Trends in Buenos Aires Real Estate

A deep dive into latest prices and STRs in the city and neighborhoods of Buenos Aires

Welcome Avatar! The near future for Argentina seems to promise a much more market friendly environment, and it is not surprising to see more movement in real estate in the Ciudad de la Furia. Some of the latest trends in prices per neighborhood, STRs and Airbnb property management.

Overview

The average sales price for a studio apartment (monoambiente) in Buenos Aires is now is just $96,162, and in popular neighborhoods like Palermo and Recoleta you will see this closer to or over $100k.

On average, a two-room apartment of 50m2 is closer to $115k USD while the average 3-room, 70m2 apartment costs 159k USD.

Neighborhoods

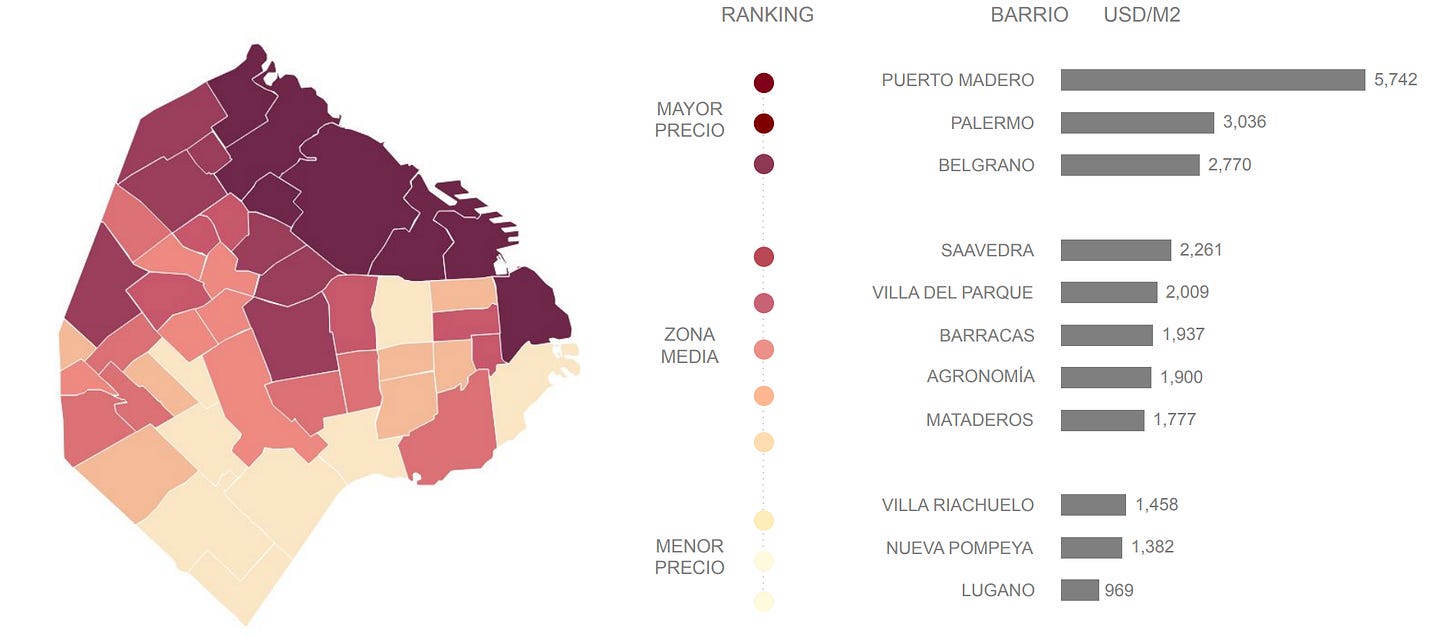

When looking at the neigborhood heatmap for average price/m2, Puerto Madero always sticks out, together with the usual suspects of Palermo, Belgrano (and Recoleta). Everything in the northern corridor of the city is closer to $3,000/m2:

