January 2025 BA Real Estate update

Mortgage issuance, new Airbnb regs and RE sales update up to January 2025

Welcome Avatar! The real estate boom cycle in Buenos Aires is humming, with average m2 prices in some neighborhoods increasing by double digits YoY, while Mayor Macri is implementing new regulation around Airbnbs. Let’s dig into the current state of the sales and short term rental market.

January Real Estate Overview

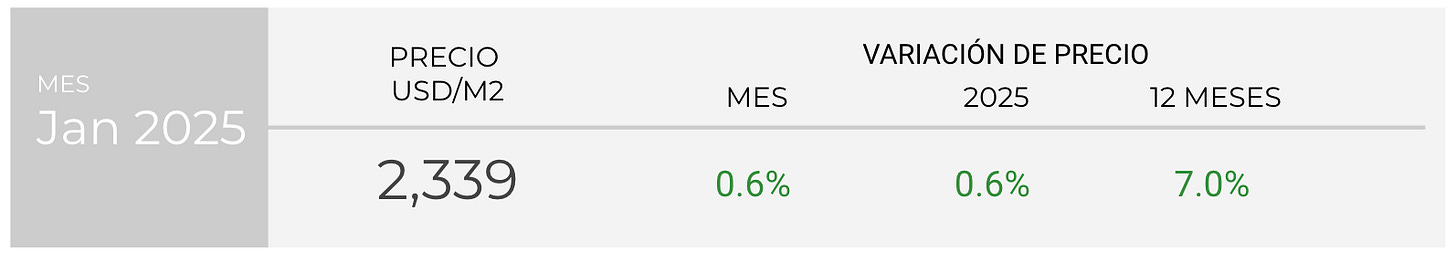

The average listed sales price in the city of Buenos Aires increased by 0.6% in January and currently stands at USD 2,339 per m2, a level similar to that of 2022. As you can see, there is still a long road ahead of us to get back to the 2018 peak in real terms, meaning USD prices adjusted for inflation.

When looking at the average yearly prices, these increase by 7.0%. Newer and brand new apartments in desirable neighborhoods have seen price increases into the double digits.

From the absolute bottom in June of 2023, the average m2 price in Buenos Aires is 8.7% higher. The amount of property deeds signed increased by 35% in 2024 when compared to 2023, and an interesting side note is that 9% of these were signed with a mortgage, which is more than double when compared to 2023 (4%).

The individual average increases for the property types above, measured against January 2024 are:

Studio apartment: +7.15%

1-Bedroom apartment: +7.33%

2-Bedroom apartment: +6.64%

A pretty decent bump from compared to the same month last year. As we will see below, the increase in certain neighborhoods like Palermo and Recoleta is even more noteworthy.

The pozo trend (buying a new apartment that in a construction project) from last year is accelerating:

The investment interest for new apartments continues to climb, and the pozo price increases are really starting to give those newer units an even bigger price differential:

To Pozo or not to Pozo

There are multiple factors that contribute to this price increase besides demand, and that is the stable usd/peso rate, which makes new developments more expensive in dollar terms due to the way the majority is structured: 30-40% down payment, and the rest is paid in installments during the remainder of the project until it’s finished (usually 18, 24 or 36 instalments depending on the building size).

These 60-70% for these instalments are usually converted to pesos, and include a CAC-rate (construction price index) that is applied monthly according to construction inflation. This has made pozo investments considerably more expensive over time (I have invested in one of these peso structures myself and unless there’s a devaluation on the horizon, I expect to pay about 12-15% more in dollar terms once I finish paying the last instalment later this year.

My timing on shorting the peso in that development project has not materialized, but luckily another project that has fixed USD instalments (which is almost not offered anymore due to the current currency dynamics in Argentina), makes up for it. You can read more on the potential currency arbitrage through development projects here:

One important thing to keep in mind, is that earlier this month Milei has practically confirmed when currency restrictions will be lifted.

This gives peso carry traders a window of opportunity until October leave their peso positions before the mid-term elections, and let the fx chips fall where they may once the results roll in.

For the adventurous investor, or someone speculating on a peso devaluation once fx restrictions are lifted after October, a pozo in pesos could be a very interesting bet with a potential USD discount on a new property.

This is not investment advice, and is definitely not without risk (see my personal experience above with that bet going south due to Milei’s current monetary policies creating a stronger and stable peso).

But if you are eyeing property in Buenos Aires anyway and are not in a rush, it is a good thing to keep in mind in terms of timing. In my case that pozo is for me personally, and since m2 prices in that area have practically kept up with the additional USD I will end up paying with the installments, I am not too worried about it.

Mortgage Trends

Unless we have any unsuspected turbulence before the October elections, I suspect mortgage issuance to continue at the same or a slightly lower pace (some bigger banks have started to adjust rates to absurd levels (10%+ on top of the adjusted UVA) to slow down demand.

The publicly owned banks like Banco Ciudad and Nación are currently offering the best deals, but rates also depend on certain zoning (the BA government provides discounts in mortgage rates for less desirable zones).

