The Promised Land in 2025

Are we in for a melt up?

Welcome Avatar! President Milei presented his 2025 budget in front of Congress last week, where his vow for zero deficit stood out as one of the main points. How is Argentina doing in terms of reserve accumulation, foreign investment and more? Let’s dig in.

One of the main worries of any administration in Argentina is the amount of dollars in the banking system and on the BCRA’s balance sheet.

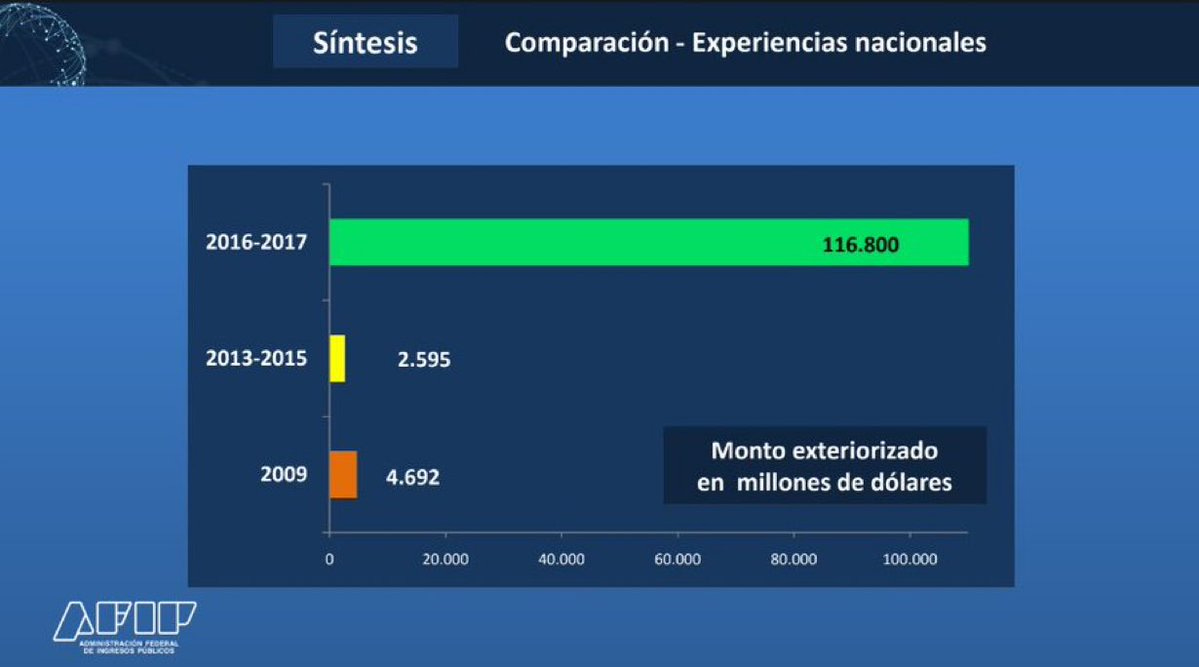

Argentines are estimated to have a whopping $400 billion (about 15 BRCAs, lol) outside of the banking system, and each government tries to get its hands on some of those undeclared funds by creating a tax amnesty. So did Milei’s administration, with very lenient terms.

We still have to see how much of those undeclared Benjamins will find their way into the Argentine banking system, but so far it is looking promising.

Estimates suggest that up to $40 billion dollars could enter the Argentine banking system — roughly 10% of undeclared funds.

Private deposits in foreign currency have grown by more than $5 billion since Milei took office, at their highest level since January 2020. In terms of reserves, they contributed more than USD 2 billion to the Central Bank's assets.

The BCRA has accumulated net purchases in the foreign exchange market for USD 17.5 billion since the Milei government started last year.

But it retained just over a third of this figure, mainly due to sovereign debt payments: international reserves improved by $6.25 billion USD or 29.5%, from $21.2 billion on December 7, 2023.

Of those $6.25 billion, 33.4% corresponded to the contribution of private deposit reserves.

Mortgage Market

The potential knock-on effects of the blanqueo on the mortgage market should not be understated.

For example, in order to access a mortgage of $200,000 USD, a borrower needs to have 25% in cash, the equivalent of $50,000. Many of the potential borrowers already have the 25% cash they need for the bank to lend them the money, but they have no way of justifying those funds.

It is very likely that they will enter the blanqueo to take out a mortgage loan right after.

This phenomenon really pick up starting in October, when those dollars can be withdrawn from the bank (the deposits need to stay in the bank until the end of September). The current stable dollar rate is also beneficial, since it allows the debt to be liquefied in the event of a potential devaluation.

