Carry That Weight

Will we see the end of the peso carry trade once fx restrictions get lifted?

Welcome Avatar! Doom scrollers united this week to announce a tearful end to the peso carry trade, predicting it will end the way it has multiple times before in the recent past. Will this time be any different? Let’s dig in.

In Spanish America the silver coin called the peso — which literally translates to “weight” in English — was minted for the first time in 1536. It weighed 27 grams (one ounce) and had a fineness of 0.92, meaning it was 92% pure silver.

It was equivalent to 8 reales and circulated widely from the 16th century onwards, not only in Spanish America, but also in the European colonies on the continent.

Peso Carry Trade

Today, seven countries in the Americas still use a national peso currency, but the weight-backing has long since disappeared. Despite its dismal track record as a store of value, the peso in the land of silver has captured investor’s interest once more.

Investors and consumers alike are flocking into a renewed carry trade in Argentina by investing in pesos, capturing the profit and then ending up with more dollars.

Bonds and other investments in pesos are now yielding around 30% annually, and since the peso rate against the dollar is stable and even strengthening, this is basically 30% in USD terms.

In Argentina, this strategy is known as the bicicleta financiera. In September alone, this financial bicycle returned around 5.35%, while in October yields have reached 5.68% with an even further strengthening peso against the dollar.

That seems fantastic, but this carry trade is only profitable if the exchange rate remains stable, the peso strengthens (as is the case now) or if the peso devalues at a lower rate than the profit of the investment in local currency. So the main dilemma is always one of timing: when to get out.

Or at least, that used to be the golden rule in Argentina’s volatile past because it was always a matter of when, not if, that another devaluation would pop up around the corner for the silver peso trade to convert into scrap metal again.

In the current scenario, the downside of a stable and even appreciating peso combined with MoM inflation of 2-3% is that it has made Argentina a lot more expensive in real dollar terms. The fact that inflation is down MoM is great, and it is considerably lower compared to the 25% when Milei started.

Unfortunately digital brokemads can’t have their steak and eat it too: inflation is slowing down thanks to Milei’s monetary policy but is still present, so prices continue to rise and their dollar checks buy a smaller steak with each passing month.

Prices are moving closer to the historic mean, which is considerably higher versus the price anomaly that was present during Alberto Fernández’s presidency, which made Argentina insanely cheap while steak-flexing ran rampant.

In The Ghost of la Tablita we discussed the dangers of the dynamic of the crawling peg with an artificially strengthening peso in depth, and on social media comparisons with previous pegs often pop up.

This comment by influencer Carlos Maslatón in response to an observation on X if dollar purchasing power has ever been so bad in Argentina is a good example:

I have warned you several times in this regards since we dialogue via Twitter. The dollar-peso exchange rate is artificial, subsidized by the Milei government using very short term notes that pay interest rates higher than the official monthly devaluation scale.

Since inflation persists, and it is even artificially repressed, every month Argentina is more and more expensive in USD, EUR or AUD terms.

Argentina is today 200% more expensive than a year ago. Milei's plan, despite his public speech, is to continue with this policy until the crash. This financial method, not tested in any other part of the world, received a popular journalistic denomination almost half a century ago: financial bicycle.

And, yes, we have seen these ridiculous level of prices twice in the past. During 1979-1981 and during 2016-2018. It's up to you to discover what happened next. Welcome to the Argentina School of Economics 'Martínez de Hoz', Jordan.

Maslatón is describing the carry trade described in detail above as the bicicleta financiera that will end in the same way as before: a brutal devaluation and high inflation.

Now, he is often labelled as the Argie Jim Cramer for his notoriously bad calls when it comes to stocks or Bitcoin, so let’s see if this is another one of Maslatón’s counter signals and this time under Milei is actually different.

As far as “Argentina being expensive” due to the exchange rate goes, the dollar has historically never been as expensive in peso terms — and Argentina as cheap in dollar terms — as under the previous presidency:

Under Cristina and Macri, the dollar was relatively cheap and the rate under Milei is hovering around the average. So if inflation turns into deflation eventually, we could see prices drop and dollar purchasing power increase.