Autist note: If you speak Spanish and are a resident in Argentina looking for mortgage credit, then this video by Santiago Magnin is a must watch. It explains all the intricacies that come into play when applying for a mortgage. This is still not as easy as in most other countries, and if you are not a resident or do not have any real income to show in Argentina, then you shouldn’t bother with applying for a mortgage here since it is a guaranteed denial in those cases.

The mortgage and sales numbers have increased signficantly, and are above those in 2019, which was the last year without currency restrictions — Macri reinstated the cepo a few months before leaving office, and you can see the number of sales absolutely crater after 2018. So the fact that we are currently at 2018 sales levels with currency restrictions still in place, is quite remarkable:

Imagine what happens once that cepo finally gets ripped off.

It’s important to take into account that pozo investments do not show up here, because you cannot “register” the property yet since it doesn’t exist yet. So all these new unit contracts under construction are not taken into account.

Autist note: you can find some additional articles below that shed some more light on Argentina’s real estate market:

If inflation continues to fall as shown in the chart below, mortgage lending could begin to recover. Today, inflation uncertainty makes it impossible to project long-term costs, which is the main roadblock to wider access to mortgage loans.

But if mortgages would be issued in nominal terms — not through an indexed unit like the UVA — with fixed, variable or mixed rates, we could see a boom not seen before.

Keep in mind that Argentina is probably a long way from providing direct nominal USD loans for property and would need years of currency stability and low inflation to get there.

Short Term Rental Situation

After the Milei government repealed the Rental Law, rental property supply has skyrocketed, and real prices in dollar terms for long term rentals have remained stable and even decreased in some neighborhoods.

This has caused the over supply in short term rentals at the height of the Rental Law to gradually decrease, since many owners decided that their returns on the long term rental market were better or equal, with less headaches.

For long term rental returns however, the less popular barrios (except for Puerto Madero) below, have the best returns.

The average return in Buenos Aires for long term rentals is 5.42%, but some of these Villa Lugano, Agronomía etc have much higher percentages. A combination of less supply, more residential neighborhoods and lower property prices.

For short term rentals (STRs) returns, a lot of different factors come into play like location, tourism (which is down by -25% YoY), and amenities etc. But overall unless you have a top notch unit that caters to the higher end tourist, returns are similar to the overall long term Buenos Aires rental market.

Anything above 10% would be an excepcional return and not realistic, especially not when factoring in building expenses etc. Personally my studio unit in Palermo with a good location has been fully booked for the last 3 months, and return on 2024 was 6.25%.

New Airbnb Registry

As BA major Jorge Macri has shown during his administration so far, there is nothing he loves more than increasing local taxes way above inflation levels (ABL, car tax), and to see if there is some wiggle room somewhere to implement some additional taxes.

It seems he has found a potential new cash cow in the short term rental market.

The Buenos Aires city government has tried before to “regulate” Airbnbs, to no avail. In 2021, mayor Larreta and AirBnB signed and agreement to this effect, under the “BA Digital Nomad program” that never went anywhere.

Point 1.2 reads:

"This Agreement is entered into voluntarily between the Parties and in good faith. It will not be interpreted or used to the detriment of the Parties.

The Parties will not take legal or economic measures against the other, in relation to any of the issues established in this Agreement, nor will they assist third parties to take economic or legal measures against any of them."

Basically that second paragraph already indicated that Larreta’s efforts to regulate Airbnbs was doomed to fail, since any regulation inherently comes with economic and legal measures. And so, from the 20,000+ listed properties in Buenos Aires, only a handful ended up registering as a short term rental (around 600).

Airbnb has since then deleted that Larreta press release — likely due to Jorge Macri’s new regulations — it can still be viewed here on the Wayback Machine.

Jorge Macri’s Resolution No. 8 (page 136) is more likely to impact the STR market and make it even less profitable for property owners:

Once registered, the platform will charge foreign tourists 1.5% per person per night for urban use. This percentage will go to the Buenos Aires government to finance the Visit BUE program, which is responsible for promoting the city around the world. — Source

Airbnb and Booking are already familiar with such surtaxes in other countries, and in places like Barcelona for example, your STR will simply not be listed on these platforms unless you have an official registration number.

It looks like my idea for CuevaBNB for booking STRs with stablecoins might have some future potential if Buenos Aires starts to demand the same.

Even though most property owners will eventually cave in and take the 1.5% hit or tack it onto their existing prices, it does mean that the BA short term rental market will start to see more needless bureaucracy.

Conclusion

2025 will be another year of sustained price/m2 increases, especially if mortgage issuance continues at the same rate.

One of the most interesting moments to watch with potential shifts in dollar/peso levels will be between October and January 2026, which is the moment the cepo will be lifted, according to Milei.

The new Airbnb/Booking registration is something to keep an eye on, and I will provide an update if anything changes, or if it turns out to be a nothing burger just like the last time under Larreta and no one actually registers their STR.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.