil in disguise if the debt dynamic doesn’t change that is currently at the backbone of the BCRA reserve accumulation — with interest. This means Argentina is still very far removed from closing the Central Bank.

With this backdrop in mind, lifting dollar restrictions later this year has the potential to cause another run on the dollar, which is becoming more likely. Looks like the peso installments for my apartment will eventually work out fine after all; timing is everything.

Since this rodent is grounded in reality — despite being an anonymous cartoon character —, I have decided to sell 75% of my Argentina sovereign bonds position.

I started accumulating around 23 cents on the dollar in Apr-June last year, and a 2x+ now at close to 50 cents it has been a great trade. Not exactly Bitcoin, but still a good return.

See you in the Jungle, anon!