Welcome Avatar! As Argentina is now on a hard peso cap according to minister Caputo, inflation should cease to be an issue towards the end of the year. Could the peso become a store of value any time soon? Let’s dig in.

In an recent interview Minister of Economy Luis Caputo said that “folks will have to start selling dollars to pay for taxes” due to the scarcity of pesos on the market after the latest policy shift to “zero peso emission” by Milei’s economic team to stop inflation.

Inflation Be Gone

So far, this administration has managed to do an impressive job with regards to nuking inflation. Just look at this chart.

Impressive to say the least. It’s a result of taking away the remunerated short term peso liabilities at the BCRA, combined with lower interest rates and a slowing down of economic activity (-5% in the first 6 months of the year).

This trend will continue from the emission side, as Caputo referenced: the peso printer will be shut down.

BCRA: RIP Peso Ponzi

The Peso Ponzi Party has finally come to a halt: the remunerated liabilities at the BCRA reached a peak of $58 trillion pesos in August last year at today’s prices.

The main fiscal adjustment this year was to dismantle the financial cycle of the LELIQs (peso liabilities), which allowed the deactivation of a potential hyperinflation and generated impressive savings for the State.

Since Milei started, the BCRA's debt was cut in half in real terms and in addition, the interest rate was lowered from 133% to 40%.

The combination of reducing capital and the rate allowed the interest burden generated by the BCRA's debt to be reduced from 10% of GDP in 2023 to 3% of GDP in 2024.

In short, the stock was reduced by 50% and the rate by 70%, prior to passing the debt to its true owner (the Treasury), but under conditions that it can face it without compromising fiscal balance.

The interest burden on the consolidated public debt (Treasury + BCRA) dropped from 12% of GDP in 2023 to 4% of GDP in 2024. Savings in interest on net debt amount to 7% of GDP, equivalent to 42 billion dollars per year.

An important fact is that the State did it respecting all contracts and under market operations.

Few understand what a big impact this will have in the long run.

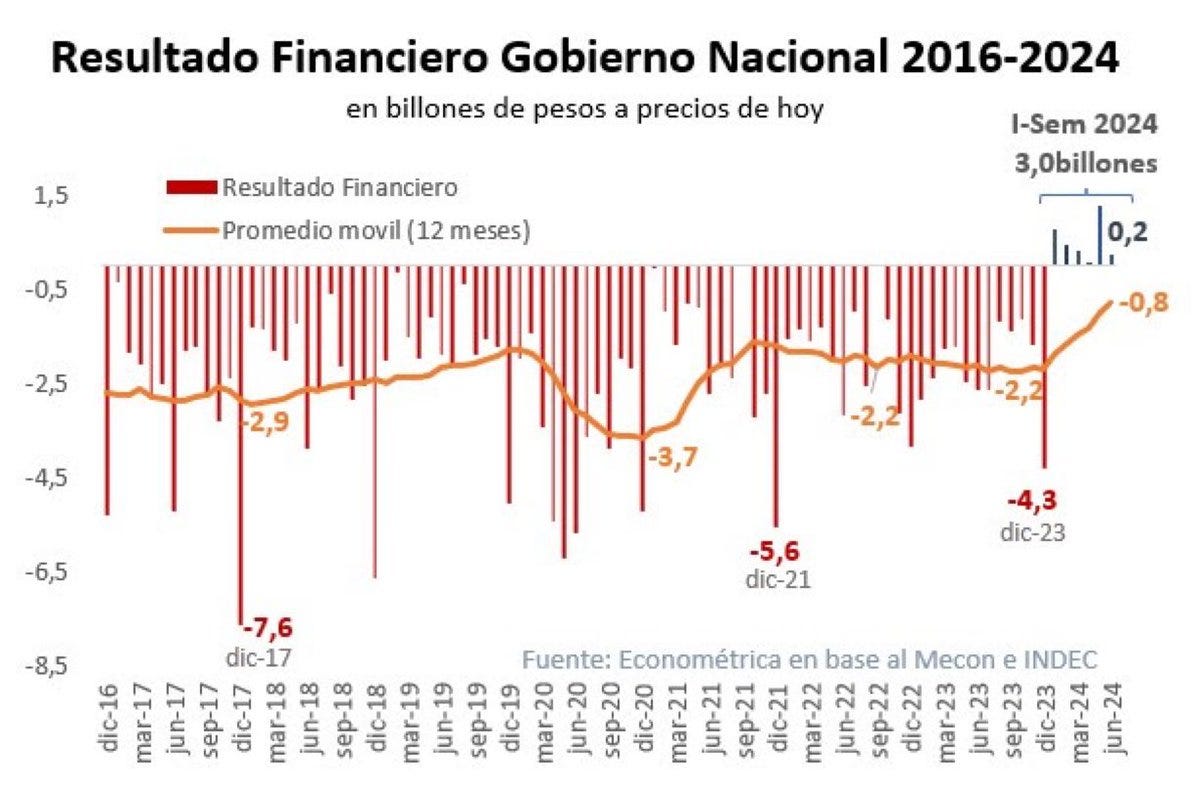

In the short term, despite economic contraction in the first half of the year, Milei achieved a surplus every consecutive month:

It is unlikely that this surplus will continue for the upcoming months since some maturities are due and energy and importer payments were moved to the second half of the year in order to maintain the surplus in the first few months.

