BCRA: Peso Debt & Rates to Zero?

The side effects of BCRA nuking interest rates, transferring liabilities to the treasury, Omnibus Law update and more.

Welcome Avatar! There have been some interesting developments in the BCRA’s balance sheet and interest rates in the past few weeks. Could things be moving in the direction of closing the Central Bank? What about debt levels, inflation and dollar rates? Let’s dig in.

The Central Bank's policy of successive interest rate cuts seems to have encountered a barrier imposed by the market: the blue dollar rate started pumping as much as 14% in just three days as rates dropped from 60% to 40% in less than a month.

The BCRA's decision to reduce overnight repo rates to 40% reactivated the demand for dollars.

With successive reductions in the yields of monetary policy instruments, the Government sought to liquefy remunerated liabilities and at the same time reactivate credit.

The decrease in interest rates is the main driver of the recent pump in USD rate, with a fixed term that yields only 2.5% effective monthly, well below the expected inflation, which is still around 5 percent MoM.

This could be one of the objectives, among others, sought by the BCRA to improve the equation for exporters by 20% of what was settled in the CCL dollar given the decision not to devalue.

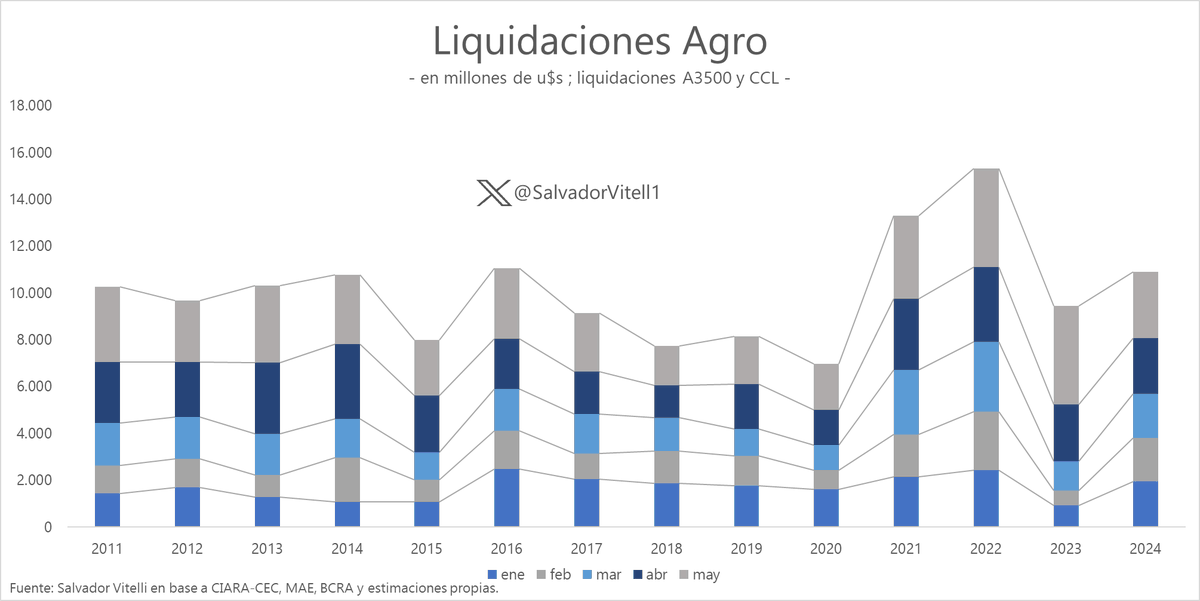

The delay in the soybean harvest is impacting the CCL. Remember that exporters settle foreign currency in the "blend dollar", a mix of 80% of the official dollar and 20% of the "CCL" dollar. If fewer exporters sell, there is less supply in the CCL.

