Milei's Federalist Model

Are governors prepared to take some pain, or will they tax their subjects into oblivion?

Welcome Avatar! After a brutal 2024 without discretional federal transfers to the provincial governments, the Milei government is planning on even more cuts for 2025. Are governors prepared to take some pain, or will they tax their subjects into oblivion? Let’s find out.

In the first week of his presidency, Milei announced that his administration would be cutting back on discretional transfers to provinces.

According to the Federal Co-participation Law, of the total of shared taxes (mainly VAT and Income Tax), 42.34% is kept by the national government, 56.66% is distributed among the provinces automatically, and 1% is reserved for the National Treasury Contribution Fund (ATN).

That one percent is distributed through non-automatic or “discretionary” transfers, and these funds can be distributed according to the will of the national Executive, but without following any criteria or priority established in advance.

During previous governments, this additional money was wired to whichever governor was bigger buddies with the Executive branch, no questions asked.

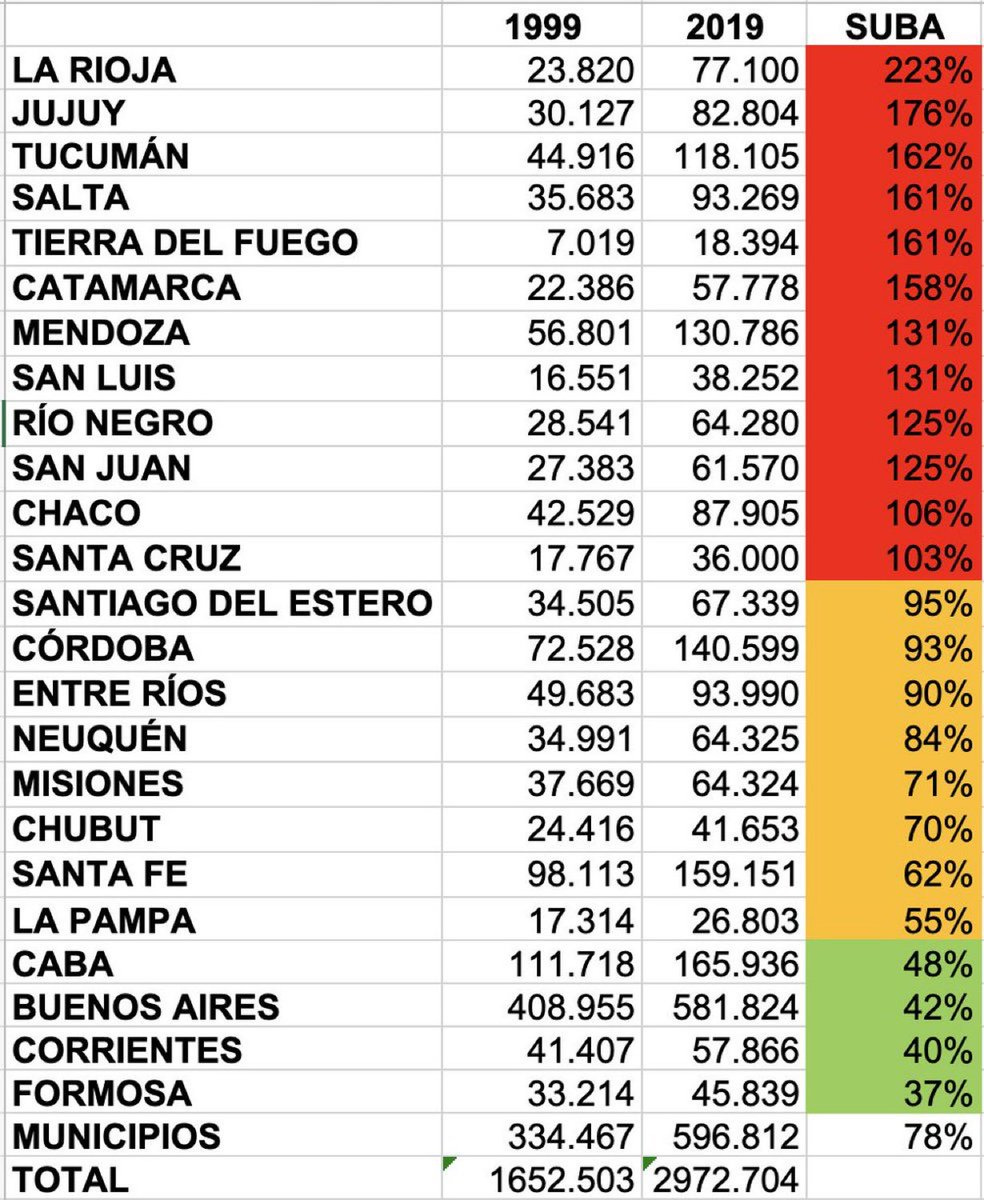

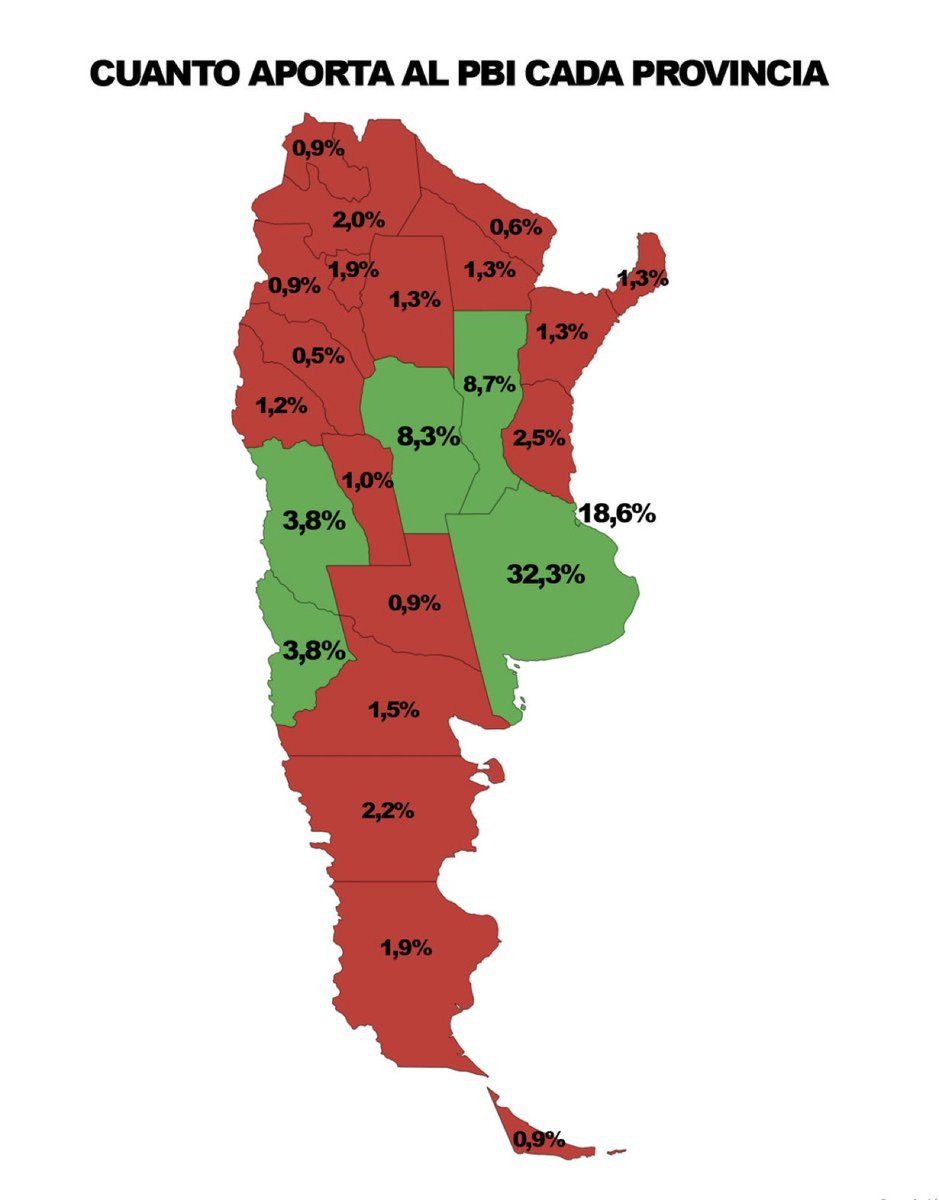

Even without these discretional transfers, the imbalance between provinces that pay more than they receive is very clear, and some provinces are kept alive solely by the Co-participation Law:

In 2023, every single province besides Buenos Aires, CABA, Mendoza, Neuquén and Santa Fe, received more from this Co-Participation model than it contributed. Even Córdoba, which is surprising.

