The Return of the Jaguar

Reasons for the Argentine peso gaining against the dollar and short-term outlook

Welcome Avatar! You might have noticed that Argentina is quickly becoming more expensive. Soon enough it will drop off the top spot in NomadList as digital tightwads will not be able to afford to geo-arbitrage in the land of silver linings. The monetary experiment currently unfolding in Argentina is a unique first at this speed, so let’s dig into the reasons for this quick appreciation of the peso and what will likely happen in the upcoming months.

Much against all expectations, futures and analysts, instead of moving towards the $2,000 pesos per dollar mark, the blue rate (black market rate) started moving lower and lower, from its peak at $1,300+ pesos to $940 at the time of writing.

MoM inflation is decreasing, but still very high: from 25% in December, to 20% in January to an estimated 15% in February (official numbers still have to come out). Yearly inflation for 2024 will likely end up in the 200% range.

Needless to say that with monthly inflation still averaging at 15%, and frozen salaries in pesos, this makes life in Argentina suddenly VERY expensive for locals, even though a peso would buy them more goods and services outside of Argentina. For people earning in foreign currency, local prices have roughly 2x’d in dollar terms since December last year.

Peso Strengthening: WTF?

Anybody who has ever visited Argentina or has lived there for long enough knows: never bet on the peso. This has been true for the better part of a century, with multiple local currencies nuking to zero against the dollar in Argentina.

Why would this time be different? It might not on a long term horizon, but on the short to medium term, it definitely is and the peso will continue to strengthen. But why?

What feels like a last scam wick downwards to push higher after, like the peso has done so many times before, is actually a deliberate result of Milei’s monetary and fiscal policy.

On the demand side, the government is liquefying the fixed terms peso savings (plazo fijos) by offering a negative interest rate on locked pesos compared to current inflation levels. This is causing the amount of plazos fijos savings in the private sector to plummet in real terms:

Normally, this would mean these pesos now move to the dollar, and the dollar goes up. But keep in mind that most goods and services that are fixed costs for many consumers did a 2x or more in dollar terms since December: service bills, private schools, health insurance, etc.

The only thing that is relatively cheaper is long term peso rentals which are now mainly priced in dollars after Milei deregulated the rental market.

The increase in cost of living in real dollar terms is also reflected in private deposits held at the bank (left), together with a sharp decrease in the private sector M2 & M3 money supply and savings (right) — it clearly shows the decrease in monetary aggregates so that there is less money (pesos) in the overall economy:

What does this eventually mean? That there are less pesos to flee to safety by buying dollars: Argentines now have less money to save and buy dollars, so there is no demand for dollars and the dollar rate does not increase.

In terms of currency in circulation there is a very sharp drop as well. The graphs below show the amount of money in nominal (blue) and real (green) terms plummeting in real terms adjusted for inflation.

Where the initial currency restrictions were put in place at the end of Macri’s term in 2019, there were 100 pesos on the street, whereas today there are just 40:

Part of the plan is for the economic activity levels to collapse, with the promise of a V-shaped recovery later. This causes individuals and SMEs to spit out dollars to sustain their costs of living which have drastically increased, propping up the demand for pesos which are currently scarcer than before.

The peso blender is creating a smoothy out of dollar savings, and one of the short term goals of the Milei administration is to slow down economic activity, so that rates can be combined and restrictions lifted.

1 Jaguar = 1 US Token, for Realz?

Granted, the headline for this article is a bit clickbaity, insinuating that the blue rate could drop to $500 which will not happen. However, the direction is definitely headed towards the jaguar.

The strategy of the Milei administration is two fold: 1) Keep the 2% devaluation crawling peg per month for the official rate and 2) Make sure there’s not enough pesos to go round to buy dollars so the blue rate keeps dropping lower.

The end goal? Have these two rates converge as quickly as virtually possible, probably in the $900-950 range.

Right now the official rate is at $865, so with the crawling peg it will be closer to the $900-950 range within 2-3 months so the Milei administration can combine rates and lift forex restrictions if this all works out as planned.

If the blue rate drops faster, which it does look like now that it’s moving towards the $940 range, rate unification could happen even sooner than that.

Salaries

Meanwhile, salaries are getting crushed, because despite the peso strengthening, most salaries haven’t caught up with inflation since the start of the year.

In January this year, the average remuneration subject to contributions to the Argentine Integrated Pension System (also called the RIPTE rate) increased 14.7% MoM, which implies a drop of 22.2% YoY in real terms, and a drop of 5% monthly.

For the two-month period of December to January, salaries’ purchasing power dropped -18% in real terms. In constant currency, what this means is that salaries are returning to May 2005 levels.

This is the largest real YoY drop since March 2003, which was right after Argentina had lost the 1:1 peso/dollar peg and the peso was devalued to 3 pesos per dollar.

Now, even though on paper the peso is worth more after appreciating against the dollar, the dynamics of sustained inflation and evaporating purchasing power like this will not sit well with the majority of the population, even if people understand the need of cleaning house after decades of helicopter money raining down on a large portion of the population in the form of subsidies and public employment.

Fortunately, Argentina has a large black economy, which is what has maintained the levels of activity and employment until now to a certain extent.

But the collapse in the amount of money in the very short term is already generating a strong recession. In other words: time is running out.

What Happens Next?