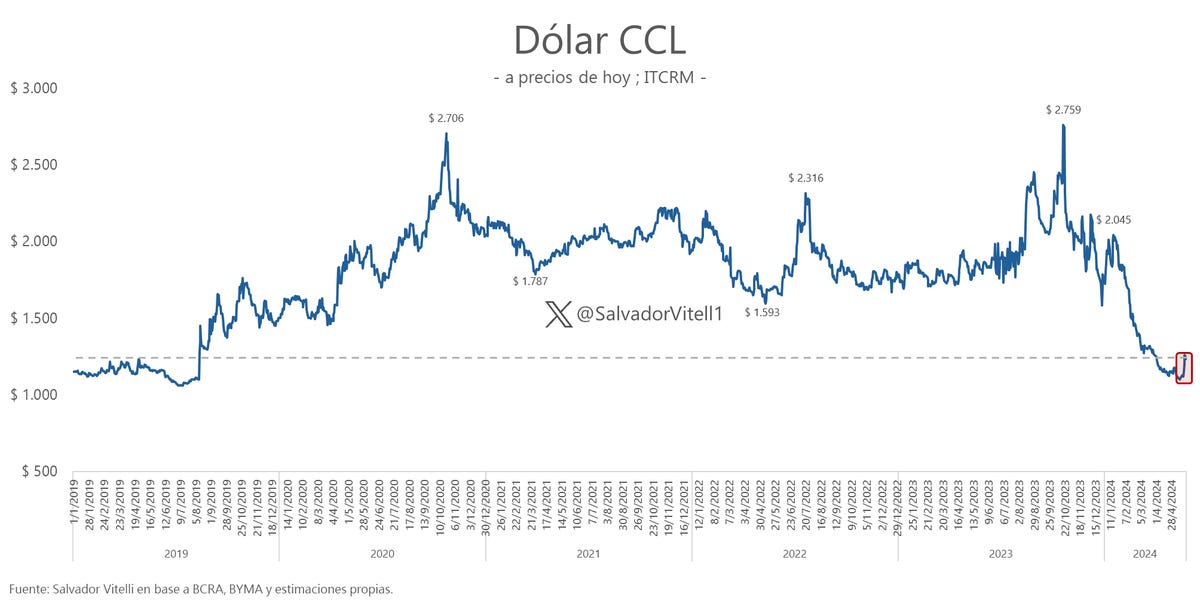

The BCRA —> Treasury Swap

There is consensus in the market that the Government has found a limit to its aggressive policy of lowering rates, which led repos to yield only a nominal 40% annually and fixed peso savings accounts to yield 30% on average.

Although the Government seeks that the upper limit for rates now be Treasury bonds, there are doubts in the banks regarding its implementation. The thing is that they are reluctant to change “BCRA risk” for “Treasury risk.”

It’s not only the question of greater risk, but also the differences between the terms of the instruments prevail in the resistance of the banks. Maturities and interest rates are different.

But from a strictly BCRA-perspective, it is interesting that everything is being shoved to the Treasury: is Milei emptying the BCRA balance sheet in order to eventually close down the printer? Not so fast.

Monetary Base Still Up

Despite inflation being back to single digits (and May is looking to end up around 5-6% MoM), the remunerated liabilities are still inflating the monetary base.

Not as fast as before with LELIQs with higher interest rates, but it is still considerable: from December to May, the monetary base increased close to 60%.

No doubt that this is way better than 1.8 monetary bases every 2 months that was the case during the final hours of Sergio Massa in office, but still considerable.

This recent move to transfer liabilities from the BCRA to the treasury does include a higher interest rate, so that means more future emissions, even though the thought behind moving the overnight BCRA repos to Treasury bills is that this slows down inflation in the short term (less overnight emissions).

The mechanic shifts emission (inflation) expectations from short-medium to medium-long term. However, this move actually increases the deficit, because while the BCRA pays around 3.3% monthly for repos, the Treasury pays 4.5% monthly for its bills.