As history shows, shorting the peso like this is almost always a good bet.

The month of August already showed a significant jump in mortgage transactions: more than 400 deeds were recorded, which, despite the relatively low number, is a 300% increase in just two months.

Energy Exports, RIGI and Investments

In 2022, Argentina had an energy deficit of US$ 4.4 billion. But in 2024, an equivalent surplus of US$ 4 billion is expected.

Oil exports grew by 30% and Vaca Muerta gas production replaced imports. Infrastructure is still lacking to allow foreign sales to take off but Argentina is slowly getting its ducks in a row.

In August, the energy trade balance registered a surplus of 313 million dollars, which accumulates $3.1 billion in the first 8 months of the year.

Last month, exports also increased by 8.9% while imports decreased by -29.4%.

This is a trend that will continue, and the energy and mining sectors are already turning out to be the big winners in the time Milei has been in office.

This trend was already visible in early 2023 when the previous government was still in office, but the current administration has made investments in the sector less cumbersome and the energy trade less burdensome thanks to the hydrocarbon chapter in the Omnibus Law Ley de Bases.

Autist note: you can find an overview of Argentina’s energy landscape and the individual chapters of the Ley de Bases here:

This energy narrative shift is catching on internationally, with Doomberg publishing his excellent Dead Cow piece specifically about Milei’s energy policies and stimulus for the sector.

This brings us the RIGI investment scheme, which we have wrote about before in RIGI: Will it Start Raining Benjamins?:

The RIGI establishes “incentives, certainty, legal certainty and an efficient system of protection of acquired rights” for “holders of a single project” of investments that exceed US$200 million.

So far, even though foreign investment during Milei’s term so far is still lower compared to the average in previous years, RIGI investments for projects over $200 million have started to pick up.

Each province in Argentina has to adhere on an individual basis in order to allow RIGI investments to be made in its territory, and more than half of the provinces in the country have already done so.

One of the outliers is the province of Buenos Aires, where opposing governor Axel Kicillof — yes, the same guy responsible for the YPF expropriation that will end up costing Argentina over $16 billion USD — decided to create his own type of RIGI scheme without the 30 year tax incentives and fixed investment outlook provided in Milei’s version.

We have already seen how that is working out for governor Kicillof, with companies like YPF deciding not to invest in Buenos Aires but just at the border of in a neighboring province, and some cities within the province province of Buenos Aires like Bahía Blanca adhering to the RIGI scheme independently, to try to break free from the governor’s apparent aversion to capital.

Competition is a beautiful thing.

IMF

In Washington, there is a consensus that there will be US financing for Argentina. The big question is how, when and how much.

So far, the Milei government has far exceeded the terms set by the IMF, and when compared to the previous government it is quite striking to see the difference in objectives and reality:

Javier Milei's administration negotiated new goals with the IMF and in the first quarter of 2024 it met all the established parameters, but in the second quarter it would not be able to meet the accumulation of net reserves, according to estimates by consulting firms.

Last week, president Milei presented his 2025 budget bill, with fiscal stability being the main anchor. His 2025 Budget promotes a new fiscal rule according to which expenses must be adjusted based on achieving a surplus. For 2025, Javier Milei's administration foresees a primary surplus of 1.3% and a balanced financial result.

If Argentina has a program that makes sense and the IMF agrees, a crucial part of the program is to gradually remove current restrictions like the cepo currency restrictions by having a floating exchange rate and no cap on foreign exchange purchases.

Removing these restrictions will allow investment to increase, but in order to be able to lift restrictions, Argentina will need more reserves and disbursements.

If the IMF is convinced of Milei’s program, it could go ahead with disbursements, to allow Argentina to accumulate reserves faster, remove the restrictions and generate this virtuous circle.

Autist note: Argentina has been on these crossroads before. Read more about the potential dangers for Argentina of keeping a crawling peg and a fixed exchange rate for too long here:

However, there is also another possible scenario: If the Government puts together a program that does not full convince the IMF, or that the IMF only partially agrees with, it is unlikely that the Milei admin will see a new inflow of capital from Washington.

