Cepo End Date & Deep Chainsaw

More government entities ¡afuera!, IMF on standby and the CEPO end date?

Welcome Avatar! It looks like the end of the currency restrictions (CEPO) is finally in sight, end date included, while talks with the IMF seem to be reaching a conclusion in terms of a new agreement. Besides this, Milei also announced a new phase of the chainsaw mowing through the public sector. Let’s dig in.

At the start of this week, president Milei gave an interview with Esteban Trebucq on LN+ that contained answers to some of the uncertainties written about on this blog. For one, he confirmed that the cepo or currency restrictions will not be present in 2026:

“Without the help of the International Monetary Fund (IMF), the restrictions will cease to exist on January 1, 2026. Now, if there is a disbursement, we could do it faster. We have to see how the program is structured.”

Announcing a specific end date or start date well in advance for any economic input in Argentina is a risky move, purely because many will try to anticipate the change for some arbitrage one way or another.

Given Argentina’s history, this is almost a certainty, so usually these kind of moves are unannounced until their d-day, and preferably done on a Friday night so the market is closed and no one can pump or dump based on a decision by the Ministry of Economy.

In my opinion, the most likely scenario is that the cepo will be lifted somewhere between October 2025 (after the Midterm elections) and January 1, 2026. Milei had already indicated that restrictions would remain in place until the elections, to avoid exchange rate volatility which is practically a given in an election year.

This fixed timeline also means that the peso carry trade, despite the lower rates (now around 32%) and the 1% crawling peg devaluation, will be a close to sure bet until October this year.

Autist note: read more about the peso carry trade here:

Besides confirming the end date of the currency restrictions, Milei hinted at another agreement with the IMF being in the final stages:

“We are working on making progress in this regard. But we are also convinced that Argentina’s success depends only on us.

Our policy is to be tough on fiscal matters, not to negotiate a zero deficit and to maintain a tough monetary policy. If we then have financial bridges to accelerate, that will be welcome.”

The elimination of the cepo is one of the most important issues for the government in economic matters, not only because it was one of its main campaign promises, but also because it would imply a better positioning for Argentina for foreign investments.

IMF Deal Close

A few days later, Minister Luis Caputo clarified Milei’s comments around a new IMF agreement in an interview with Luis Majul:

“There will be no devaluation due to the agreement with the Fund. It also does not mean that once an agreement is reached, the exchange restrictions will be lifted the next day.”

Stressing the point of not devaluating is important, since the IMF has so far been reluctant to enter a new loan agreement unless the peso is devalued first.

Caputo has repeated time and time again that another devaluation of the official peso rate is not in the cards — much to the chagrin of the “Argentina has Switzerland prices and is über expensive” crowd.

When asked about the possibility of a lagging exchange rate, the minister denied this and hinted at the foreign reserve accumulation last year — which has mainly gone to serve maturities and interest payments in 2025:

“In 2024, the Central Bank bought US$19 billion of reserves; a historic record in Argentina. How can it buy US$19 billion with delayed dollar rates?

It is true that there are some prices that were increased in advance, which does not mean that the dollar is lagging behind.”

In the same interview the minister also said that fresh IMF funds will serve to recapitalize the Central Bank (BCRA), which is still in negative net reserves territory, and that it is necessary to eliminate the surplus of pesos in order to reach a convergence of the monthly CPI to the crawling peg and international (USD) inflation.

There was no mention about any specific number for a potential new IMF loan, but estimates are that this would be around $10 billion if it happens. That would give Argentina some maturity breathing room, and also allow fx restrictions to be lifted sooner.

