Crawling Back to Normality

The future of the crawling peg and a free floating ARS exchange rate

Welcome Avatar! December inflation data will be released tomorrow, and will likely result in a slicing of the crawling peg to 1%. What does this mean for peso interest rates and more importantly for the expected lifting of the exchange restrictions? After that I will also discuss Saifedean’s comments on Milei. Let’s dig in.

The monthly crawling peg at 2%, with a gradual and predictable devaluation of the official exchange rate of the peso against the dollar, has existed for 13 month now.

Depending on the monthly inflation data for December that will be released tomorrow at 4pm by national statistics agency INDEC, Argentina could be looking at a slower pace of devaluation for the official ARS rate.

Both Javier Milei and Luis Caputo stated that they will proceed to lower it to 1% monthly if the rise in prices approaches 2% monthly. In November, the CPI showed an increase of 2.4%, fueling expectations of an imminent reduction in the crawling peg by the Central Bank (BCRA).

According to private consultants, the figure could be between 2.2% and 2.9%, which would mean the crawling peg would slow down at -1% a month, this will have a corresponding impact in peso interest rates, which will be lowered.

This means the peso carry trade is nearing its end, and in the last 2 months traders have gradually started closing positions.

During the past week, versions of an imminent reduction of the BCRA's monetary policy rate have already been circulating and the BCRA lowers the crawl rate to 1% this week, it would be accompanied by a reduction in the LEFI rates, currently at 32% nominal per year.

The BCRA's policy objectives are not only about the disinflation of the economy but also that of growth. The LECAP rates, one of the favorite instruments for the pes carry trade, show a negative slope, confirming the expectation of a decrease in inflation and therefore of the BCRA rates.

The thing to watch if this happens, is what happens to the price of alternative official dollar rates like the CCL and the MEP rates. The blue rate is not significant enough in volume compared to the previous two, and is more comparable to low cap altcoin volume which tend to overshoot on low volume and then correct back down again.

When CEPO Off?

Hate to be a party pooper here but my expectation is that the currency restrictions (CEPO) will stay on until after the midterm elections in October.

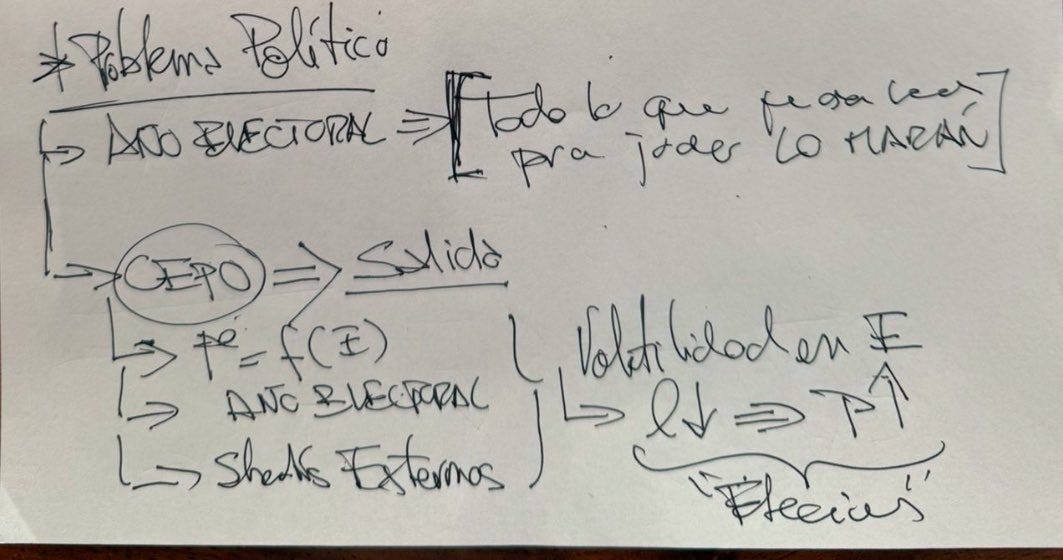

This was my suspicion before, which was confirmed after seeing these Milei scribblings from a meeting with the BCRA team:

So it seems Argentina will be living with a 1-2% crawling peg longer than anticipated, to much chagrin of many market participants.