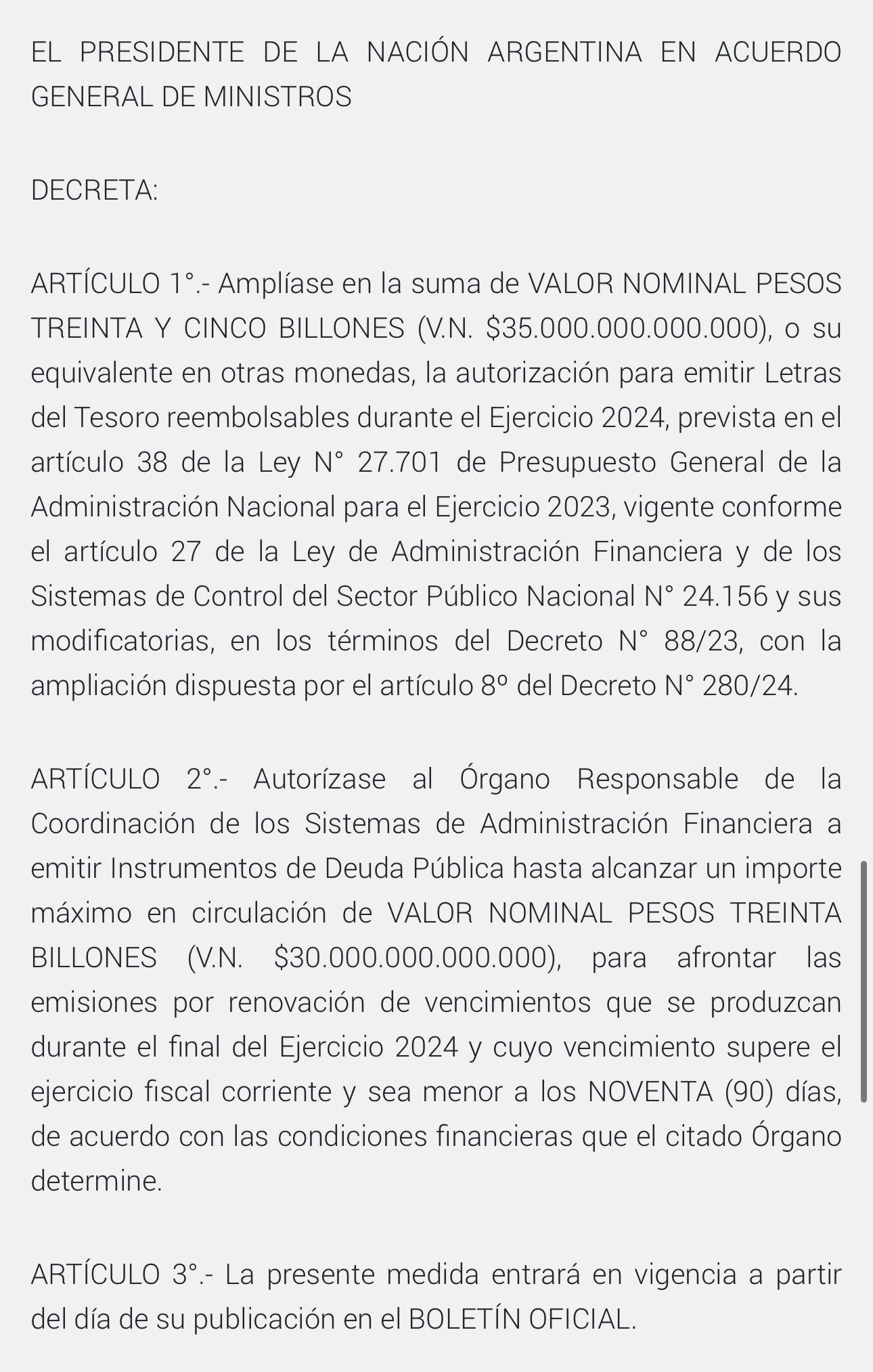

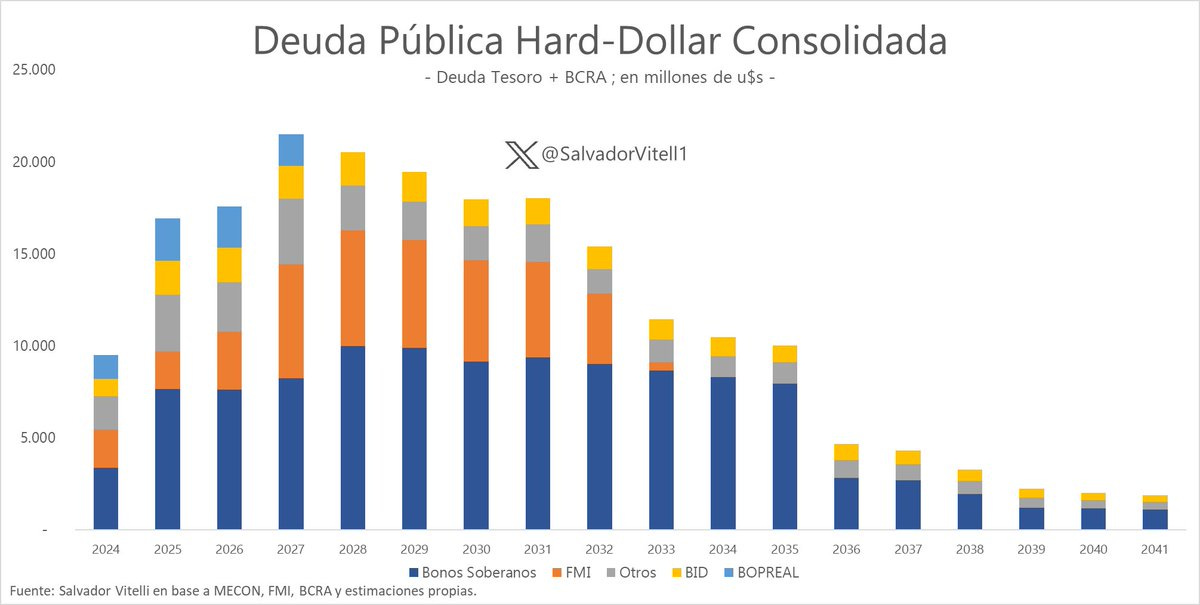

Argentina’s maturities when looking at the total debt in hard dollar terms, don’t look pretty (and this doesn’t include local peso debt):

This brings total maturities for foreign debt to around $65 billion USD during the first 4 years of the Milei presidency.

If you take into account the peso debt as well, that number spikes up to over $215 billion USD at the current exchange rate. Uf.

When we look at just the Treasury debt including peso debt for the 2024-2027 period until the next elections, it becomes a bit of a head scratcher (almost double in the next 2 years):

