Davos DDOS & Short-Term Argentina Outlook

Milei's Davos DDOS speech, the upcoming challenges for Argentina’s economy & more

Welcome Avatar! Unless you’ve been living under a rock, you’ve probably seen some news around Javier Milei’s intervention speech at Davos this week. Today we’ll dive into the speech, the upcoming challenges for Argentina’s economy, dollarizing, deregulation and more.

Davos DDOS

Most of you have probably seen or heard the speech by now, but if you haven’t you can listen to it in English simultaneous translation, English AI dubbed or original Spanish without voiceover.

Milei has once been a speaker at the WEF in Davos before in 2014, and was not invited again after that. As a head of state it was harder to refuse him giving another speech, since most heads of state are in Davos to discuss trade, commerce and of course the woke 2030 agenda items.

Milei’s speech in Davos marks a pivotal moment. He warns that Western values are under threat, leading us towards socialism and poverty.

Basically he warns against the WEF and other multilateral organizations like it, which tend to favor collectivism over the rights and wellbeing of the individual.

His words reminded of Hayek’s warning against the inevitable dangers of collectivism, which we have all seen increase in the first quarter of this century, starting with the “for everyone’s safety” TEA measures after 9/11, and turned into overdrive with the pandemic (and now “climate change”):

“Once you admit that the individual is merely a means to serve the ends of the higher entity called society or the nation, most of those features of totalitarian regimes which horrify us follow of necessity.

From the collectivist standpoint intolerance and brutal suppression of dissent, the complete disregard of the life and happiness of the individual, are essential and unavoidable consequences of this basic premise, and the collectivist can admit this and at the same time claim that his system is superior to one in which the "selfish" interests of the individual are allowed to obstruct the full realisation of the ends the community pursues.”

― Friedrich Hayek, The Road to Serfdom

It could be a turning point after decades of increased collectivism, which in my opinion saw a peak during the pandemic and correspondent lockdowns.

Autist note: Milei’s speech had some golden nuggets fit for quotes / memes, so I’ve included the full speech in the PDF below. Thanks to FutureTeslaNow who compiled the speech. You can also read the original Spanish text here.

This is why it’s essential that Milei’s presidency is successful in Argentina, because if not, it would be a poster child for “failed neoliberal policies”, as Marxists like to call normal capitalism nowadays.

Reforms

Even if 1/10 of the reforms of Milei’s administration stick, it would make Argentina a vastly more open country compared to the walled Paris of South America the financial center of Buenos Aires is today in terms of trade and finance.

The government has called for Extraordinary Sessions to treat the Omnibus Law, and this is currently being discussed, much to the chagrin of the opposition who prefer to be on the beach during recess in January.

The deregulation decree is still in force, but several protective actions were filed by different organizations who saw their livelihood threatened.

Probably the most important to note is the temporary block in the labor reforms as a consequence, which basically means unions will still get their 3% of GDP in healthcare deductions on salaries, whether the employee wants this or not.

As you can see, this has nothing to do with “protecting the rights of workers”, and everything with unions not losing their golden goose handed to them during the Onganía dicatorship in 1970.

Most other parts of the deregulation decree are in place and active, such as the Open Skies policy and the end of the Rental Law.

Autist note: you can read all about the details around the proposed changes and deregulations proposals in this article:

These kind of blocks will continue, but it will be very hard to keep them in place forever in my opinion.

Inflation

The ghost of inflation that keeps haunting Argentina is a sticky one, and very hard to get rid of after the campaign spending frenzy by the previous administration, which was printing an additional monetary base each 1.5 months when they handed the time bomb over to Milei.

There were two things the new government had to do almost directly: solve the spread between the official and blue dollar rates as much as possible (devaluing the peso), and try to disarm the peso bonds that in interest alone were spitting out monetary bases like candy.

Autist note: read more about the challenges the Milei government faces after the handover, which represents one of the biggest crises in Argentine history:

The biggest problem of the peso debt bomb in the form of LELIQs (bonds) was disarmed on January 11th. These were simply not renewed, but banks now hold Pases (REPOs), which still have high interest that increases the money supply.

