The Peso Countdown

Potential exchange scenarios for after the elections this Sunday

Welcome Avatar! In the final trading rounds before the midterm election this Sunday, the peso keeps losing ground despite the renewed Treasury Swap and talks of an additional $20 billion bailout to boost Argentina’s fx reserves. It looks like the days of the fixed currency bands are numbered. Let’s go over some scenarios for after the elections.

La Tablita

With the last few weeks of peso action, it looks like the The Ghost of La Tablita is rearing its ugly head once again as savers and investors rush out of their peso postions and try to dollarize ahead of the elections:

It is a tale as old as the love of Argentines for saving in dollars: liberating exchange conditions too fast can mean blowing up the local currency, and a return of high inflation, whereas keeping controls in place will likely deepen the current recession.

In the last 50 years we have 2 instances where things ended up badly, namely during the 1976-1983 dictatorship and during Macri’s presidency (2015-2019).

In the former it was through a deregulation of many sectors of the economy that Milei has also started, albeit at a more segmented pace. The latter in 2015 was a complete opening up of the fx restrictions and banking system without any kind of real deregulation. Basically, Kirchnerism with the floodgates open.

As you can see, it is very hard for Argentina to crawl out of the Groundhog Day loop that it has been in for the past 80+ years.

And here we are once more. Granted that the conditions are always a bit different, but the currency bands approved by the IMF as per its renewed agreement with Argentina are the same bands they approved during the biggest IMF loan ever that was granted during Macri’s term in 2018, in an attempt to get him re-elected and stop the country from going back to Peronism in the 2019 elections.

What ended up happening? Argentina basically lost four years and once the 2019 primary results were known, the Argentine stock market saw one of the biggest single-day country stock exchange crashes in history, only topped by Sri Lanka.

In terms of voter base in Argentina, Peronism has a floor of 30-35%, and that can quickly be expanded when the opposition is in power and there is not enough free candy or the economic situation is less favorable than expected.

Tío Bessent

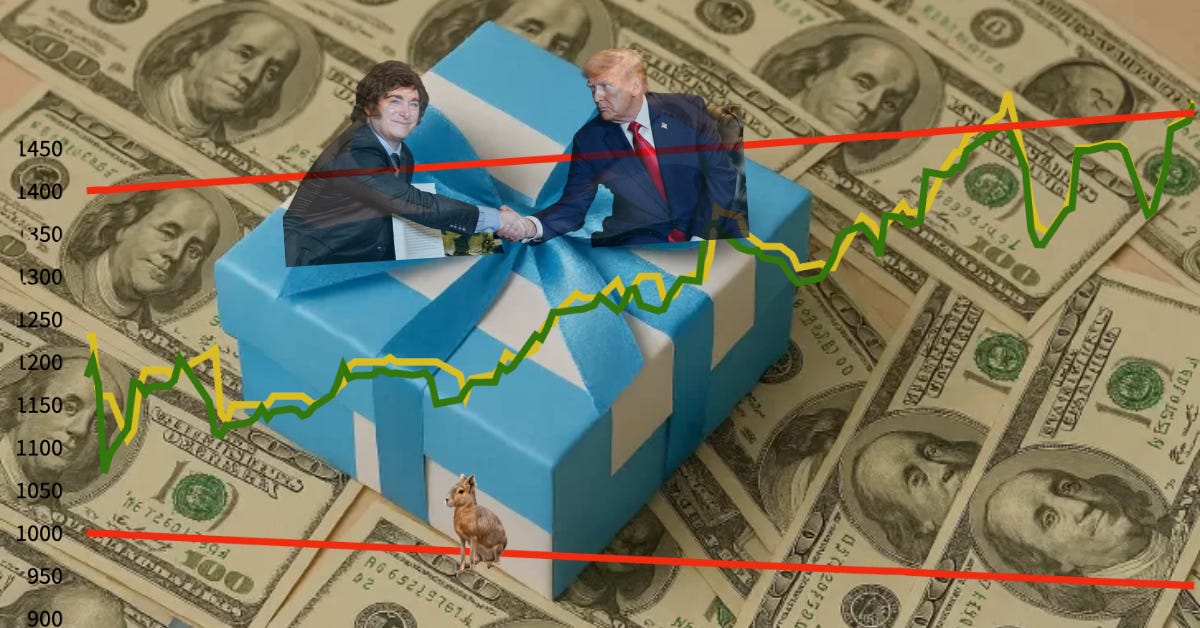

Another IMF agreement later to make the rollover easier, it feels like Argentina is back in the same spot as it was in 2018: more international trustbuilders are needed to try to make sure the election outcome does not slide into another Peronist win.

This time, on top of a new IMF agreement in 2024, the US Treasury came to the rescue with another $20 billion swap line, and as tío Scott Bessent made clear, this is very much done in the hope to steer a favorable election outcome for La Libertad Avanza and President Milei:

“As we work to stabilize and secure the Western Hemisphere and Make America Safe Again, the US Treasury has signed an economic stabilization agreement with the Central Bank of Argentina. President Milei’s efforts to reverse his nation’s decades of decline, stemming from the radical leftism of the Peronists are of critical importance.

Argentina now has the opportunity to embrace economic freedom, and our stabilization agreement is a bridge to a better economic future for Argentina, not a bailout.

President Milei has worked hard to reverse previous irresponsible economic policies, including overspending, fiscal irresponsibility, and reckless borrowing. Just this month, the IMF re-emphasized that it is fully in support of Argentina’s strong economic program.

We do not want another failed state in Latin America, and a strong, stable Argentina as a good neighbor is explicitly in the strategic interest of the United States.”

Even with all this additional support, the official dollar rate surpassed the $1,500 mark for the first time in a month today. Five days before the elections, it’s trading at $1,515 at Banco Nación, an increase of 20 pesos on the day.

Now, what is different, and this makes all the difference compared to previous periods is that Argentina keeps running a fiscal surplus under Milei.

The current problems are way more related to the fear of a bad election outcome after the bad results in the local election in Buenos Aires, and a fixed pattern of dollarizing savings before each election than a structural issue in Milei’s monetary policy.

But, as with all fiat currencies, once the faith is gone, its value quickly follows, and for good reasons Argentines tend to have very little faith when it comes to the peso.

Below we will go over potential scenarios for the exchange rate policy going forward and what that means for local prices, inflation and more.