Peso debt can be managed by Argentina, but paying the dollar-denominated maturities will be a real challenge after lowering or eliminating the current export tariffs — which the government will be forced to do sooner rather than later, more on that in the next section.

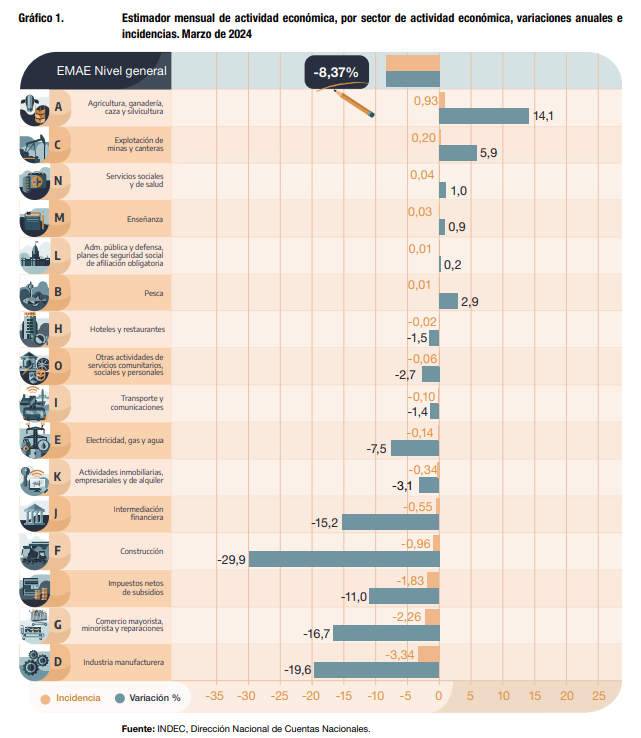

Besides taking out overnight repos, the reason why inflation is dropping so fast is twofold: 1) Lowering of interest rates and 2) declining economic activity.

Lower Activity: Recession

In a context of slowing inflation, the Government reduces rates to keep them in negative territory and coordinate downward expectations. But this decision also negatively impacts the interest received by families' savings. At the end of the day, families have less resources to devote to consumption, and the recession continues.