For some of these deficitary feudal kingdoms, even that wasn’t enough and they still relied on the 1% discretionary transfers on top of that.

Since December that has come to a halt. Milei is seeking to achieve one-fifth of the public spending cuts needed to achieve fiscal balance by eliminating non-automatic national transfers to provinces.

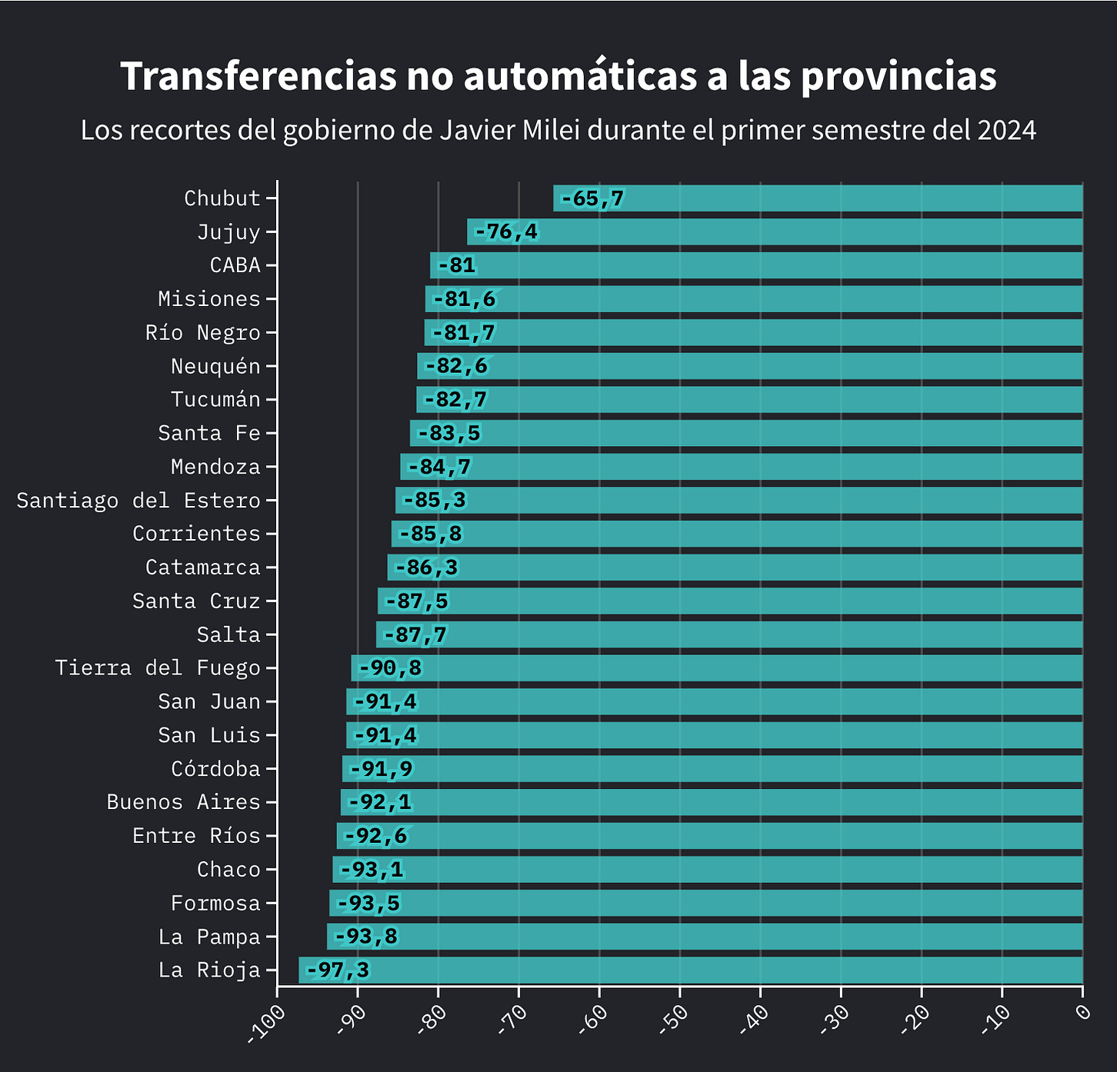

Discretionary transfers from the national government to the provinces have decreased by 84% in the first half of 2024:

According to official data, the three provinces where non-automatic transfers decreased the most are La Rioja (-97.3%), La Pampa (-93.8%) and Formosa (-93.5%).

