Dirty Laundry: The End of the Grey List?

How tomorrow's Financial Action Task Force (FATF) visit to Argentina could ruin a good thing

Welcome Avatar! Just like like the majority of the world’s population, Argentines aren’t particular fans of paying taxes or declaring assets. There’s one important distinction: in Argentina non-compliance never had any real consequences. On paper, Argentina is tax hell, while in practice, few care. Most previous governments have nurtured this dynamic where enforcement against money laundering is not taken all that seriously. Could this change under the Milei administration? Let’s find out.

Argentina is one of the few places left on earth where you show up with a suitcase full of Benjamins to buy property, while at the same time the country increasingly runs on digital payments and crypto (USD stablecoins).

The fact that cash is still used so much also makes it very appealing in terms of anonymity and bending certain rules, leaving out a portion of a contract, etc. All a lot harder to do with digital transactions.

Autist note: none of this is financial or tax advise, just describing how certain things work in practice. If you plan on staying in Argentina for the long haul and want to buy property, I recommend getting a good and especially creative accountant here, which are not always that common (will do an article on best setups for foreign income while residing in Argentina at a later point in time).

Overall this is a good thing, it makes Argentina one of the countries with a higher degree of freedom. While most countries in the Western world keep sending more user meta data to their financial regulators, in Argentina it’s still somewhat possible to escape the Eye of Sauron’s gaze on every transaction.

But, as we have seen in Individual Sovereignty in the Age of Cashless Societies, Argentina was already moving into the direction of more control, less cash, and being tougher on crypto.

This weeks arrival of the Financial Action Task Force (FATF) for an audit, could kick this into overdrive.

1) What?

Yes, you read that correctly. Organizations like the FATF are the ones that you should prefer to keep out of your borders as long as possible, but since Argentina has been a member for decades, they do drop by from time to time.