And what are banks doing now that lending money to the BCRA is no longer an option?

Consumer Credit Availability Increasing

The so called UVA mortgage loans were announced in April. By June, banks already doubled the loans granted.

After the BCRA lowered interest rates some more and moved all passive liabilities to the Treasury, banks have less and less incentives to lend their pesos to the State, and will increasingly start lending to the private sector.

At the start, the UVAs increased at a pace of 20% MoM and now this is already down to 5% and falling. As inflation slows down, the rates will become more reasonable, and since these are applied to pesos, it could be beneficial to take one on, especially as a hedge against the peso in case the strengthening of the peso turns out to be unsustainable in the long term.

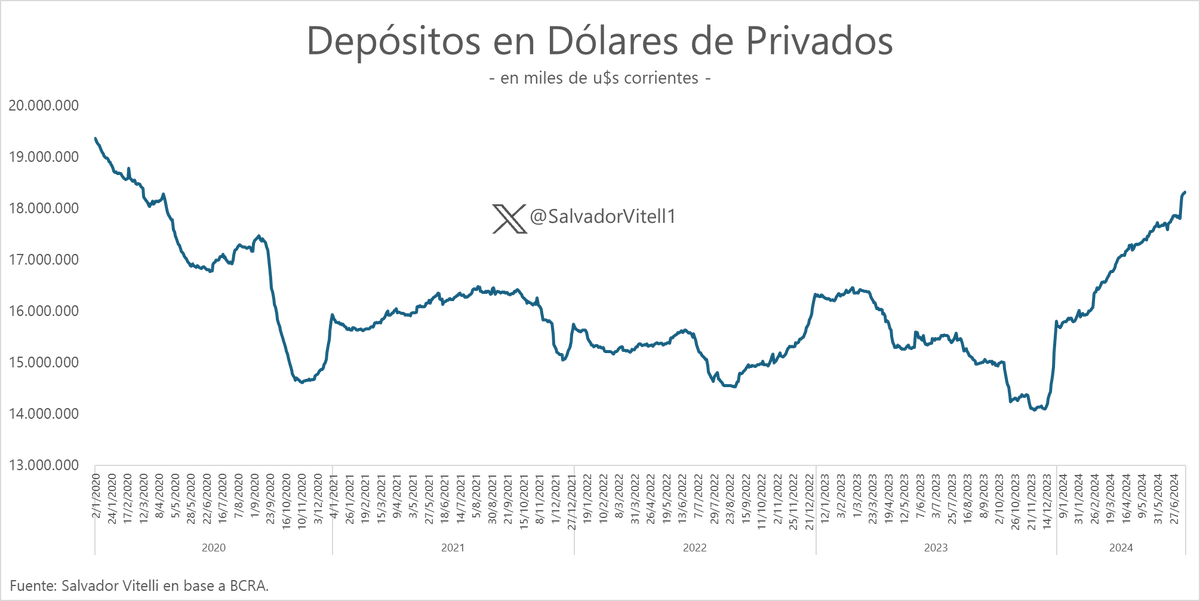

Private sector bank deposit have increased by $4 billion USD since Milei took office, and it seems that businesses and consumers alike are not afraid to keep their precious Benjamins in local bank accounts:

But with consumer credit doubling and USD deposits increasing month over month, Argentina is still waiting for Godot when it comes to obtaining additional credit.

Still No Credit For Argentina

The Government intends to move forward firmly with a new financial agreement with the IMF that would grant additional disbursements. With these additional dollars, the economic team would be closer to being able to execute an orderly exit from the currency restrictions (cepo).

The timing is key: Caputo mentioned to lift fx restrictions at some point later this year, around the end of 2024.

Managing Director of the IMF, Kristalina Georgieva met with Caputo in Rio this month and praised “Argentina’s solid performance in the fight against inflation”. And even though it is crystal clear for Kristalina that Argentina’s economy is growing beyond expectations, no other promises were made.

In my opinion Argentina would do well to pay off the current IMF debt, but not take on any additional debt.

There is no scenario where that additional debt would “help” in terms of getting out of the current situation: it would be a temporary cushion that would get depleted quickly, just like what happened with Macri.

There needs to be a long term solution, with more genuine investment capital entering the country. Unfortunately that will take time, and foreign investments will likely start to pick up if Milei’s La Libertad Avanza is able to secure more seats during the 2025 midterms.

BCRA Reserves

Despite no new credit, the BCRA has been accumulating foreign reserves all throughout Milei’s term:

This looks impressive and it it, especially compared to the previous administration. Unfortunately for the Milei administration, buying USD so aggressively is not a “nice to have” but absolutely necessary for its survival. As discussed in previous articles, the maturities due during Milei’s current term are mind-boggling and there will be a lot of sacrifices needed in order to meet them without facing another default.

So far in July, the Central Bank's stock of gross international reserves has dropped by almost $1.5 billion USD, to $27.4 billion USD, very close to its four-month low of $27.1 billion USD on March 27.