The danger here is what we discussed in The Ghost of La Tablita, by leaving a crawling peg in place for too long, Argentina could go from gradually to suddenly very fast in terms of devaluations.

Current monetary and fiscal policies are completely different today however, and this could buy Milei more time in terms of not lifting the CEPO.

Saifedean’s Difficulties with Milei’s Peso Standard

At the start of the weekend, Saifedean Ammous, famous author of The Bitcoin Standard, launched an offensive on X criticizing Milei’s economic policies and decisions.

Unfortunately like Javier Milei himself, Saife seems to have a trigger happy finger when it comes to the block function, and this rodent has been blocked for years despite never having interacted with either one of these two economists that I hold in high esteem.

So despite being able to read his tirade, I wasn’t able to provide a direct response to Saifedean, and had to do so indirectly in a short thread, with a retweet of Shellbanger’s excellent reply here (worth a follow).

Without going into too much more detail, the core of Saifedean’s argument was that Argentina’s monetary base was still expanding, and Milei was taking on “staggering” amounts of debt.

Some of the main points:

“Under its new supposedly free-market Rothbardian president, Argentina's money supply in 2024 has increased at these astonishing rates: M0: 209% M1: 133% M2: 93% M3: 123%. […]

By not defaulting and hiring the same bankers who brought calamity to the country in the previous administrations, it seems Milei is eager to get another IMF bailout, which will saddle Argentinians with generational debt slavery and more fiscal crises in the future. […]

In Milei’s first six months in office, public debt grew from $370 billion to $442 billion, a staggering increase of 19.4%. Borrowing $72 billion in 6 months can make any economic statistics look good, but the problem of course is in the long-term consequences. […]

By not shutting down the central bank and letting it ramp up its money printing, Milei is sowing the seeds for currency crises in Argentina’s future.”

Let’s go over these most important points one by one, starting with the aggregated monetary base.

At the start of Milei’s term, the peso bonds called LELIQs were printing an additional monetary base in interest alone every 1.5 months, which was the main cause for the hyperinflationary dynamics under the previous Kirchnerist administration, that had the potential to completely spiral out of control.

The LELIQs bomb was unwound gradually in the first 3 months, which still implicated peso printing. After that, as you can clearly see in the graph, emission was close to zero. Saifedean makes the mistake of looking at the monetary base without taking into account that dynamic and current valuations.

But that’s not all.