On day 2 of Milei’s presidency, Minister of Economy Luis Caputo devalued the official rate by 54% and installed a crawling peg, which will devalue the peso at an additional -2% per month. These measures gave some breathing room to exporters who could now almost double the return on their exports, despite export tariffs remaining equal.

In the same month of December, the Central Bank (BCRA) completely stopped issuance to finance the fiscal deficit in December (the main source of issuance was the purchase of reserves).

The public sector did not receive temporary advances or transfer of profits from the BCRA last month and even negatively influenced the expansion of the monetary base:

But of course, none of these measures could stop the train wreck that was already in motion, and MoM inflation in December was 25.5%, which closed 2023 at 211.4%, the highest values in 3 decades.

Wholesale inflation shot up to 54% in December and exceeded the worst expectations. The sharp variation in the Domestic Wholesale Price Index (IPIM) was a consequence of the 51.1% rise in "Domestic Products" and 80.6% in "Imported Products."

As Milton Freedman explains in these two minutes, inflation has a delayed reaction and it can take a long time to get rid of it. During the previous hyperinflation in Argentina in 1989, it took the new government 18 months to fully get rid of it. Therefore we will most likely see more inflation in Q1 2024, peaking somewhere around April/May, before starting a sharp decline.

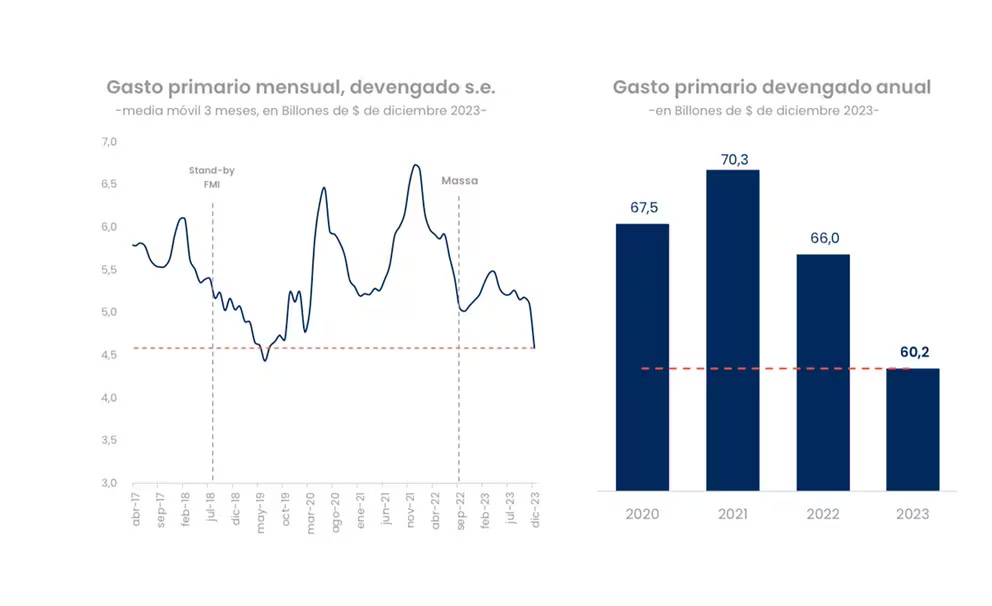

There is also good news however: according to an official report, real government spending decreased by 31% in December compared to November, and 33.8% in YoY terms:

Dollarization & Closing the BCRA

So, what’s up with dollarizing the economy? This was one of Milei’s campaign promises, and it was always meant to be a long term plan.

Inflation is one of Argentina’s main historic problems, caused by chronic fiscal deficit paid for by printing additional pesos. Getting rid of the drugs will eventually cure the junkie, is Milei’s stance.

The thing is that this is easier said than done, especially since the BCRA still comes up short in terms of dollars needed to dollarize — no one came up with an exact number, but estimates are that about $60 billion USD would be needed, and if no creditor wants to lend that amount to Argentina, getting there by accumulating reserves will be an herculean task.