If deposits that are computed as reserves and loans - such as the Chinese "swap" - are discounted from this figure, net reserves are close to a negative balance of -$6 billion, the lowest result since March.

In July, multiple payments were made: $2.6 billion USD for Bonares (AL - local law) and Globales (GD - foreign law) holders, both series issued during the sovereign debt restructuring by Alberto Fernández in 2020.

$640 million was paid to the IMF, the last amortization payment of the extended facilities program valid until November 2024.

At the end of the month the BCRA will pay off another 167 million USD of the first maturity of the Bopreal bonds, created for the debt with importers.

So far, so good, but additional insurance is needed.

Argentina’s Gold reserves

President Milei knows that debt payments could become an issue next year, and assured that he already has a “repo ready for next year” to pay the maturities in case the rollover he is seeking fails: “If we don't manage to secure a rollover, that repo will cover it.”

The BCRA has approximately 4.7 billion dollars in bullion gold (physical) that does not yield any interest.

In order for that money to yield something, the BCRA has now lent out 10% of its gold holdings (paper gold). This way, Argentina can charge interest and use that gold as collateral in potential debt negotiations.

The downside of this measure is that Argentina still has to pay around $16+ billion for the YPF nationalization, and since this gold is located abroad, it could potentially be seized by Burford if judge Preska allows it.

The “Blanqueo” Laundromat

It’s been clear for a while that Argentina will need all the money it can get. Besides collaterilizing a part of the BCRA gold reserves, a tax amnesty on undeclared funds passed Congress earlier this year.

The conditions of this blanqueo are very favorable, and since such a big part of Argentina’s private savings are either located abroad or remain undeclared in local mattresses, expectations are that the adherence to this tax amnesty will be considerable.

Each government has a similar blanqueo program, but the conditions and amounts tend to differ. One of the highlights of this blanqueo is that, if the money is kept in the national financial system until December 31, 2025, it will be possible to regularize any amount of undeclared funds at close to no cost.

Those who regularize any kind of assets or holdings for a value of up to $100,000 USD will not be subject to paying taxes either.

The capital to be laundered can be located both in the country and abroad, for residents and non-residents, and covers the following assets:

National or foreign currency, in cash or bank accounts;

Real estate in Argentina;

Shares, participation in companies, etc.;

Shares or bonds listed on exchanges regulated by the National Securities Commission (CNV);

Cryptocurrencies;

Assets abroad.

The sooner one enters the regime, the lower the rate to be paid. Rates are divided into three stages:

Until September 30, 2024: tax rate of a 5% rate only on the excess of $100,000 USD.

Until December 31, 2024: tax rate of 10%.

Until March 31, 2025: tax rate of 15%.

Let’s see how many people will enter, but my guess is this time it will be considerable.

Final Thoughts

Besides a private credit rebound, and the investments that come with the RIGI and the Blanqueo or tax amnesty, it is likely that there will be an increased demand for pesos and that Caputo’s peso scarcity bet will have the intended effect.

As the demand for pesos increases without a new supply of pesos (zero emission), the liquidity in the economy (today in State liabilities) will gradually transform into genuine demand for pesos.

As the surplus of pesos in the economy gradually decreases, there will come a point where exchange controls will no longer be necessary since the demand for pesos finally managed to equal a fixed supply of pesos, giving rise to the third stage, the liberalization of the exchange market.

The real question is timing: this process cannot take too long, as I mentioned in The Ghost of la Tablita.

Another thing to keep in mind is that in real life, very few “zero x” plans turn out to be zero. Macri coined a phrase with “zero poverty”, the EUSSR has its “net zero” and now Argentina’s monetary policy will be “zero peso emissions / zero inflation”.

The background to Caputo's defense of the peso is a new chapter of the old "He who bets on the dollar loses," the infamous phrase coined by Minister of Economy Lorenzo Sigaut (1981) shortly before a devaluation.

Even Cristina Kirchner insisted on the idea in 2014, when she said: “People who believe that their savings will be protected by buying dollars or saving money to avoid consuming, will most likely end up losing out in the medium term.” We all know what happened to savers who took her advice: they lost 80%+ of their purchasing power in the next 5 years.

Will banking on the peso work this time around? For the Milei Government, the story is different today due to one key factor: its religious fiscal discipline. This non-renounceable principle of this administration is the differential that will anchor the rest of the variables and will order the stabilization.

The question remains if those surpluses can be maintained throughout a longer period of time — especially given the fact that the second half of the year tends to have more government spending and inflation historically.

If savers feel that the current set up is not sustainable or if the recession deepens, there is a possibility that demand for pesos falls. If they believe the current setup, it works out well; but, if they don’t and it goes south, restricting the amount of pesos will end up hitting the real economy much harder.

See you in the Jungle, anon!

Other ways to get in touch:

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

Great article! I think Milei & Toto are hot candidates for the Nobel price of economics.

"For the Milei Government, the story is different today due to one key factor: its religious fiscal discipline."

They really have been religious about it, right? And they've held fast to zero deficit. So, as you say, let's see what happens in the latter part of the year.