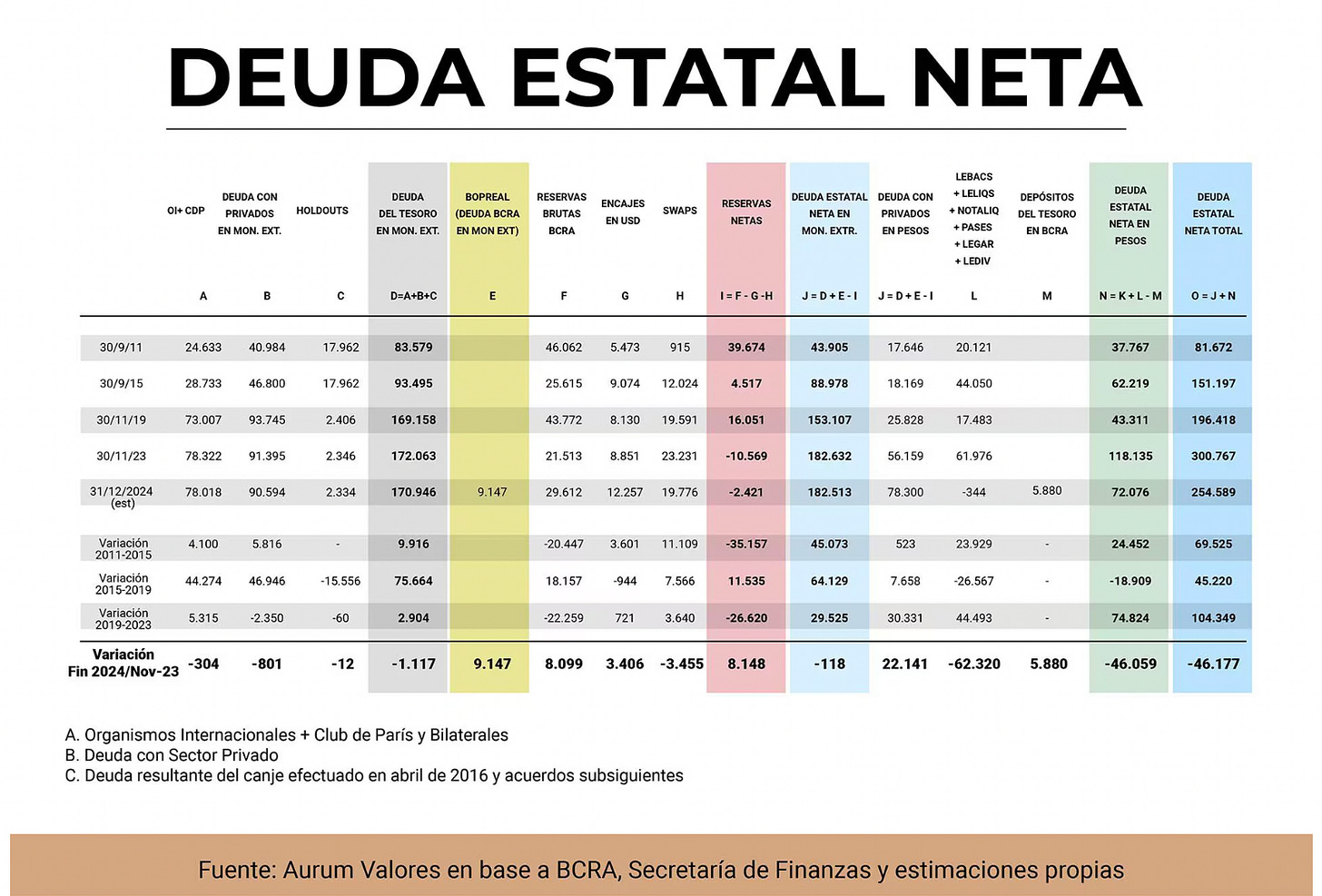

One of the biggest oversights by Saifedean in his criticism is that he only analyzed Argentina’s Treasury debt. He completely missed that the BCRA debt was moved to the Treasury, and Argentina’s net debt actually DECREASED.

Pretty big oversight if you ask me.

This dynamic of debt consolidation at the Treasury is also the first step into being able to close the BCRA in the first place, something that Milei cannot do directly by Executive Order since the Constitution states that Argentina needs to have a central bank issuing currency and it would rain lawsuits for an unconstitutional measure taken directly by Milei.

Surely Saife does not seem to be aware of this, and in his mind Milei has a magic wand as an absolute ruler that allows him to completely bypass Argentina’s constitution.

Autist note: you can read more on potential dollarization scenarios / closing the BCRA here:

It’s a shame but Saifedean seems to have a desire for Milei to fail, or simply half-assed his data sourcing without doing some more research first.

There are plenty of things to criticize still in Argentina under Milei, but monetary policy and debt management aren’t among them.

As to Saifedean’s following comment that:

“A default on foreign debt, and a shuttering of the central bank would have caused a few months of painful adjustment, after which the Argentine economy would recover on a solid footing”

We can only say that this is exactly the kind kindergarten level economic thinking that proliferated under Kirchnerism in Argentina: it’s almost not even worth going into.