First, Argentina has to combine rates. There are still multiple dollar exchange rates, and the spread between the blue rate and the official rate is widening again (from a low point of 17% right after Caputo’s latest official devaluation, to 47% now, with an official dollar rate of $807 vs a blue rate of $1,190).

From the World Economic Forum in Davos, Caputo when asked about inflation and if he was worried, to which the Minister replied that "In no way can we make a forecast about it, because then one is trapped. We hope that things improve by the end of the year."

The Minister also said that the first goal of the government is to stabilize the economy and then deal with the Central Bank. The minister clarified that the context is not ideal to carry out the dollarization Milei promoted during the campaign and concluded that "there is no rush."

The current priority according to Caputo, is to stabilize the economy.

Autist note: in this Milkshakes Markets Madness podcast from the man of the Dollar Milkshake Theory himself, Brent Johnson, we go over the potential scenarios under Milei and what it means for Argentina that he was elected:

IMF

The Government formalized an agreement with the IMF to resume the disbursement schedule that had been suspended due to non-compliance with goals during the previous Government:

IMF staff and the Argentine authorities have reached staff-level agreement on the seventh review under Argentina’s EFF arrangement. Subject to approval by the IMF Executive Board, Argentina would have access to about US$ 4.7 billion.

It’s important to understand that this is not new debt that Milei is taking on, but still part of the $50 billion IMF loan granted to the Macri administration.

President Javier Milei and his economic team held a meeting at Davos with the managing director of the IMF, Kristalina Georgieva, where they ratified the direction of the management to convince the organization's Board to approve the agreement reached to obtain the 4.7 billion dollars.

Georgieva was hopping on the Milei duckface photo bandwagon (see video here), and posted this on X shortly after:

Very good meeting with Argentina's President Javier Milei @JMilei . We talked about Argentina's deep economic & social challenges and decisive steps underway to bring down inflation, promote private sector led growth, and use scarce public money to help the most vulnerable people.

The $4.7bn still has to be reviewed by its board, which will take several weeks. Without these additional crispy Benjies coming in, it is almost a given that Argentina will default again.

YPF Kicillof Heritage

On January 10, the $16 billion US token from the Burford YPF nationalization case, was due. Of course, this money was nowhere to be found and Argentina has not paid a dime yet, so embargo requests could begin.

The Government had asked to extend the January 10 deadline to present guarantees, but Judge Preska denied it.