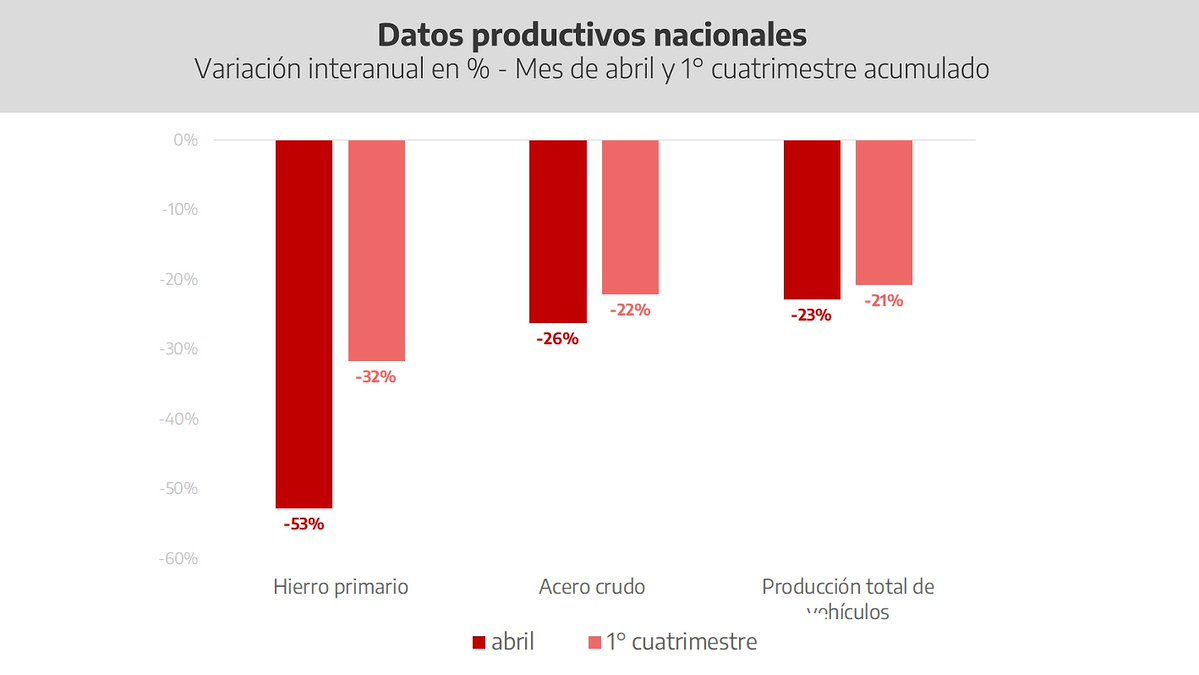

The beginning of the second quarter comes with a softening of the intensity of the drop in economic activity in most economic sectors, and it is possible that March could have marked a floor of the recession.

There are still sectors and indicators that show a worsening in year-on-year terms, so there are still no signs that the much-announced 'V-shaped recovery' will begin to occur.

In April, the interannual variation for industrial activity was -11.7% and -19.2% so far in May. Estimating a prediction model to explain industrial activity through sectoral energy demand, the drop in production during April would reach -18.4% and would deepen to -21.7% in May.

The rate cuts reduce families' savings and takes away their consumption capacity, which deepens the recession. Less spending, and exchanging dollar savings for daily expenses.

In a macroeconomy with exchange controls, very low commercial credit dynamism, and a drop in wages and sales, the reduction in current income from the lowering of rates will likely deepen the recession.

Reserves, CEPO & the Ghost of the China Swapline

When will foreign exchange controls, aka the cepo, get lifted? It looks like that could still take a while.

As deputy and economist José Luis Espert put it:

"The Government is going to wait for the net reserves (in the Central Bank) to be positive; today they are at zero and were negative at 12 billion at the end of last year. Until they are in comfortable territory, with a floor of 5 billion dollars, I don't think the fx restrictions will end. Afterwards, we can think about eventual dollarization or currency competition.