These are three of the five provinces whose governors did not attend the signing of the May Pact (see the main photo of this article). The remaining two provinces are Buenos Aires (-92.1%) and Tierra del Fuego (-90.8%).

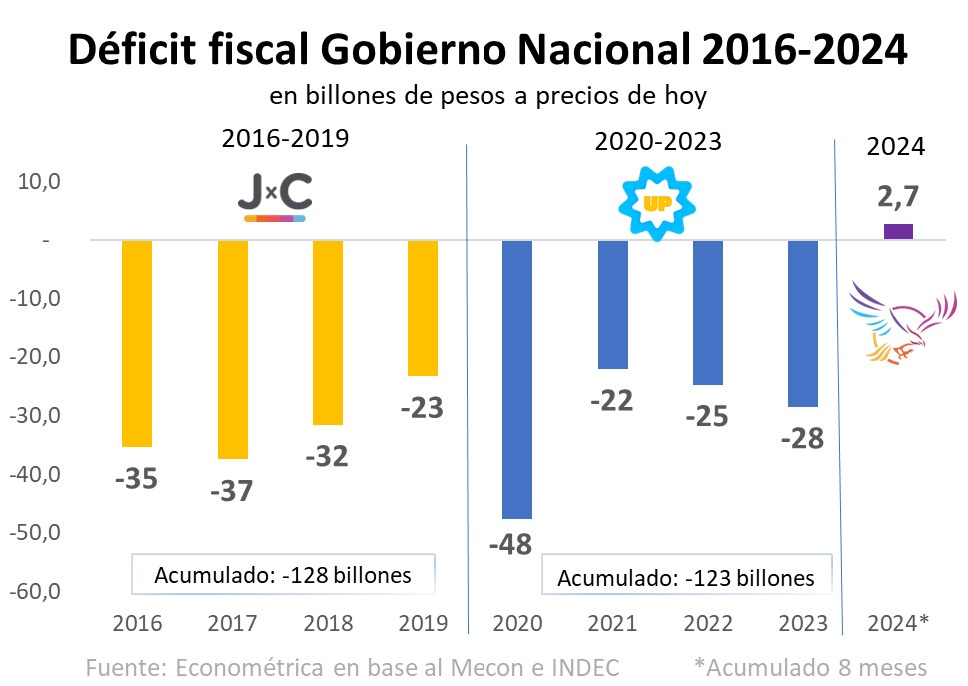

So far, judging by the fiscal surplus in 2024, this has been working like a charm in order to stop deficit spending, besides Milei’s chainsaw slashing through federal spending in general:

But when it comes to provinces and municipalities, there’s only so much the national government can do.

Trimming Provincial Fat

In his 2025 budget presentation in front of Congress last month, Milei mentioned that provinces and municipalities will have to lower their spending by a combined US$60 billion.

He was referring, among other things, to the 1.5 million public employees that were added in the last 20 years:

Later LLA representative Espert said that the real number would be closer to just $20 billion, which is still substantial:

“The cut [in provincial spending] will have to be USD 20B at the very least. At the federal level we will continue to reduce spending, there is still spending to reduce in energy subsidies, and the municipalities also have to reduce spending, they are in many cases overflowing with ñoquerío [useless employees].

In some provinces, basically the entire workforce is employed in the public sector:

A decent portion of that will be made up of ñoquis:

In Argentina and Uruguay, a ñoqui (English: gnocchi) is a person who is legally registered as a worker, usually for the government, and receives a monthly wage, but who performs little or no work.

Such individuals are called ñoquis because many Argentines and Uruguayans traditionally eat gnocchi on the 29th day of every month, around the time when people receive their monthly paychecks.

Without additional federal funds, the upkeep for a ñoqui army without a significant private sector is practically impossible.

Defaults and Taxes

In response to the loss of discretionary funds, provinces have started to find ways to source these missing donations in other ways.