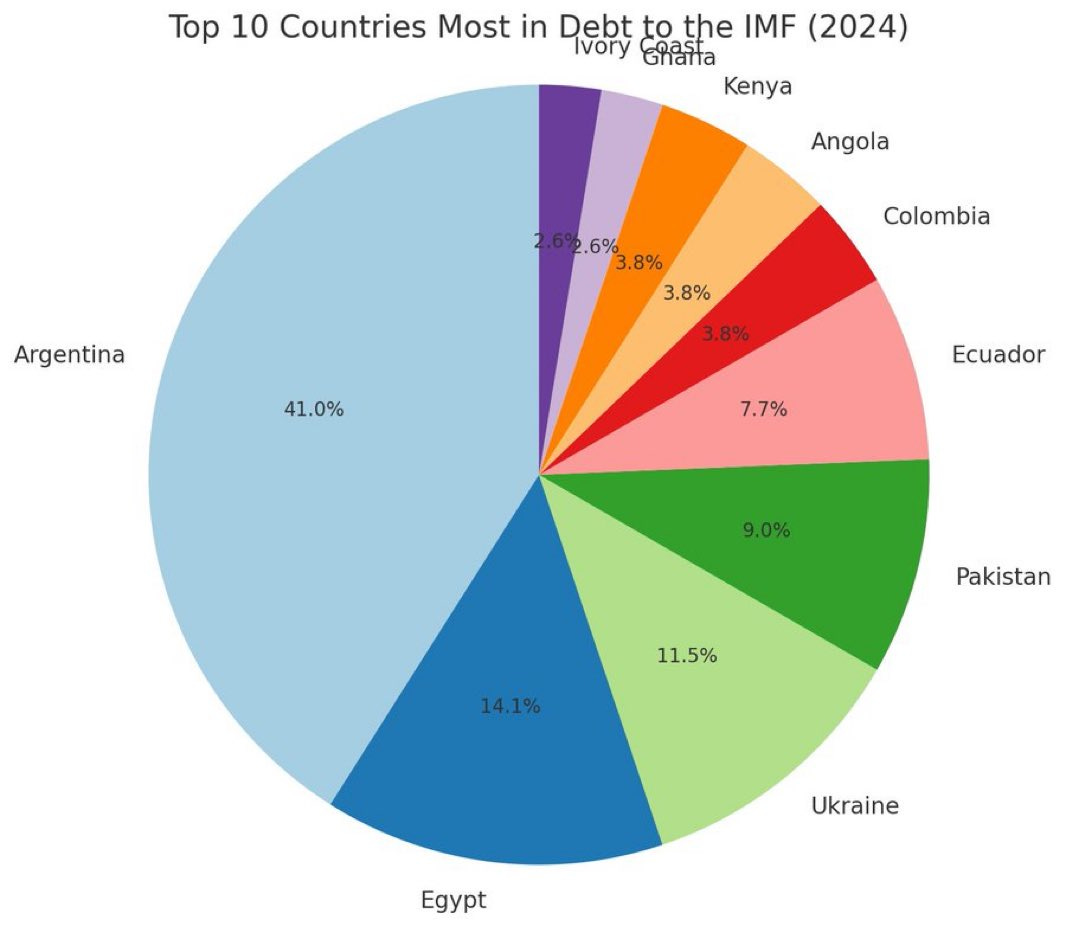

So far, the IMF has been applauding Milei’s fiscal progress, without making any promises. In a way this is understandable, since Argentina basically owns the IMF in terms of SDRs allocated per country:

Last month the organization maintained that if the government doesn’t devalue the peso, there would be no new loans, and Milei has said time and time again that another devaluation is not in the cards.

Final Thoughts

Is Argentina in the clear? No. Things are definitely moving into the right direction, but there is still no clear timeline for taking off the cepo currency restrictions.

Analysts are focusing on the Central Bank's ability to add reserves, given that this sensitive variable has not taken off in the last three months.

The BCRA foreign reserves are essential to achieve two crucial objectives for Argentina: lifting exchange rate restrictions and the return to voluntary debt markets. These two pillars could become the platform for the take-off of economic activity in 2025 after 13 years of stagnation.

At the same time, Argentina faces a tower of maturities next year that will be hard to pay without new IMF financing or another default.

The approval of Milei’s 2025 budget plan in Congress would be great news, it would reflect that the political class can agree on a budget with zero deficit. Without approval, it is only Milei's commitment.

As usual, nothing is a given in Argentina, but at least now we’re at a stage where being cautiously optimistic is no longer something to be ashamed of.

See you in the Jungle, anon!

Other ways to get in touch:

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Nostr: increasing my posts here, my npub: npub1sngpxenyrddqvnusf02fls8yl0ja3s373md9lmfkej2l0h6saz6qvglthh

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

I'm terrified for Argentina. I'm incredibly excited about this radical and almost unbelievable political development. I'm in my seventh decade so I'm rather cynical and have few positive expectations economically and politically. But Milei is doing the impossible! If he can somehow pull this off against all odds, he will be a major historical figure. Dammit!

Great article Mara, am I following this correctly.

IMF debt payments due:

2024: $4.6 billion

2025: $18 billion

Current BCRA reserves: ~$27 billion.