[…]

One of the great fans of the “cepo” (fx restrictions) is the International Monetary Fund (IMF), because it sees us buying dollars with everything collected. They are drooling because they can collect part of what they have lent us. The Fund tells us to calm down and not rush into lifting restrictions." 1

My estimate is that it will be closer to double that amount, at least. In a recent analysis, the Institute of International Finance estimated that another US$10 billion is required to be able to lift the exchange rate. Milei’s personal estimate was US$15 billion in net positive reserves.

Why does the BCRA need so many additional reserves, can’t they just lift restrictions now? The answer is no, because in the event of a run on the dollar, those dollars have to actually be available in the system.

The Milei administration if facing quite a few headwinds. China’s ending swap line is one of them.

Will Xi’s revenge for Milei calling him a commie become apparent this June and July? Even though according to some news sources it is already a given that China will not extend the existing Yuan swap, negotiations are still going.

A delegation led by Mondino (Foreign Affairs), Santiago Bausili (BCRA) and Pablo Quirno (Finance Secretary) were in Beijing at the end of April without any news.

Unless the Milei Government gives a nod to the reactivation of the construction of the Jorge Cepernic and Néstor Kirchner dams, which are financed by China and are paralyzed by Executive Order, Argentina will have to pay the swap with China with reserves from the Central Bank.

At the end of June, US$2,906 million must be paid, although there is no specific day, since it can be negotiated until the last day, and no one knows the contract. The July disbursement, for US$1,938 million, is still in negotiations.

Besides this close to $5 billion that needs to be returned to the CCP coffers this year, Argentina will still need to pay an additional US$8.4 billion in 2024, of which US$6.3 billion to international organizations and US$2.1 billion to private entities.

The problem is that Argentina will have to depend on dollars from exports, since there are no new IMF loans or new loans from other international organizations.