It’s clear that Saifedean prefers to believe in libertarian rainbow tales versus the real world, — just like the Marxist Kirchnerists preferred defaulting on international debt —, and if he would’ve known anything about what happened during all Argentina’s previous defaults, he would not be saying that Argentina should default again.

Being even more shut off from international markets, — which is the direct result of such defaults, — is an absolute disaster for a country like Argentina.

Autist note: here you can read more on how the “Argentine economy recovered on a solid footing” after the last default [insert clown face emoji]:

Saifedean’s comment on “Milei has shipped off the little remaining gold Argentina has to London, in search of some yield” was discussed at length here, and totally understable given Argentina’s net reserve situation.

Not sure where Saife got his data on Milei “is raising taxes significantly” because so far, national taxes and tariffs have only been cut, with more to come. The fact that local municipal and provincial governments keep adding taxes to the bottom line is something that Milei can’t do anything about in his position.

What Milei has done is pass a law that states ALL taxes need to be line-itemed on invoices and receipts, so that consumers see how badly local governments leech on their residents.

Saifedean’s critique goes on by saying that the budget deficit is not important or significant in Argentina’s case. If he had known anything about Argentina’s economic history, he would be aware that most of the country’s economic woes stem from budget deficits.

Still a fan of Saifedean for all his work in terms of providing an introduction to money and Bitcoin in his books, but sometimes his views are a tad fundamentalist — like in this podcast episode with Michael Saylor, which featured a heated discussion where Saylor said credit was a good thing for the economy, whereas according to Saifedean credit was inherently bad — and in this example of his critique on Milei’s administration, he completely relied on wrong assumptions.

Final Thoughts

Argentina is nearing the point where things will become interesting again, with the peso carry trade winding down and the potential of more currency fluctuations (in the real market) which tend to be the norm in an election year.

In the past, Argentina’s aggregated monetary base in Spanish reached $90 trillion pesos. Currently, it is at $28 trillion and the BCRA's ceiling is $50 trillion.

This implies that soon the peso is scarcer now, and could soon be “set free” from the CEPO fx restrictions still present at this moment. That is eventually when endogenous dollarization will gain strength, or we will see a depreciation of the peso, which seems unlikely given the monetary dynamics present at the moment.

The market price of ARS will only be known without fx restrictions and a free floating currency. The closest rates to a market rate are currently the blue dollar ($1245), and the CCL ($1197) rates, both above the $1,066 official rate (12-16% gap).

Today, no one can say that there is an exchange rate lag or that there is not, exactly because the CEPO restrictions are still present, and will likely remain present until the October midterms.

The “just default, dude” rhetoric suggested by Saifedean is exactly what Kirchnerism did, with all the fantastic outcomes we have seen in the past decades.

The most important thing to remember is that Argentina’s main problem has always been its eternal deficits, small or big. Most of the country’s economic problems lead back to that factor: defaults, currency devaluations through overprinting, hyperinflation, etc.

See you in the Jungle, anon!

Other ways to get in touch:

1x1 Consultations: book a 1x1 consultation for more information about obtaining residency, citizenship or investing in Argentina here.

X/Twitter: definitely most active here, you can also find me on Instagram but I hardly use that account.

Podcasts: You can find previous appearances on podcasts etc here.

WiFi Agency: My other (paid) blog on how to start a digital agency from A to Z.

Solid take, and I'm also disappointed at his debt fundamentalism. That doesn't help if he's seen as a BTC spokesman, but at least we've got Saylor. What do you make of Milei almost immediately meeting with Israeli representatives the second the votes were counted? They don't provide much in terms of economic input. Perhaps just indirect signaling to the US?

let me see if i get this right, they've basically moved the reverse repos from CB BS to Treasury in form of LECAPs etc. Are these no longer part of the base monetaria ampliada? ultimately, they are still paying high interest , and ultimately inflationary?