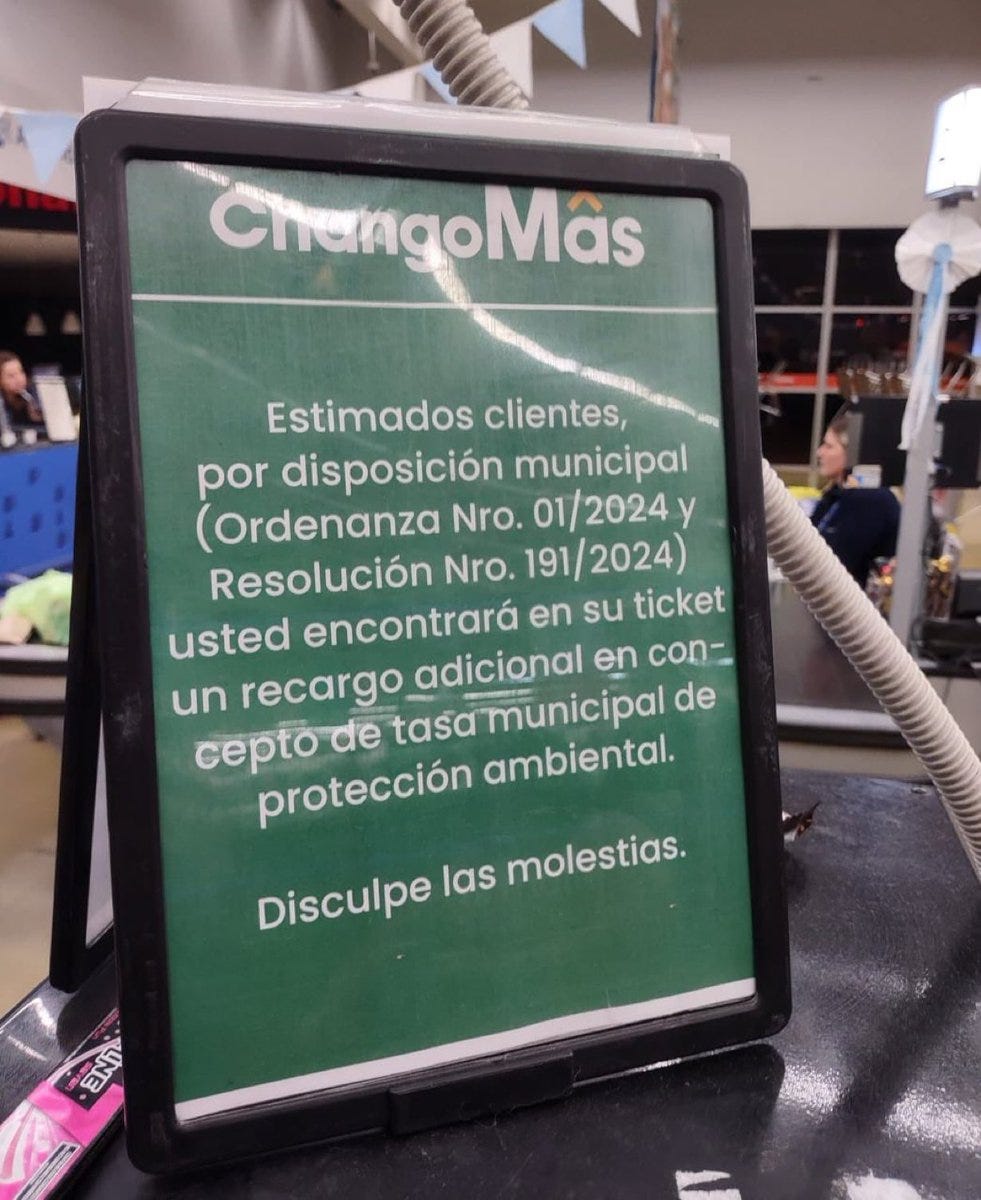

On the local level this is most visible, with municipalities adding whatever sarasa taxes to supermarket tickets, gas, energy bills, etc. The only thing left is to start taxing oxygen intake.

In the constant fight between the national government and local governments, the Milei administration has answered with an Executive Order prohibiting provinces and municipalities from including taxes and fees in utility bills.

Furthermore, if they do add taxes or fees to other tickets (for example the supermarket ticket above), these should be stated clearly on the ticket, and should have a justification.

In practice, most of these fees have zero justification and are just a ways to increase tax collection and suffocate residents even more.

In the province of Buenos Aires, multiple municipalities started adding local taxes to supermarket activities, ranging from 3 to 6%. Governor Kicillof had already increased the taxes on vehicles registered in his province by 288% — a heist he had to backtrack later, adjusting the increase to inflation rather than some arbitrary triple digits —, and municipalities like Mar del Plata added additional taxes on gas.

Córdoba started charging gross income taxes on the purchase of agricultural products destined for other provinces.