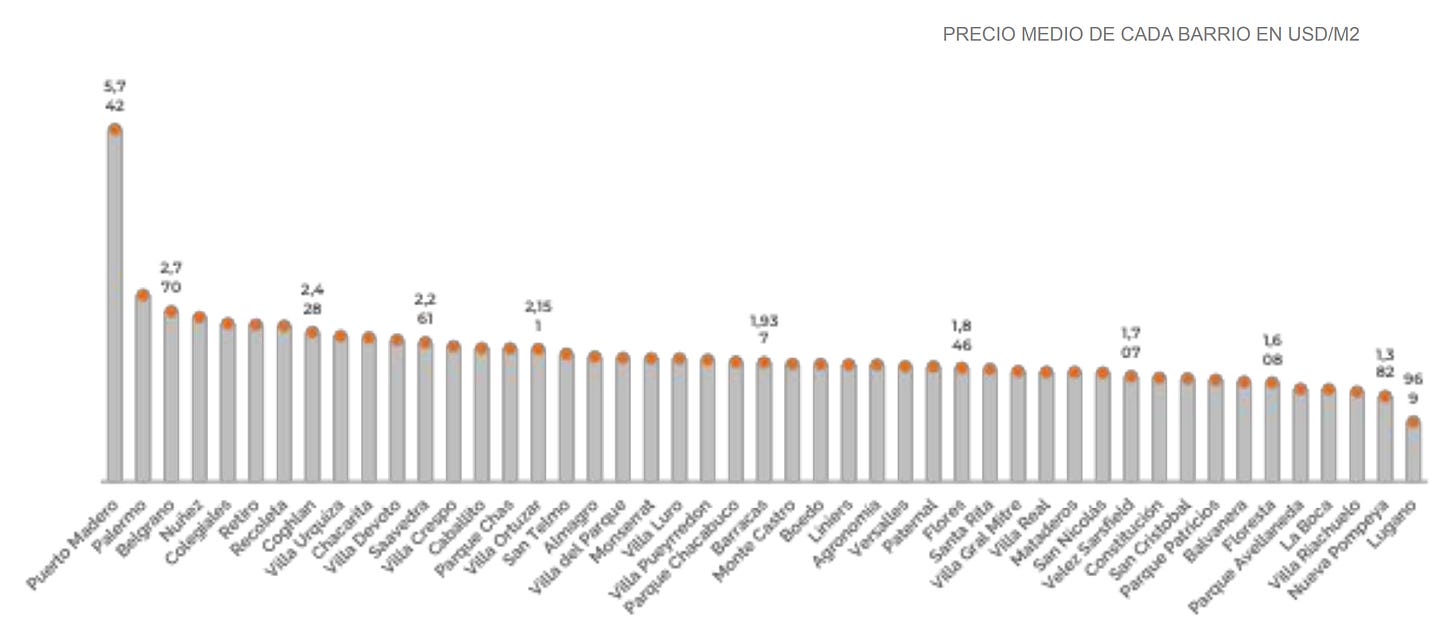

For the detailed prices per m2 per neighborhood, the bars look like this:

Anything around $2,000/m2 can still be in a very nice neighborhood and priced well below Palermo levels, while being relatively close — see Villa Crespo, Chacarita, Almagro. Caballito is very nice and residential but too far away and badly connected to turn it into an STR. If you are looking for a residential property to live in, that is also a good option.

About 30% of neighborhoods show a positive price development, again: almost all in that northern corridor, with a few exceptions.