Autist note: it is interesting to see where Argentina was just one year ago, and that the results have been better than expected. This was the situation in February 2024:

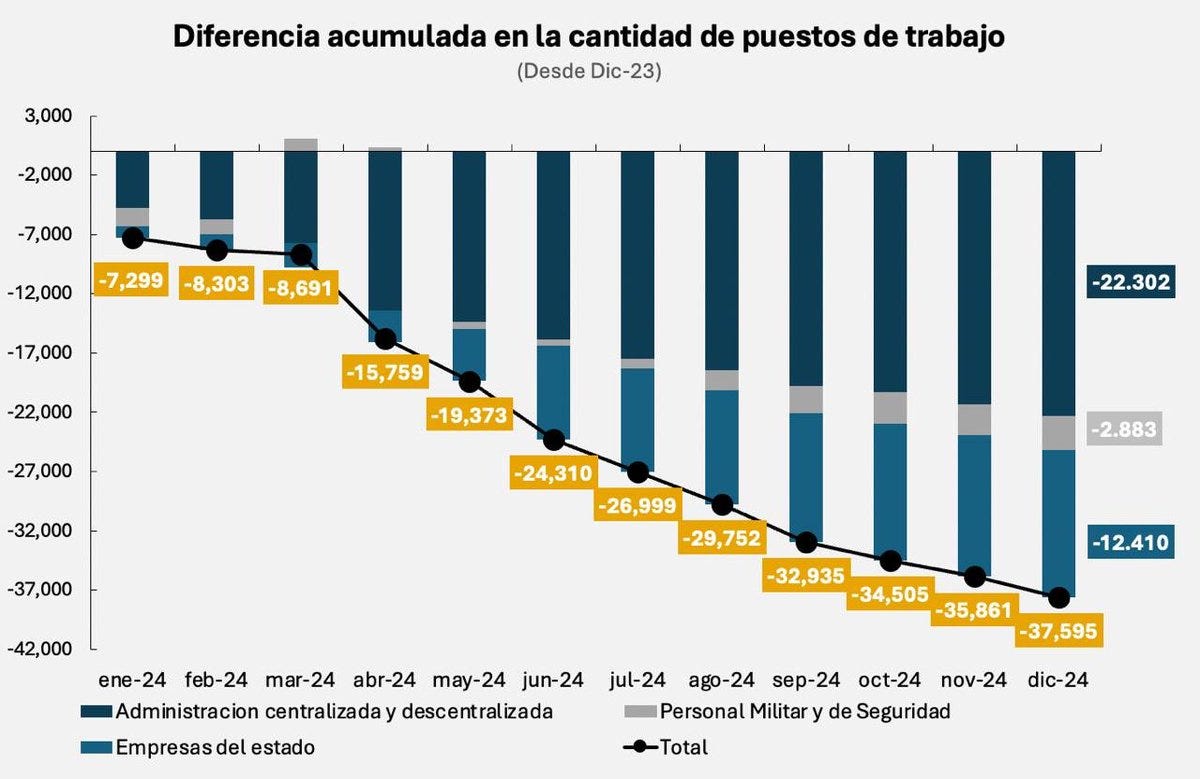

Deep Chainsaw Continues

This week, president Javier Milei also announced that a measure will be published in the next few days that will bring the chainsaw to another fifty public organizations, which is in line with what Minister Federico Sturzenegger calls the Deep Chainsaw methodology:

“Now […] we go into what we call the chainsaw 2.0, which we call the deep chainsaw. So what is the deep chainsaw? We basically did this exercise in the cabinet that we ask ourselves what should a libertarian government do or not do? We said, if it's something that the private sector can do, then we shouldn't do it.” — Source

The Ministry of Deregulation and Transformation of the State, headed by Sturzenegger, is conducting studies on what is the best plan for each agency and more than half of the ministries are already finishing the fine print of the upcoming decree.

Decree 70/2025 will be an explicit allusion to the first mega executive order implemented by the libertarian government made at the start of its term, that deregulated various parts of the economy.

Autist note: the complete content of that first mega decree in 2023 is discussed in this article:

The idea is to take another step with more measures in that same direction, taking advantage of the extraordinary powers that were granted to Milei with the Ley Bases.

In some cases, government agencies and secretariats will be merged, and others will cease to exist completely.

We’ll keep a close eye on this new Executive Order that will be published during the course of next week.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

Let's bring the Deep Chainsaw over here to the USA.

Thanks for your hard work, little rodent!