For the governors and mayors this is a double whammy: they increase tax collections, and point the finger at Milei whenever people complain about price increases. Because naturally if a 6% municipal fee is added to a supermarket ticket, that ticket increases by 6%.

RIGI

As mentioned in The Promised Land in 2025, each province in Argentina has to adhere on an individual basis in order to allow RIGI investments to be made in its territory — investments of $200M or more.

So far, more than half of the provinces in the country have already done so.

Some provinces, like the province of Buenos Aires where Axel Kicillof holds the reins, seem adamant on rejecting anything Milei proposes, even when they stand to benefit from it:

One of the outliers is the province of Buenos Aires, where opposing governor Axel Kicillof — yes, the same guy responsible for the YPF expropriation that will end up costing Argentina over $16 billion USD — decided to create his own type of RIGI scheme without the 30 year tax incentives and fixed investment outlook provided in Milei’s version.

We have already seen how that is working out for governor Kicillof, with companies like YPF deciding not to invest in Buenos Aires but just at the border of in a neighboring province, and some cities within the province province of Buenos Aires like Bahía Blanca adhering to the RIGI scheme independently, to try to break free from the governor’s apparent aversion to capital.

Besides these politically motivated and senseless boycotts from some provinces — which we have seen in several other ways, like Congress votes from the Kirchnerist bloc voting against practically every proposal LLA comes up with — the one way they respond to less national funding has been to increase taxes, without cutting down on public spending.

In a recent speech in August, President Milei highlighted the importance of the RIGI program again in combination with overall spending cuts:

“Let me be clear: the national cut in public spending alone is not enough. 44% of the State's spending in our country corresponds to the provinces and municipalities.

For every employee of the national State there are 3 employees per province, so if we want to meet that goal the contribution of the provinces is essential.

The same with the RIGI, since we approved it, we have seen investment announcement after announcement, across the entire country. The people have to know that large investments will not reach the provinces that do not adhere to the program and the politicians who deny reality will have to choose between taking off their ideological blinders and supporting the change or condemning their own citizens, depriving them of greater activity, more work and more wealth in their districts.”

Some provinces like La Rioja, have preferred to default on their USD bonds. Rather than tightening his belt with regards to public spending, governor Quintela decided to issue a quasi-currency to keep the spending spree going. Things would be a lot easier if he would just cut spending, adhere to the RIGI program and let mining companies operate in his feudal territory.

Unfortunately, you can’t cure stupid. Besides a clear betrayal to the best interest of their voter base, it’s a sad — and expensive — state of affairs. But as crypto bros would say: HFSP.

Final Thoughts

On a national level, the Milei admin is doing a phenomenal job in terms of cutting back on public spending, reducing the State and maintaining a surplus.

The extent of his budget cuts in the federal public sector have been biblical, and are still ongoing.

The Milei administration is also giving back power and autonomy to provinces, so they can start to become more competitive and independent. An example is the recent authorization for Mendoza to purchase imported medicines without previous authorization from the national government.

When we look at how much each province contributes to Argentina’s GDP, there’s an interesting correlation in the 60%+ public employment top 10:

According to certain estimates, the provinces will lose another 5 billion dollars in the 2025 budget due to specific allocations. Will even more of these feudal kingdoms default on their provincial bonds?

Or will these governors decide to take action in the best interest of their residents by cutting public spending and employment and creating more attractive conditions for foreign (and local) investment? For the provinces with 60-70% of the workforce in the public sector, this is a catch 22: they will make the case that it is in the interest of their residents to keep them employed there.

But reality is that if these provinces do not change their ways of old, they will never get out of the perpetual doom loop of over-dependence on federal funds to sustain the same situation: leeching off productive provinces but without any real improvements in living conditions or incentives.

As provinces get more and more autonomy, it will be up to the governors to decide what to do with it.

See you in the Jungle, anon!

Other ways to get in touch:

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Nostr: increasing my posts here, my npub: npub1sngpxenyrddqvnusf02fls8yl0ja3s373md9lmfkej2l0h6saz6qvglthh

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

Breathtaking to see a politician turn out to be exactly who he said he was and do precisely what he said he'd do before he was in power. He has the charismatic style but at the same time a deeply serious substance behind it. I brace myself to be disappointed by politicians; this one fails to disappoint time after time.

Fantastic piece as always! Where could I read more about this ñoquis phenomenon, or at least the history/purpose of so many public ostensibly useless public employees?