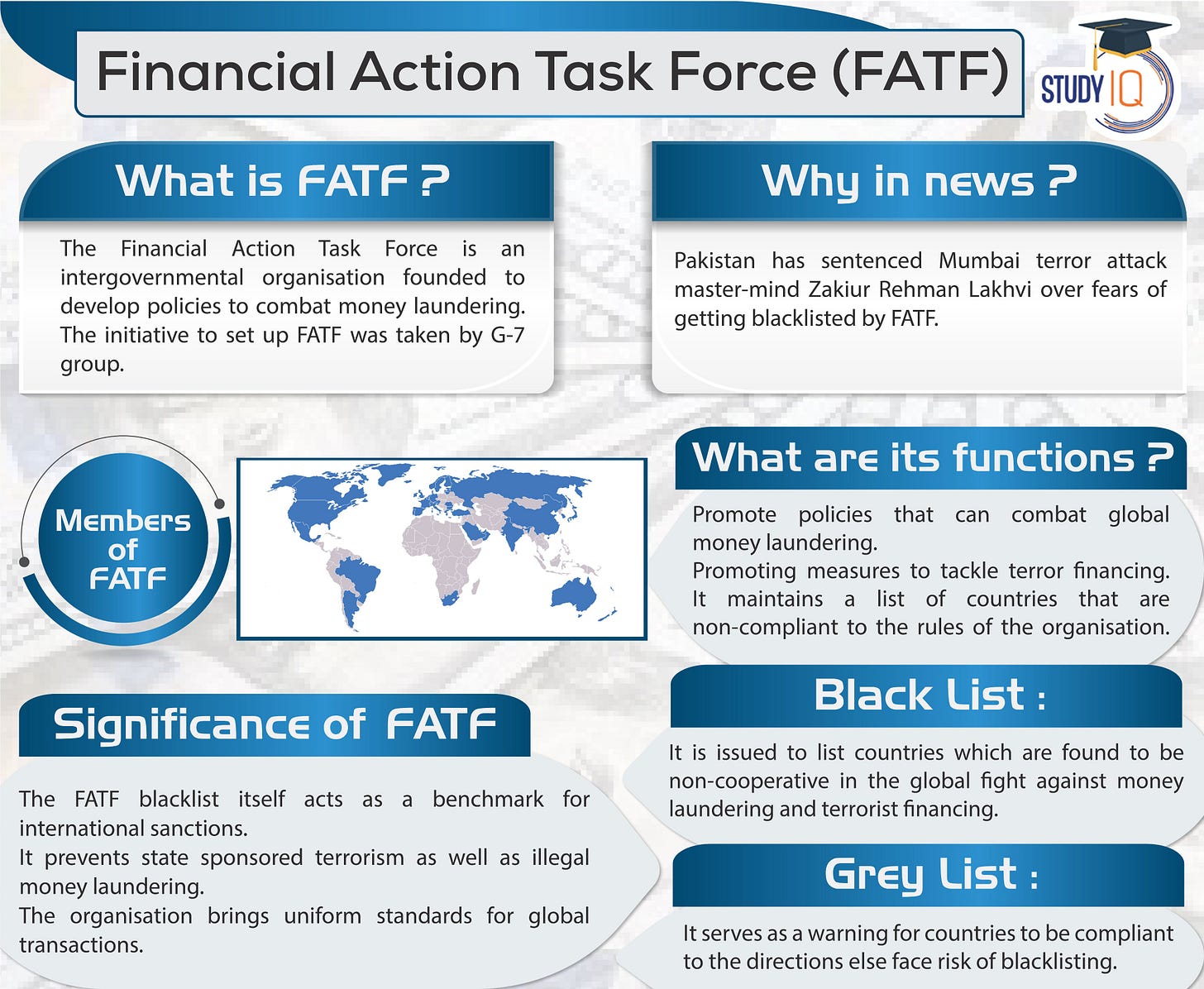

This 4-letter intergovernmental institution was originally created in 1989 by the G7 to promulgate an international framework of anti-money laundering standards. At that time it had 16 member countries and currently it is made up of 34 countries, including Argentina, which became a member in 2000.

The FATF has 25 international organizations such as observers including the IMF, the UN and the World Bank. Again, all supranational organizations that most freedom loving individuals frown upon.

Basically it’s a tool in the Central Planners’ coercion toolbox to make sure certain jurisdictions start walking in line, or else.

The “or else” in the case of Argentina is intertwined with the IMF and Washington DC. From 2010 onwards, the country has been on the FATF “Grey List” since the organization’s last visit.

If Argentina shows it is willing to move up the ladder by taking a harder stance on AML, this potentially opens up the door to more potential IMF loan agreements or restructuring, and a good relationship with the US.

The latter is very important to the Milei admin, since China already indicated that it will not renew any currency swaps with Argentina: No Hay Yuan.

So far the Milei government has done a great job steering away from a default without additional loans — even though certain commercial debts were converted into bonds, these debts already existed, and the IMF funds were still part of the 2018 loan taken on by the Macri administration — but dollarizing the economy and nuking the central bank (BCRA) will not be possible without additional funds.

The FATF committee will arrive in Buenos Aires tomorrow (March 6, 2024), to evaluate Argentina for two weeks to assess if meets the standards set by the organization or not.

Additional AML & Crypto Regulation?

At the moment, Argentina does not have a Money Laundering Prevention law, so according to local media, the Government is preparing an Executive Order to appease the FATF paper pushers before their arrival: this DNU (decree) would adapt the current regulations against money laundering.

The list of obligated entities includes banks, financial companies, crypto exchanges, car dealerships and insurance companies. These would all be responsible for reporting the operations of their clients when their economic profile is not consistent with their investments.

The purpose is to prevent Argentina from being placed on a blacklist of countries that do not combat money laundering from terrorism and drug trafficking.

Under the new decree, all cryptocurrency service providers would have to register with the national cryptocurrency watchdog and operate under a license that would be provided by the organization even if they are not based in Argentina. Also, these would have to provide information to the national intelligence unit to comply with anti-money laundering laws, forcing cryptocurrency services lenders to produce risk reports and report suspicious movements. — source

From what has come out so far, the potential decree would only add more compliance regulation for crypto exchanges, and leave personal user wallets onchain untouched.

However, the overall oversight for exchanges would be assigned to the local SEC (CNV), yes, that entity that was hacked multiple times last year. That delegation of broad regulation and control powers goes far beyond just AML compliance.

According to many, the FATF visit will be defining for the crypto space in Argentina. Not complying with the FATF request for “clear rules” can mean that the country stays on the gray list of “unreliable nations” that are not a tax haven.

One of the key things to see is how personal wallets and P2P transactions are treated once Milei’s decree comes out.

Final Thoughts

The Milei government has to play ball if it wants access to more credit and get off the “grey list” with countries facilitating money laundering. At 12pm tonight it is time to refresh the official Gazette page and see if this DNU came out ahead of the FATF visit.

The FATF March review lasts between two and three weeks in Argentina, but there is an evaluation in June and a final one in October, when the final grades are posted.

Not that it will change much. There have been multiple “anti money laundering” laws over time in Argentina. In the end what always ends up happening is that the more rigorous controls become, the more money gets laundered / offshored.

Autist note: If you want to read more on why Argentina, despite all its issues, is such a great place to find personal freedom, this is a good start (all these articles are bundled in the mobility category on this blog):

I don’t expect this time to be different, no matter what the DNU says. There is a completely functional parallel economy facilitating anonymity, and many professionals work in that very sector to make sure everybody is happy with the supply and demand dynamics.

One of the changes that is mentioned around the decree that still has to be filed is that lawyers will be obliged to report suspicious transactions of their clients. In practice? Forget it.

The distrust in government and especially the tax office (AFIP) is just too big for most to care or decide to suddenly blindly follow the rules. This attitude is one of the things that make Argentina so great, and difficult at the same time.

Think about it this way: Argentina has been a FATF member since 2000, lol. Literally nothing has changed since then.

See you in the Jungle of anonymous transactions, anon.

Really enjoy your content, keep it coming!

Interestingly they don't show it as being on the grey list currently - https://www.fatf-gafi.org/en/countries/black-and-grey-lists.html