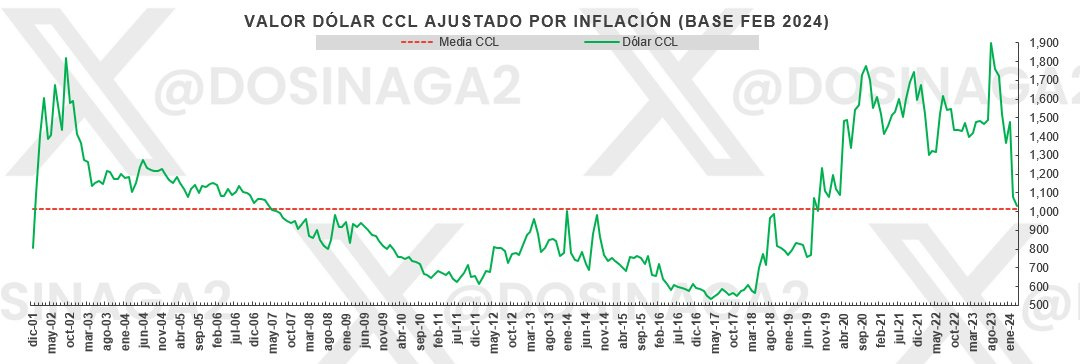

Once restrictions on forex are lifted and CCL, MEP, Blue and Official dollar rates are more or less unified into a single floating exchange rate, we will likely start seeing some more moves to the upside in terms of peso devaluation.

This is what happened when Egypt eliminated currency controls this week: the official EGP 0.00%↑ rate jumped from $31 to $50 — a 38% weakening of the currency in a few hours. Egypt also has a black market rate, which was trading in the $52 zone.

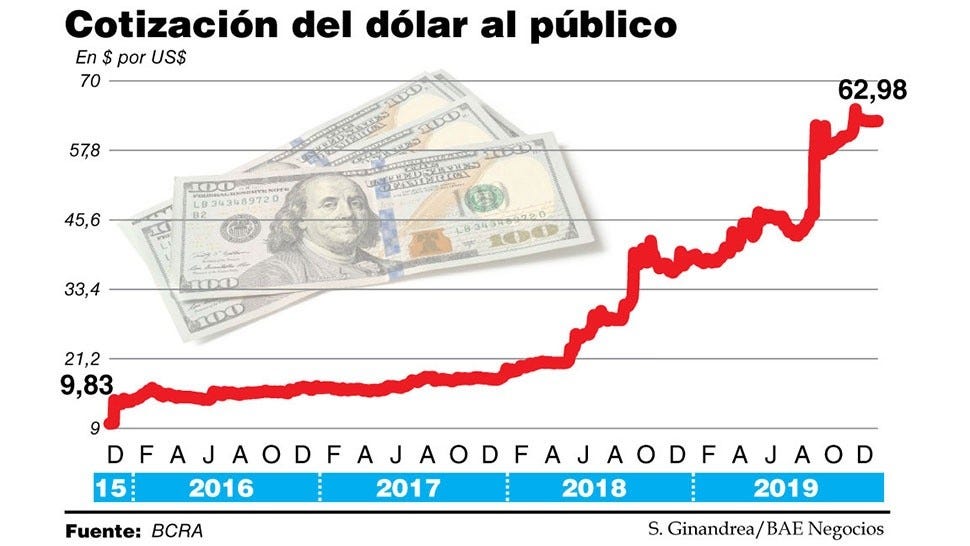

When Macri lifted restrictions at the start of his presidency in 2015, the sequence looked like this:

That first jump is not so noticeable on the chart, but it is a similar devaluation to the one above in Egypt’s case, since the black market rate was at $16 while the official rate was closer to $10.

After that initial drop it took until 2018 for the dollar to really start its run again against the peso, when Macri had to take out an emergency loan at the IMF and it became clear that nothing was really going to change under his administration due to its gradualist approach funded with the peso printer.

Macri’s administration started the LELIQ/Peso debt bomb that ran out of control under Alberto Fernández’s administration, and it is ironic that Caputo is now basically unwinding what he started under Macri when he was also Minister of Economy.

Compared to Macri’s opening up and free floating the peso, the dynamics are different now with Milei’s shock therapy.

A lot will depend on the patience of the population to keep up with it until rates are combined and restrictions lifted.

If the administration is able to pull it off come June/July this year, the recovery will be quick and the starting base will be a lot more healthy fiscally and monetarily compared to Macri’s.

The fact that the Caputo/Milei team is moving the rates closer together before opening up comes with a (hopefully short-lived) recession and a V-shaped recovery after that.

Final Thoughts

Timing the market is hard, and timing a market like Argentina’s is close to impossible.

That said, my current expectation is that this dynamic of peso appreciation versus the dollar will continue, while inflation will probably remain high until Q3-Q4 of this year — around then Argentina should be back at single digit MoM inflation.

A recession is a given at this point (estimates range from -3.5% to -5% for 2024), and activity will slow down even more.

This is a game of attrition and the reason the Milei government is moving so fast with these monetary adjustments is to make it quick and painful, in order to get out ahead more quickly after unifying exchange rates and lifting forex restrictions.

The million peso question is what will wear out first: the consumer and businesses, or the fiscal and monetary adjustments without the need for a new devaluation until rates can be combined?

History has taught us that as soon as the middle class in Argentina has to swap dollar savings to sustain its cost of living in pesos, patience will run thin very fast, and social tensions will rise quickly.

I expect massive volatility once dollar restrictions are lifted, and a slow drag until then with potential social unrest.

Even though this rodent doesn’t have a crystal ball, one thing is certain: 2024 will see considerably less digital nomads in Buenos Aires to steak-flex on the Gram.

See you in the Jungle, anon!

Are you saying that once the rates unify, you expect the peso to resume its devaluation vs the $?

Interesting.

I would like to see you write about why ARG won't simply dollarize to USD. Mr Steve Hanke says it would be fast & effective? Have you read his plan? Nice to see a pros/cons, analysis.