October inflation would be the first to break the 3% monthly to the downside since at least November 2021, when it registered 2.5%. Private surveys indicate that it will be 2.8%, a drop of 0.7 percentage points compared to September. Moving closer and closer to zero.

Exchange Rates

At the same time, we are close to an inflection point in terms of converging exchange rates between the blue rate (black market dollar rate) and the official exchange rate:

Once and if they cross over, it could signal a perfect moment to take off the current currency restrictions (cepo) and introduce a floating exchange rate.

This dynamic combined with the fact that dollar deposits have reached all time highs compared to the gross Central Bank reserves, and the fact that another 8 billion dollar loan was secured, could indicate an inflection point where the cepo could be removed without any major exchange rate disruptions — or a renewed spike in inflation for that matter.

Whatever happens next, we are close to a crossroads where the government will have to make a decision to lift the currency restrictions as fx rates converge, or to continue down the current road. Doing the former in the upcoming months has the danger of stimulating a flight to the dollar like we saw under Macri’s presidency, and keeping the latter in place could end in tears as well.

An alternative outcome for each of these two scenarios is that they work despite what happened in the past, and the exchange rates stabilize and the economy takes off.

There is no crystal ball, much less for Argentina. The only thing that is certain is that no one knows how this time will turn out, since many factors are different, despite showing many similarities. Milei is much more radical in terms of taking quick political and economic action than any of his predecessors, and has so far proved most critics wrong.

Blanqueo / Tax Amnesty

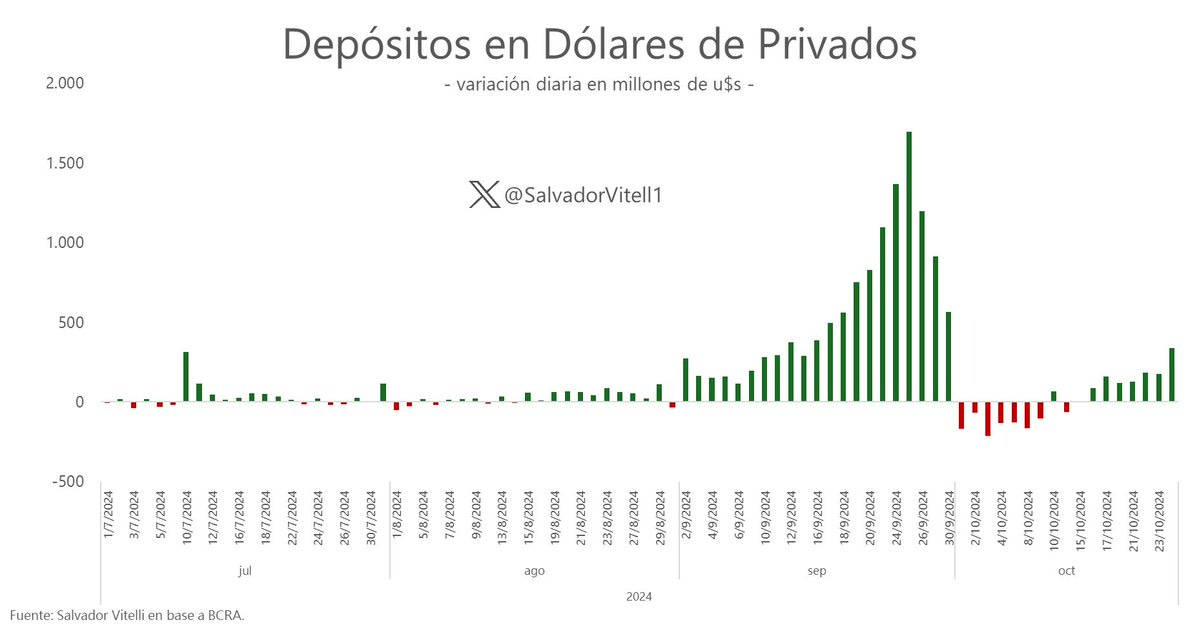

According to data from the Central Bank, since the start of the tax amnesty or blanqueo in August, around US$ 15 billion in dollar deposits were deposited into local USD accounts - double the result obtained by Mauricio Macri in 2016 - despite the withdrawal of US$ 1 billion that has been recorded since October 1.