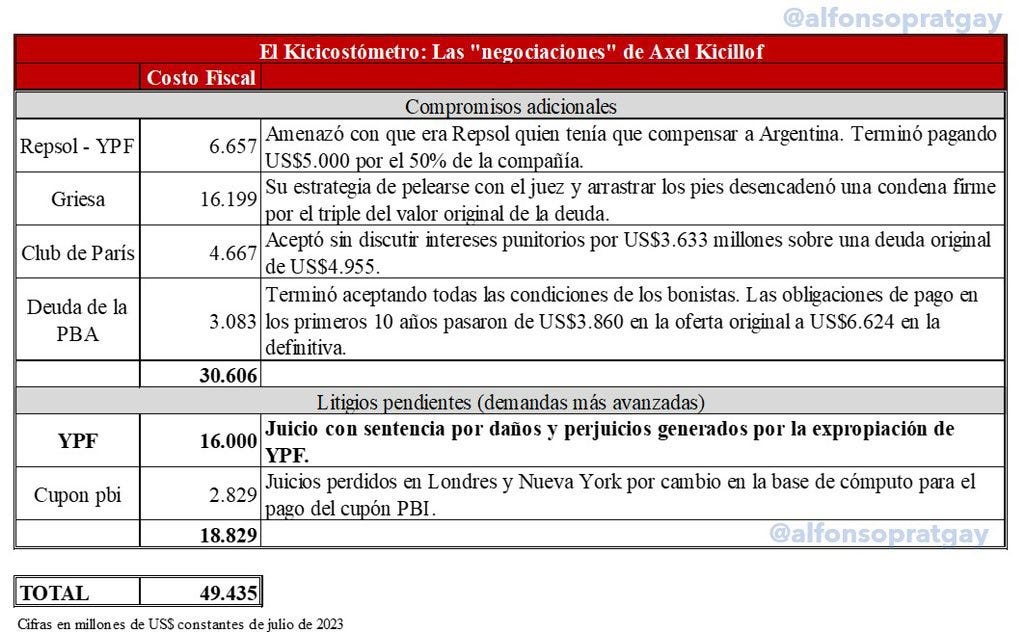

Milei came up with a “Kicillof Tax” (after the Minister of Economy responsible for the nationalization) in order to pay for it, but so far this has not materialized.

Autist note: read more on the absolutely crazy corruption story around YPF (and how politicians involved in the nationalization are also filling their pockets with the Burford case against the Argentine state):

Following the ruling, Burford can now claim asset seizure, a process that could take its time but that Argentina is certainly familiar with — see a previous case of a navy ship that was embargoed by hedge funds.

Any seizure of State assets that may occur from today will not be placed as collateral but will be the property of the beneficiaries of the ruling who will take them as a form of payment for the $16.1 billion.

Some people speculate that besides sending the message of “No Hay Plata” (there’s no cash), Milei might be taking commercial flights internationally to avoid seizure of the presidential plane — which the government is considering to put up for sale.

The impact of the YPF case will depend on when the period of seizure of assets on the State begins. This can last months or years, unless the litigant finds a seizable asset outside Argentina that do not require the approval of Congress (as would be the case with YPF shares) or local justice (as in the case of oil royalties and Aerolíneas Argentinas planes).

In the case of YPF, Burford already has documents ready to begin the execution of the ruling, but it is not yet clear when they will begin. It is more likely that Burford tries to bring Argentina to the negotiating table.

This also means that Milei could’ve taken the presidential plane to Davos, but decided not to out of principle.

Meanwhile a new criminal complaint was filed against the former president Cristina Fernández de Kirchner and her minister of economy Axel Kicillof, who has cost Argentina dearly.

Social Context

So far, there haven’t been mass riots or protests. Some neighborhood cacerolazos here and there, and mainly confined to certain middle class neighborhoods in Buenos Aires.

However, some vocal opponents have called for a violent destitution of Milei in the streets, and on January 24th the CGT (Unions) will organize the fastest general strike in the history of Argentina’s democracy since 1983.

These unions don’t go on strike to defend workers: they go on strike to defend their interests and elite privileges that Milei is taking away.

The last 4 years under Alberto Fernández these phantoms were nowhere to be seen since they had their interests protected.

We’ll have to see how things evolve, but my estimate is that these kind of protests will only heat up further during Milei’s administration.

Quasi-currencies make a comeback!

One final noteworthy mention is that the quasi-currencies we wrote about in 2001: Coinmarketcap in real life, are making a comeback in different provinces, since the Milei government is not handing out candy like before and wants provinces to be self-sustainable.

Provinces like the Buenos Aires province under governor Kicillof are exploring issuing a local provincial currency, and La Rioja will already advance with its provincial currency project:

The Legislature of La Rioja approved an official project that creates a Debt Cancellation Bonus (Bocade) that will bear the name “El Chacho” in honor of the leader Ángel Vicente Peñaloza and that Governor Ricardo Quintela justified as a measure his administration was “forced to take” by “the cruelty of the austerity” applied by the national government.

A consequence of issuing these provincial bonds in the form of currencies, is that provincial finances will deteriorate due to the impact of the decrease in national tax collection and a decrease in revenues.

Milei already indicated that provinces are more than welcome to issue their own currencies: “may the best one win”. He also stated that this time, there would be no rescue from the state when these currencies fail, not if.

As you can see, never a dull moment in Argentina with regards to currencies and inflation.

See you in the Jungle, anon!