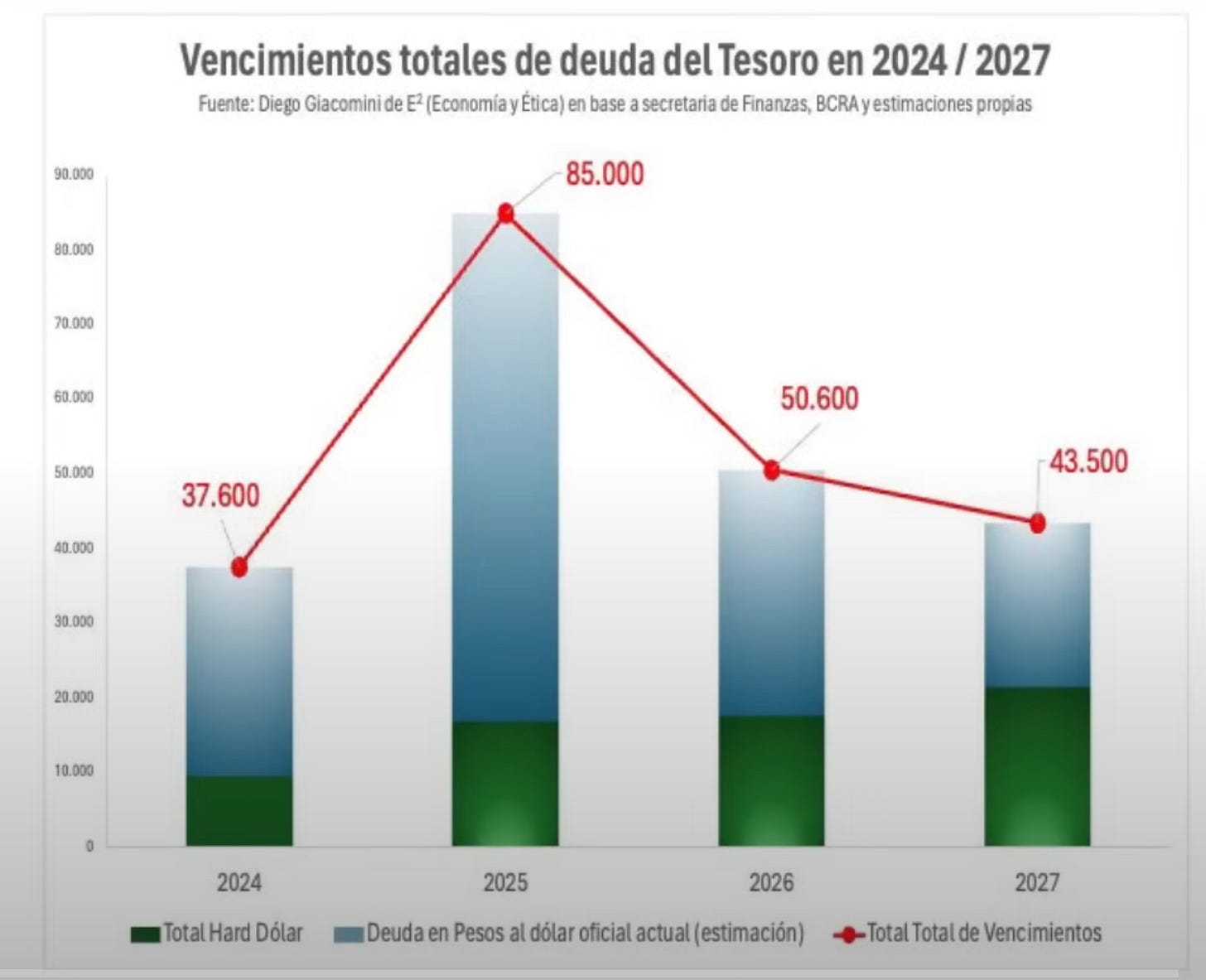

When we look at the liquidaciones of crop exports so far, it is a bit worrying that 2024 is over 2023 levels already, without this having a noticeable impact on foreign reserve levels:

Granted, 2023 was a very bad year due to droughts, but so far it is nowhere close to 2021 or 2022.

Also, we have to take into account that the soybean harvest of 2024 is the most delayed in the last 10 years, so there is still a lot of soybeans stored, waiting to get exported. Producers sometimes prefer to wait to get better prices.

As explained before, the BCRA depends heavily on the export tariffs placed on agricultural exports, which is the biggest source of foreign reserves (in good years it can be close to 10%).

Needless to say that if the Milei administration doesn’t significantly lower or abolishes these export tariffs starting next year, it will start losing support of producers quickly.

Meanwhile, in 2025 there are payments from international organizations, which includes the IMF, for US$7.8 billion and from private entities for US$7.2 billion, between capital and interest, which gives a total of US$15 billion.

Omnibus Law & May June Pact?

While many still hoped on a quick vote in the Senate to pass the Omnibus Law, it took Milei a change of Chief of Staff to get the signatures needed to discuss it in the Senate.

Guillermo Francos replaced Nicolás Posse, who Milei accused of spying on internal cabinet members. After that change, on May 30th, Francos was able to get the signatures needed to treat the Omnibus bill in the Senate. Better Call Francos.

This delay did mean that the so-called “May Pact” on the 25th could not materialize, and that the signing of this agreement between the provincial governors and the national administration will have to occur at a later date.

By now, it is becoming painfully clear how hard it is for the Milei administration to push any significant changes in existing or new laws through both chambers.

The initial Omnibus Law of 350+ pages was butchered and found heavy resistance in the chamber of Deputies, forcing changes that touched on less areas of the economy, with smaller changes.

If we look at the number of laws passed during the first six months of the Milei administration, we see a number of ZERO:

This is a record, to say the least. Never in Argentine history has a democratically elected government faced more opposition than during the current administration. Another drawback would be if the Senate decides that the articles of the current (already heavily dumbed down) bill need changes, and sends it back to Deputies. That would restart the complete process from scratch.

The light at the end of the legislative tunnel is that the more pushback Milei receives, the more likely it is that his party La Libertad Avanza will win the 2025 midterm elections with a massive landslide. After that, pushing changes through both chambers will become a lot easier.

The only thing that could potentially hinder that is if the economy does not pick up in the second half of this year.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

"Besides taking out overnight repos, the reason why inflation is dropping so fast is twofold: 1) Lowering of interest rates and 2) declining economic activity." Reduced supply of money? Change in velocity of circulation?

This is funny: you confused Nicolás Posse, the guy who got ejected from Milei's government, and Abel Posse, a much more famous and influential man (already deceased; he was a writer, journalist and politician).