Due to the success the government extended the amnesty for 1 more month, and October 31st will be the last day to enter the more favorable terms of 0% for any amounts under $100k USD, and 5% for any amount exceeding $100k.

What will happen after November 1st cut off date is very likely a similar outflow of dollar deposits like we saw after the first month of the tax amnesty concluded:

Those crispy Benjamins will most likely end up in local real estate, is my guess.

The investment rate in Argentina dropped to 14.6% of GDP in the second quarter, well below the average of 17.7% between 2021 and 2023. The first half of the year closed with a sharp drop in private consumption (-8.2% annually), public consumption (-5.2% annually) and investment (-27% annually).

In this context, the Government is betting on strengthening the financial bridge to reach the summer month of December, January and February with the dollars from the tax amnesty and a REPO loan that has not yet been confirmed. The Ministry of Economy announced that it bought US$ 2.7 billion to pay the January maturities.

Despite the improvement in the financial scenario and the purchases of the BCRA, the exchange balance shows a current account deficit of US$ 700 million in September due to the outflow of dollars for tourism and interest payments on debt.

This will be something to watch closely as dollar outflows could worsen during the summer months, since now it is actually cheaper for Argentines to go on holiday to neighboring countries versus Mar del Plata or other local destinations.

Dollarization & Closing the BCRA?

Despite the potential outflow of dollars in the near term, a few steps into the direction of either dollarizing or closing the BCRA have been completed thus far:

All BCRA debt was transferred to the Treasury;

No more peso issuance (still some, but compared to previous gvmts this is close to zero);

Local dollar-denominated bank accounts can now be used for everyday expenses in pesos;

The USD deposits of the private sector outweigh the BCRA dollar reserves for the first time in history

Different rates converging to ~$1,100 pesos per dollar

Just to give an idea of how common it is in Argentina to transact or save in dollars, about 17.2 million Argentines have a dollar bank account. This is roughly half of the adult population.

This number is growing fast: in the first half of 2024, around 1.6 million people opened foreign currency accounts, compared to the same period last year, when just over 1 million new account holders did so.

Now, closing the BCRA will not be as straightforward as closing and restructuring the AFIP (IRS) office: in the Constitution there is mention of a Central Bank that has to issue currency in Argentina.

In Dollarization Scenarios for Argentina we discussed how the Milei government might circumvent that, by focusing on the Peso Oro and delete pesos (ARS) from the database altogether.

The downside there is that a next government might launch a new shitcoin and start the printing cycle again. For absolute certainty, a constitutional change would be needed, taking out or changing article 75:6 in Chapter 4, which states that it is the responsibility of Congress to:

Establish and regulate a federal bank with the power to issue currency, as well as other national banks.

Until that is gone or changed, it could be debated from a legal point of view that a Central Bank is needed.

The most likely scenario is that the Milei government will not even consider the closure of the BCRA until the second half of its term, or even wait with any action until a second term.

No doubt that securing more seats in next year’s midterm elections will help with this initiative. But twelve months is a long time, and in Argentina it’s a lifetime.

Volatility has always been a close friend of Argentine exchange rates, and in the run up to the 2025 elections we will see if the peso will still be worth it’s weight to continue the carry trade, or if it will be replaced by something else.

See you in the Jungle, anon!

Other ways to get in touch:

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Nostr: increasing my posts here, my npub: npub1sngpxenyrddqvnusf02fls8yl0ja3s373md9lmfkej2l0h6saz6qvglthh

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

For someone looking to invest in a pozo within the next 3 months, how could this affect real estate prices? From what I understood, short term, prices could go up due to outflow from dollar deposits with amnesty, but curious about mid-term?