The average price/m2 keeps hovering around $2,200/m2, and it is not likely to increase very much soon, except for some neighborhoods that are quickly gentrifying:

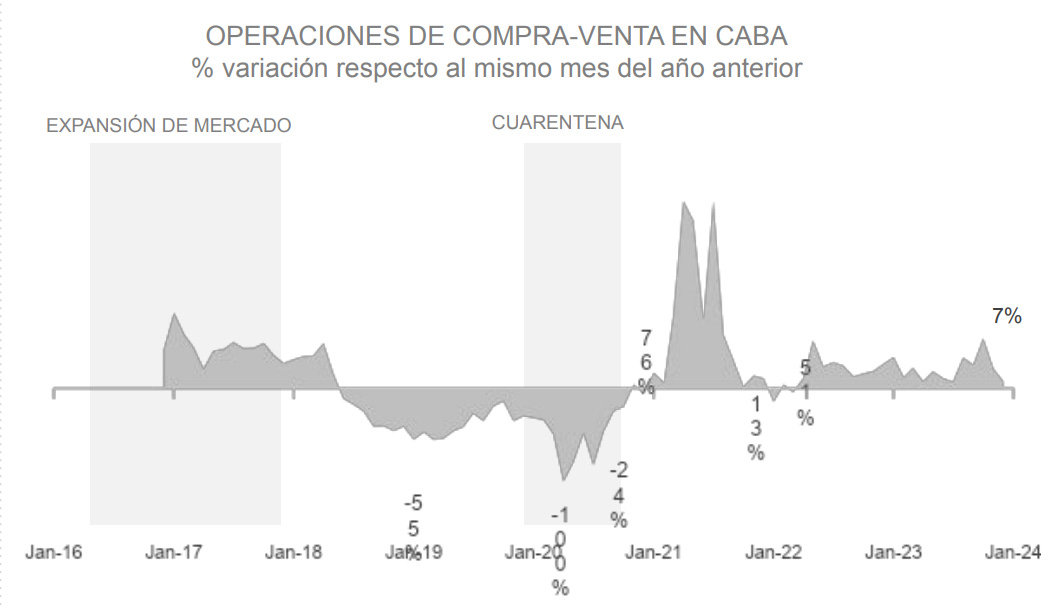

Looking at sales, we can definitely see a positive trend in the last 2 years (although that first peak in 2021 is mainly due to the lack of deeds signed during covid):

So now volume is genuinely picking up, although it will take some time to get back to the 2017-18 levels.

New Construction

Construction never stops in the city of Buenos Aires, and it is interesting to see that despite the 56% devaluation during the first month of the Milei government, construction costs in dollars have gone down:

This is positive for all the new developments and makes it more interesting to invest in a pozo or new development.

Read more about pozo developments here:

Airbnb / STR Returns in Buenos Aires

Currently the returns for longer term rentals in pesos is around 5%, while returns for an actively managed Airbnb with shorter stays are closer to the 8-10% mark.

There are many management companies around, who will usually take a 20% management fee to take care of everything: cleaning, bookings, keys etc.

Very convenient and definitely something you do not want to deal with if you value your time. I did for a while but a Patagonian rodent just isn’t made for cleaning apartments and the back & forths between guests.

All in all it was very time consuming, leading me to steer towards only offering longer stays of 15+ nights, which definitely lowered returns.

After some research my STRs are now with a management company, and they actively adjust prices according to supply and demand, focusing on short stays of 1 or 2 nights so returns are higher. So far it is working out great, they include a return dashboard that allows the owner to book nights for personal use, see reservations and returns:

Great thing is that the Owner Revenue above is all paid out offshore, which is an additional plus. No more hassle with cash etc, and it’s dollarized instantly.

Another company I am looking into is AiresBnB, from X follower Sovereign Horizon, which offers 18% management fee and an additional package for furniture leases etc, which will be interesting if you buy a new property and still need to furnish everything and don’t want to deal with that headache.

Autist note: you can find some additional articles below that shed some more light on Argentina’s real estate market:

Conclusion

Overall, there is positive price movements in Buenos Aires, and sales volume is picking up. It will take a while before prices really start going up.

Volume is still too low, and unless local salaries improve, that will probably stay this way for a while.

This does mean that if you have the funds available and you plan on buying real estate in Buenos Aires anyways, now is a great time to start making that dream a reality.

See you in the Jungle, anon!

Thank u for all u offer.

Can u point me towards information on ex-pats moving to Argentina?

What’s involved with attaining citizenship, owning a business, etc.?

Thank u again